US election 2016: From Sanders to Trump, uncertainty is bigger threat to stock markets than candidates

Following Super Tuesday, Hillary Clinton and Donald Trump have come out on top as the prospective Democratic and Republican frontrunners. The Democratic partt as well as the GOP debates have been dominated by talks about foreign policy, migration and health care.

But with talks of the US entering a recession in 2017, people are increasingly looking at the candidates' economic policies. IBTimes UK spoke with Kully Samra, UK boss of US investment company Charles Schwab, about the American stock markets and the influence of the election.

Donald Trump, the Republican frontrunner, received a slap in the face from former presidential candidate Mitt Romney, who said the real estate tycoon "has a kindergarten view of economics" and would make recession a certainty.

The expert

Kully Samra is the UK managing director of Charles Schwab, one of the largest providers of US investment services, managing $2.5tn worth of client asssets.

"The question is now how comfortable would the market be not knowing or understanding what Trump's policies are at this stage," Samra said.

Clinton, meanwhile, has received $2.5m (£1.76m, €2.27m) in sponsorship money from Wall Street, $6m including banks' contribution from PACs (7.7% of her total campaign money).

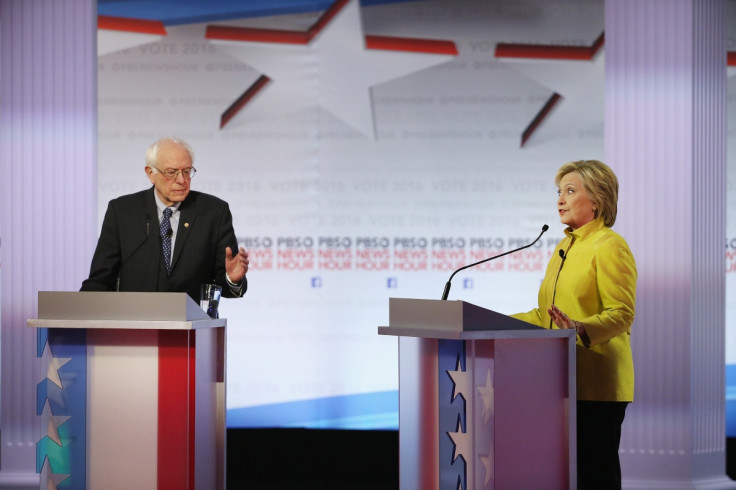

Meanwhile, the former Secretary of State's biggest threat in the Democrat party, runner-up Bernie Sanders, has long voiced his criticism towards financial misconduct after the 2008 financial crash. The Vermont Senator has even said he wants to break up big financial institutions on Wall Street.

"We must break up too-big-to-fail financial institutions," he writes on his campaign website. "Those institutions received a $700 billion bailout from the US taxpayer, and more than $16 trillion in virtually zero interest loans from the Federal Reserve."

Despite the wide range of economic views taking the stage during the primaries, Wall Street will be left relatively unaffected, whichever candidate takes to the Oval Office, Samra said.

"When it comes to the economy, it does not even really matter if the next president is Republican or Democrat," the investment boss said. "The economy has been in recession and boom times regardless of what political party is in power."

Samra added that the president needs agreement from the US Cabinet as well before significant policy changes can be introduced. Whether it is Sanders, Hilton, Trump or even Cruz or Rubio taking the Oval Office, before they can seriously impact Wall Street, they need to have their office on board.

"The office of the presidency has a lot of checks and balances in place so really there's not a huge amount that can be done unless it goes through these checks and balances," Samra explained. "I think the way the office is set up, there's not a huge amount there can be done unless there's consensus of opinion really."

Beyond November

If the presidential election does not affect markets that much, then what does? The slowdown in emerging markets and the monetary policy by the Federal Reserve are often named as market movers.

After Janet Yellen's Fed increased the central interest rate for the first time in almost 10 years last December, she appeared in front of Congress and said that the Federal Open Markets Committee (FOMC) might not stick to its plans to introduce four gradual hikes in 2016.

Some analysts say that the Fed hiked too early, especially considering the sell-off in January 2016. But Samra disagrees: "Just think about the amount of credibility the Fed would've lost if they did not lift the interest rates in December, think about what signal that would've sent about the underlying economy."

More so than the Fed or emerging markets, the job market has a big impact on the US markets. On Thursday (3 March), jobless claims disappointed, but non-farm payrolls, the key benchmark macro figure, trumped expectations in February.

"I think, generally, the job market is pretty strong in the US and this is very important because this creates a virtuous cycle," Samra said. "Employment gains lead to a tight labour market, which drives up wages, increases consumption and then lead to more people being employed."

"And that, I think, is what's not being talked about enough. As long as that's going, the threats from emerging markets or the Fed's policy are relatively small."

© Copyright IBTimes 2025. All rights reserved.