Home

> Tax

Tax

HMRC defends its handling of the leaked HSBC Swiss tax dodge dossier

HMRC's chief executive Lin Homer faces questions about HSBC tax evasion before the Public Accounts Committee.

As HSBC is drawn over the coals some Swiss accounts will always be more secret than others

As HSBC faces the same exposure as UBS and Credit Suisse, a vaguely familiar story of big-ticket tax avoiders emerges.

Boris Johnson 'disappointed' with Boots boss Stefano Pessina over tax avoidance

But Tory MP hopeful insists Boots has right to off-shore for business reasons

Apple and Microsoft could face billion dollar tax bill in US over profits held offshore

If Obama proposal is enacted, US companies will face a 14% tax bill on billions of dollars held overseas

HMRC demands £4.8bn tax bill from astonished pensioner

Doug Yeomans from Derby was asked to pay £950m a month to HMRC.

Boris Johnson 'settles' US tax demand after initially refusing to make 'outrageous' payments

Mayor of London Boris Johnson was born in New York and holds dual citizenship.

Revealed: How Tony Blair's companies 'spent £57m in 4 years'

Spokesman for former prime minister disputes £57m figure.

Ed Balls: Mansion tax will be introduced from 'day one' of Labour government

The Shadow Chancellor says he would like to see the revenue going to the NHS as soon as possible.

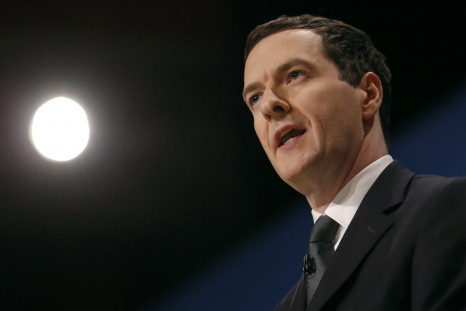

George Osborne slammed for claiming a false victory over EU tax bill

In October, the EU declared that the UK would have to pay £1.7bn in extra tax.

HMRC admit tax helpline service 'Isn't good enough' after Which? investigation

One in three calls cut off on public helpline.

Autumn Statement 2014: Small business rates relief doubled to £1,500 for 500,000 firms

High-street shops, pubs and cafes to benefit as government announces review into the tax.

Cryptocurrency round-up: Bargain Silk Road bitcoins and MasterCard attacks bitcoin anonymity

Bitcoin price drops sharply, as MasterCard complains of digital currency's anonymity.

Banking taxes reached pre-recession levels last year

The amount of tax paid by the financial sector is going up.

London Mayor Boris Johnson Refuses to Pay US Tax Bill Despite Dual Citizenship

US citizens and dual citizenship holders are obliged to file a tax return regardless of domicile.

Hungary Taxes Alcohol, Soaps, Shampoos, Supermarkets and Advertising

Hungary levies 'chips tax' on unhealthy food items and environmental fee for shampoos and soaps.

HMRC Recovers £3.65bn From Tax Dodgers

The amount recovered is up by a quarter on the 2012/13 fiscal year.

Britain's EU Tax Bill Row Needs to 'Calm Down' says Brussels Chief

Britain's new European commissioner Jonathan Hill warns of the situation getting out of hand

Britain Faces £70m Monthly Fine Over EU Tax Bill Payment Refusal

Prime Minister David Cameron pledged to forgo paying £1.7bn in extra tax.

UK Government Unveiling How Individual Taxpayer Money is Spent

Whitehall is calling it a 'revolution in tax transparency' while TUC is unsure of the motives.

HMRC Paid £400,000 to Tax Avoidance Whistleblowers in 2013

Freedom of Information request reveals how HMRC uses taxpayers' money for tax avoidance snitches.

HMRC: Tax Gap Widens for First Time in Seven Years after Increase in Fraudulent Activity

The tax gap was up 6.8% in the year to April 2013.

UK Government Hints at Inheritance Tax Hike for the Wealthy

David Cameron made comments about the 'mega rich' at charity event.

How Robots and iPods are Eating Our High Streets

As Palo Alto start-up billionaire Marc Andreseen famously said - software is eating the world.

Amazon Denies Special Treatment as EU Launches In-Depth Probe into Luxembourg Tax Affairs

Amazon claims it has received no special treatment as EU opens probe into tax dealings in Luxembourg.

AA: New Vehicle Tax System Will See Government Get 'Double Money'

It believes that some people will get taxed twice.

Apple Faces Unfavourable Precedent Over Prohibited State Aid in Ireland

Tax expert Lee Sheppard invokes state aid case involving Gibraltar and the European Court of Justice.

Holidaymakers Forced To Cough Up £1.9bn in Tax For Trips Abroad

Holiday tax has risen by almost £400m since 2008.

HMRC to Hit 10,000 Business in Tax Avoidance Crackdown

Law Firm Winckworth Sherwood said many businesses may decided to take legal action against tax advisors.

Why It Made Sense for Walgreens Not to Take Advantage of Tax Inversions

The US pharmacy chain confirmed it will try to fully take over British chemist Alliance Boots

HMRC: Nearly Half a Million Britons Miss Tax Credit Deadline

HMRC has said these people could face payment cancellation.