UK consumers favour casual dining over clothes shops as inflation begins to bite

UK consumers are however spending big in restaurants and bars.

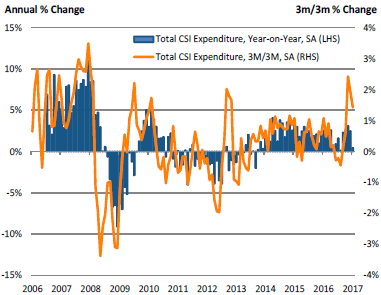

The post-Christmas blues seem to have finally caught up with UK consumers. After strong 2.5% monthly growth in consumer spending in December last year, credit card company Visa notes that January's spending slowed down sharply to just 0.4% higher than a year earlier (Chart 1).

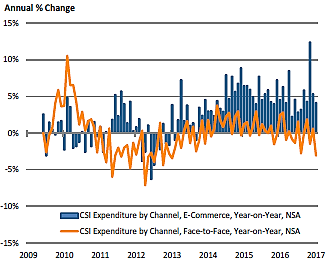

There are several trends which persists: online retail continues to do well, up over 4% from a year earlier so this segment continues to take market share away from traditional "bricks-and-mortar" retailers, called "face-to-face spend" by Visa (Chart 2). This face-to-face spending actually fell by over 3% in January compared to the previous year.

Which consumer sectors are holding up best?

For investors, the other interesting trend to note is the continued strong growth in spending in restaurants and bars, while the clothing and footwear retail segment continues to suffer declines in spending (Chart 3).

With inflation starting to rear its ugly head in the UK thanks to a combination of higher petrol pump prices and the impact of a weak pound sterling pushing up import prices, UK households could be starting to tighten their collective belts as their spending power is steadily eroded through this year.

Online spending plays: Gocompare, Debenhams

The one problem that investors are confronted with when looking at online retailers is just how expensive their shares are. It seems that a huge amount of future growth has already been priced into the likes of Asos (code: ASC), boohoo.com (BOO) and Ocado (OCDO), given their stratospheric valuations.

Two possibilities that investors might consider are Gocompare.com (code: GOCO) and Debenhams (DEB).

Gocompare.com is, as most TV viewers will know, a heavily-advertised online price comparison website (with a large moustached opera singer typically featuring) for financial services such as all types of insurance, mortgages, credit cards and savings products. Unlike the online retail companies listed above, Gocompare.com is on a very reasonable valuation and is very profitable.

Since being spun out of parent insurance company esure back in November last year, the shares have already risen from 70p to 91p today, but remain on a steady upwards trend.

A second company to consider is Debenhams. While of course a bricks and mortar department store retailer, Debenhams has nonetheless made giant strides in developing its online retailing presence (debenhams.com). This activity now generates 15% of the company's overall profits.

Note too, that unlike competitors such as Marks & Spencer and Next, Debenhams reported a strong post-Christmas trading update, with like-for-like sales in the seven-week Christmas period to January 7 of +5% year-on-year, with online sales growing 17% on the year.

Debenhams remains a cheap play on the growth of its online retail activity, as it still pays a high income via a 6% dividend yield, nothing to be sniffed at.

Growth in restaurant and bar spend: Patisserie Holdings, JD Wertherspoon, Revolution Bars

The one area where UK consumers are seemingly growing rather than trimming their spending is in restaurants and bars. The trend towards casual dining is gathering pace, with a number of companies poised to capture this growth.

Firstly, Patisserie Holdings (code: CAKE), the owners of the Patisserie Valerie café chain, is growing well. Sales in 2017 are estimated to grow 12% fuelled by a continued roll-out of this rather upmarket concept with its highly-priced French fancies.

Secondly, JD Wetherspoon (code JDW) is posting good growth at the other, rather more budget end of the market, with its cheap food and beer offerings popular across the UK. JD Wetherspoon has demonstrated an enviable record of growth over the past few years, with profit growth forecast to continue rising.

Finally, there is Revolution Bars (code RBG), a chain of 60 bar cum restaurant establishments based in town and city centres, operating under the Revolution and Revolucion de Cuba brands. It seems to be very well placed to capitalise on the growth in demand for casual dining, with its menus oriented towards "sharing plates" for groups of friends.

Growth has been steady since 2012, with new openings funded by the profits from existing bars. It remains a relatively cheap share at under 11x prospective P/E ratio, with analysts targeting on average a share price 34% higher than today's 197p level.

Disclosure: the author owns shares in Revolution Bars.

© Copyright IBTimes 2025. All rights reserved.