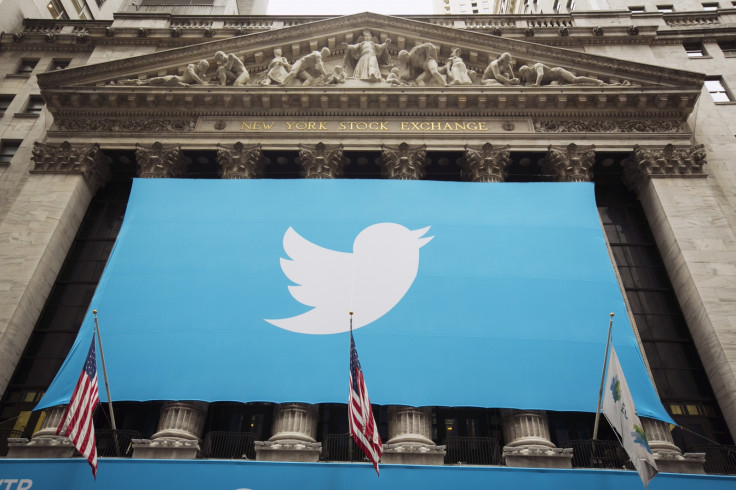

Twitter shares sink to record low amid growth concerns

Twitter shares dropped to their lowest level since their Wall Street debut amid persistent concerns over the company's long-term growth prospects. The stock price hit a low of $25.92 on 20 August – below the November 2013 initial public offer (IPO) price of $26 – before closing 5.8% lower at exactly $26.

The slide came amidst a wider sell-off on Wall Street, where the Dow Jones, Nasdaq and S&P 500 indices all closed more than 2% lower on 20 August. Shares in Twitter have been on a downward trend since late July, after acting chief executive Jack Dorsey said he was "not satisfied" with user growth.

The microblogging site reported a total of 316 million active users in its second-quarter earnings report, up slightly from 308 million in the preceding three-month period. But that figure is dwarfed by the firm's most high-profile competitor Facebook, which boasts 1.4 billion users.

'Challenging to use'

Twitter said the majority of its active users added in the second quarter came from SMS fast followers – people who receive updates from the social media site but do not have an account. The company is also struggling in its hunt for a new CEO after former boss Dick Costolo stepped down in July.

Analysts said the San Francisco-based firm must broaden its appeal to consumers who find it hard to use or risk being pigeonholed as a niche service.

"By the company's own admission, Twitter remains challenging to use and understand for the mass market consumer," analysts at Barclays told the Financial Times. "The value proposition is still poorly understood, despite high overall awareness of the product."

Shares in Twitter peaked in December 2013 at $74.7.

© Copyright IBTimes 2025. All rights reserved.