What is next for oil prices after Opec?

Opec's surprise decision to cut oil production by 1.2 million barrels per day has boosted the crude oil price.

Opec's surprise decision on November 30 to cut their oil production by 1.2 million barrels per day has boosted the crude oil price to as high as $54.50/barrel in recent days.

Further good news for oil price could come on December 10, when Opec meets non-Opec oil producers (such as Russia).

At this meeting, they hope to secure agreement for a further cut in oil production of 600,000 barrels per day (of which Russia would contribute half).

The oil price has been recovering for most of this year since February. But with this Opec decision, the Brent crude oil price has surged to a year high of over $54/barrel (see chart 1).

Can the oil price break $60?

With this renewed momentum, many oil traders are now confidently predicting that the oil price can run up to $60/barrel and even beyond, which would naturally push up the cost of petrol at the pump for households.

Oil bulls can take heart from the fact that the oil price has been a lot higher historically. Up until the middle of 2014, the Brent crude oil price was consistently above $100/barrel (see chart 2).

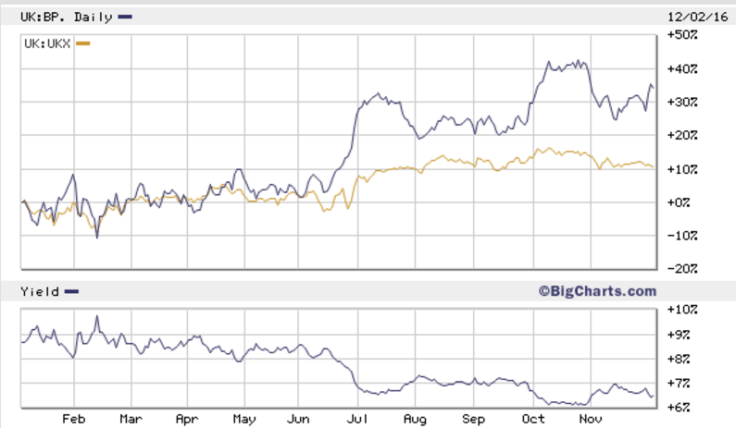

As a result of this surge in oil price, oil company shares have also done extremely well of late. In the UK, oil giants BP and Royal Dutch Shell have bettered the FTSE 100 index (code UKX). BP has already risen 35% since the beginning of this year (see chart 3).

Why I am more sceptical about oil

Despite all this apparently good news about oil, there are a number of reasons why I am sceptical of investing in oil or oil companies today.

The first issue is Opec compliance. In the past, Opec countries have been given oil production quotas to respect as part of previous Opec oil production agreements. But historically, Opec countries have not been good at respecting these quotas, with one or more countries typically "cheating" by producing more than they were supposed to.

Even the former Saudi Arabia Oil minister Mr. Ali al-Naimi has underlined this issue with his recent comments. He said at an event in Washington, DC, "The only tool they [Opec] have is to constrain production. The unfortunate part is we tend to cheat."

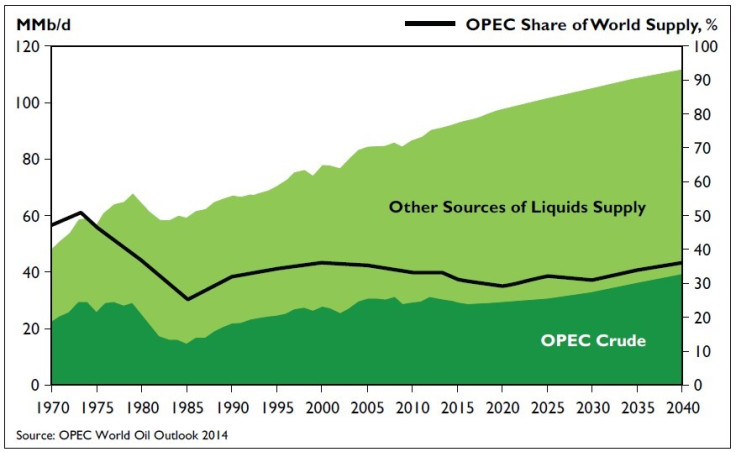

Secondly, Opec's power is waning. Today, Opec control less than 35% of the world's oil production (see chart 4). Russia is the second-largest oil producer in the world, with the USA the third-largest thanks to growth in shale oil production over the last few years.

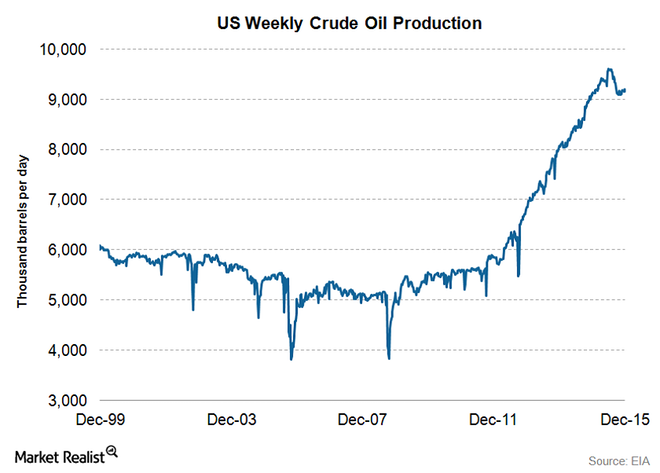

While Opec's share of world oil production has fallen, US oil production has in contrast risen sharply following the discovery of oil fields onshore in shale rock formations. As the US is by far the largest consumer of oil in the world, this has had a huge effect on the US's need to import oil from Opec nations.

Since 2011, total US crude oil production has grown by over 3.5 million barrels per day (see chart 5) to 9m barrels per day.

Most importantly, oil production in the US is on the increase once again, as US oil companies start to invest once again in shale oil wells thanks to higher crude oil prices.

Perhaps better to invest in oil service companies than oil producers

All in all, I think that a better option for investors today in the oil and gas sector are oil service companies, that benefit from investment in oil exploration and production, rather than the big oil producers like BP and Royal Dutch Shell.

UK-listed oil service companies that can benefit from these higher oil prices include:

- Wood Group (UK code WG.)

- Amec Foster Wheeler (AMFW)

- Hunting (HTG)

While this sector has suffered from the sharp fall in oil prices since 2014, the recent ramp-up in the oil price is driving better prospects for these companies. While they have already seen share price rallies this year, their prospects should continue to improve into 2017.

© Copyright IBTimes 2025. All rights reserved.