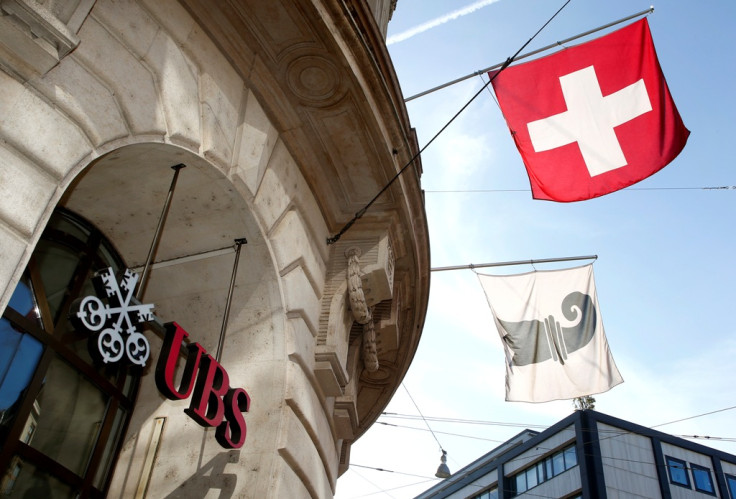

UBS Retains Private Banking Crown as Assets Near $2tn

Switzerland's UBS has benefitted from a refocus of its business onto the private banking side, as its assets climbed last year by 15.4% to $1.94tn, retaining its position as the largest wealth manager in the world.

The asset gains at UBS reinforced its lead over second place Bank of America, which sold its international wealth management division to Switzerland's Julius Baer two years ago. BoA saw its private client assets increase 12.5% to $1.9tn.

Overall the largest 25 wealth managers' assets grew 11% on average, according to wealth management and private banking consultancy Scorpio Partnership.

Morgan Stanley, Credit Suisse and Royal Bank of Canada figured among the top five wealth managers, said Scorpio.

UBS capitalised on new business coming in from emerging market clients, with some $37bn in private wealth flowing from destinations in Asia and the Brics, over the past year.

The global private banking industry now manages assets worth $20.3tn, up from $18.5tn a year ago.

However, a global tax evasion crackdown and tougher regulation has hurt private banking in Switzerland - where a large proportion of the first world's private wealth has traditionally been safely hidden.

An unrelenting assault on once-hallowed Swiss banking secrecy began in 2007 at UBS, which later agreed a $780m deferred prosecution agreement with the US. Credit Suisse, the number two Swiss private bank, received even more of a kicking from US justice authorities earlier this year.

© Copyright IBTimes 2025. All rights reserved.