Home

> Portugal

Portugal

Trauma in the travel sector

Flyglobespan was Scotland's biggest airline. Based in Edinburgh, it entered into administration all too suddenly on 16 December 2009 in rather curious circumstances involving several million pounds owed to it by its receipts-handling company. Flyglobespan's advice notice to customers, posted on its website at the time of its collapse, can be used as a typical and now all too familiar example for the 13 or so travel firms that have gone bust since:

Aug 24, 2010

Of banks and intimations

Last week a number of banks issued 2010 first-half results. Northern Rock, HSBC, Standard Chartered and Lloyds all released figures showing overall profits in their operations that were good given the current market conditions in their field of activity. All, including Northern Rock, were able to demonstrate the benefits of the "universal model" of banking and senior executives from these companies, both on and off the record, were keen to emphasise their belief in the continuance of thi...

Aug 09, 2010

IG Group Holdings share price down on FTSE 250 despite rise in FY profit of 25%

Shares in IG Group Holdings were down on the FTSE 250 in afternoon trading despite posting a rise in adjusted pre-tax profit of 25 per cent to £157.6 million in the full year ended 31 May.

Jul 20, 2010

Pound up against euro and dollar as single currency hit by Portugal downgrade

The pound was up against the euro today after the single currency was hit by a downgrade on one of the so-called "piig" states at risk from sovereign debt.

Jul 13, 2010

The pain in Spain lies mainly on the Costas

Once the full extent of the financial crisis in Greece became apparent, the governments of the EU, the European Commission and the European Central Bank, set about putting together a rescue package which eventually also took account of money market pressures against Portugal and Spain. Owing to several delays in getting this massive project under way, the money markets rapidly lost confidence in any determined action from the EU and Eurozone countries and had started to concentrate, not simply ...

Jun 21, 2010

European Central Bank and EU at a crossroads?

In 1971, the Bretton Woods Gold-Dollar exchange rate system broke down, bringing in an era of floating exchange rates with all their uncertainty. Governments, especially the USA's and UK's may have been relieved of defending a particular parity by having to take deflationary action but this simply passed the burden on to trade and industry. As rates of exchange might vary at any time, both exporters and importers feared exchange rate losses, so increasing risk and uncertainty in the busi...

Jun 15, 2010

Lloyds Banking Group, RBS and HSBC shares rally on FTSE 100 following eurozone falls

Shares in British banks were up, with the exception of Barclays, in morning trading on the FTSE 100, as investors took advantage of the low prices, brought down by ongoing fears over the state of the eurozone.

Jun 09, 2010

Lloyds Banking Group, RBS and HSBC shares down on FTSE 100 following US jobs data and Hungary news

Shares in British banks were a mixed bag in afternoon trading as investors showed concern at the weakness of the economic recovery in the USA and fresh fears about sovereign debt in Hungary came to bear.

Jun 07, 2010

Lloyds Banking Group, RBS, Barclays and HSBC shares up on FTSE 100 as China assures on eurozone

Shares in British banks continued their recovery on the FTSE 100 after ongoing worries about sovereign debt in the eurozone helped drag shares in recent weeks.

May 27, 2010

Lloyds Banking Group, RBS, Barclays and HSBC shares plummet sending FTSE below 5,000

Shares in British banks plummeted on the FTSE 100 thanks to a flurry of worries in the world of finance.

May 25, 2010

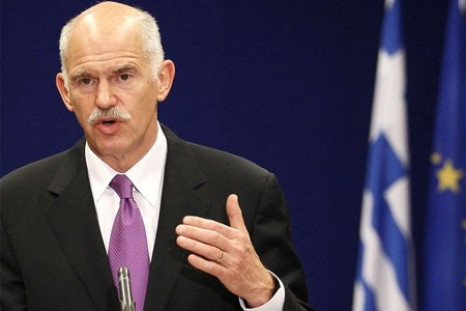

Greek tragedy, but there might be a silver lining

Beware of Greeks bearing gifts? It has been touch and go this past month or so as to whether or not a wooden horse would make a suitable coffin for the euro. The EU itself has been shaken at its very core by a rift between President Sarkozy of France and Germany's Chancellor Angela Merkel when, was been reported, the French President banged his fist on the table and threatened his country would pull out of the euro if Germany did not give its full backing to a rescue/bailout package for Gre...

May 24, 2010

Lloyds Banking Group, RBS, Barclays, HSBC shares drop on FTSE 100 thanks to eurozone debt, US regulation

Shares in British banks were down on the FTSE 100 thanks to continuing fears about sovereign debt in the eurozone and news that the US Senate had passed legislation imposing stringent regulation on Wall Street.

May 21, 2010

Lloyds Banking Group, RBS, Barclays and HSBC shares up FTSE 100 as Dubai World reassures on debt

Shares in British banks were up in morning trading on the FTSE 100 thanks to promising news on debt at Dubai World, following days of uncertainty over regulation and European debt.

May 20, 2010

Lloyds Banking Group, RBS, Barclays and HSBC shares up on FTSE 100 as eurozone rescue deal looks more secure

Shares in British banks were up on the FTSE 100 as investors quietly grow in confidence after eurozone finance ministers appeared to solidify a deal aimed at preventing the spread of Greece's sovereign debt crisis.

May 18, 2010

Lloyds Banking Group, RBS, Barclays shares rise after early losses on FTSE 100

Shares in British banks were up on the FTSE 100 despite early losses caused by worries on the euro and a negative note from JPMorgan.

May 17, 2010

Pages

- PREV

- 30

- 31

- 32

- 33

- 34