Why UK house price growth will be unstoppable in 2015

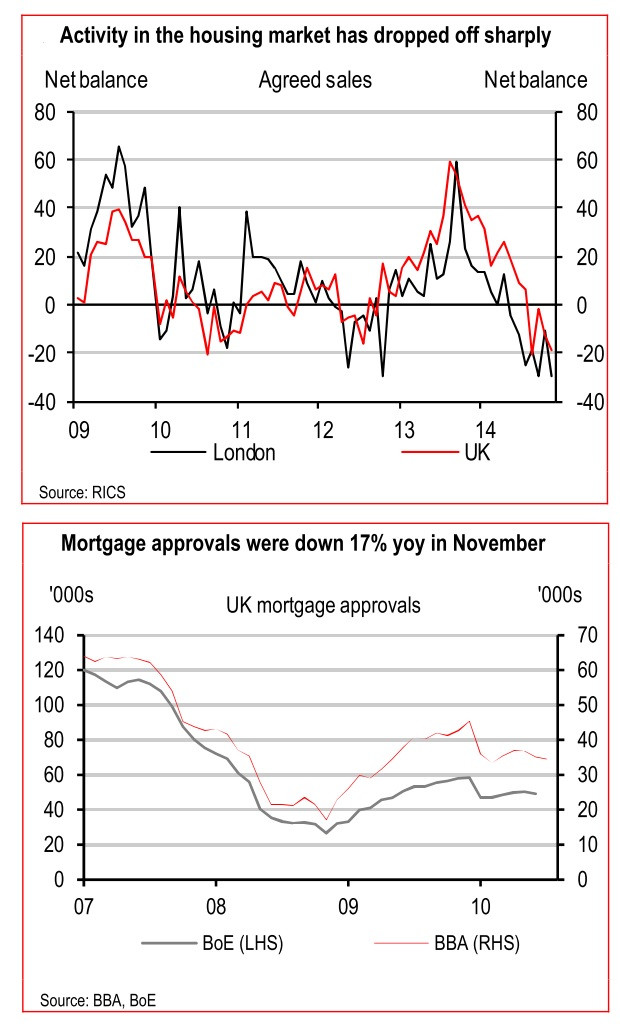

UK house price growth has started to slow over the past few months amid a raft of mortgage lending curbing measures and uncertainty over the general election in May 2015.

The Bank of England (BoE) has kept UK interest rates at a record low of 0.5% since 2009.

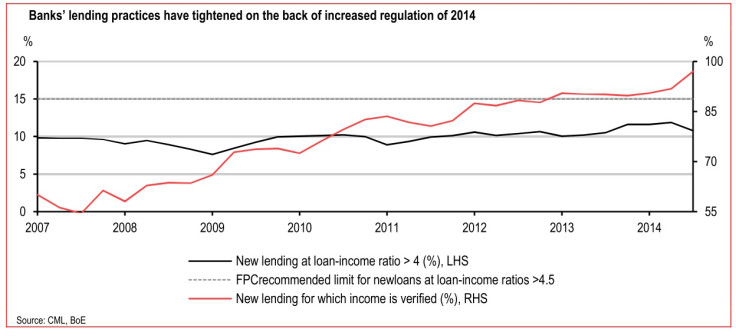

The BoE capped mortgage lending on 1 October while the Financial Conduct Authority (FCA) installed new affordability checks for homeowners to stop soaring UK house prices [Figure 1].

The checks are also designed to make sure Britons are able to withstand a rise in rates after obtaining a mortgage.

Falling house prices

The Office for National Statistics showed the average UK house price stood at £271,000 (€339,695, $425,190) in October, which is a slight decline from £273,000 in September 2014 and £274,000 in August.

Meanwhile, the Royal Institution of Chartered Surveyors (Rics) revealed UK house price growth fell to its slowest pace since May 2013 in the final three months of last year, which falls in line with estimates from Nationwide, the UK's second biggest mortgage lender.

Nationwide said house price growth in the UK was at its slowest pace for a year in December as property price inflation fell to 7.2% in December on an annual basis, down from 8.5% in November.

However, HSBC said buyers should not expect prices to fall much further this year.

"Momentum in the housing market has slowed and demand will likely remain soft in the run-up to the election," said Liz Martins, UK economist at HSBC.

"But falling mortgage rates, stamp duty reforms and supply constraints make it hard to be too negative.

"Away from the prime London market, which is governed by separate forces and looks set for further downside, we find it hard to be too negative on the UK property market."

Technical drops, market correction and stimulus measures

HSBC, as well as the BoE, has remarked that dampened house price growth will not last for long despite the central bank's lending measures and the FCA's borrowing checks [Figure 2].

"On regulation, the impact has been significant: 97% of mortgages are now income verified, and banks have reduced the proportion of new lending at higher loan-value ratios," Martins said.

"But this is only a small segment of the market anyway and there are indications – not least the increasingly competitive pricing – that banks' appetite to lend is increasing once more."

Recently, BoE governor Mark Carney warned "momentum may return to the UK housing market after the stamp duty cut and the fall in mortgage rates".

UK Prime Minister David Cameron confirmed tens of thousands of young Britons will be able to snap up one of the 100,000 new homes to be built on under-used or unviable brownfield land, with a minimum 20% discount.

The government also confirmed Britain will be able to afford the move because planning costs and levies will be waived in return for a promise from housebuilders of such discounts.

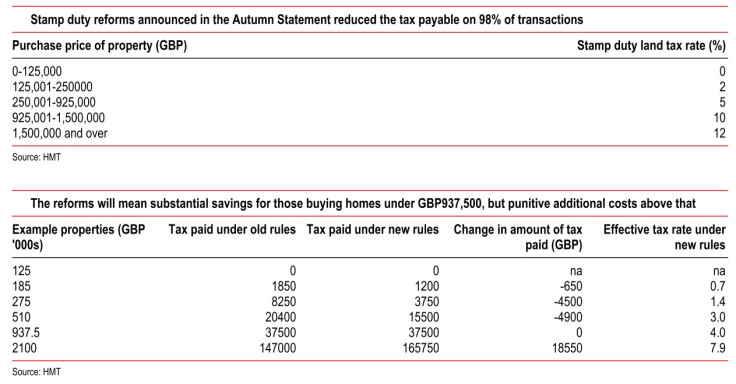

Furthermore, in the chancellor's Autumn Statement, George Osborne abolished the old stamp duty system.

Stamp duty works on a "slab" basis, by which the percentage paid applies to the purchase price band. This can have a distorting effect on the housing market, because a house is very difficult to sell at prices just above each threshold, for example £250,001 [Figure 3].

However, under the new rules, stamp duty on a property will be paid in a method comparable to the system of income tax, which apparently affects "98%" of Britons, say Whitehall.

"The impact of mortgage regulations should be wearing off," said Martins.

"This is not necessarily to say that prices won't fall in the coming months [although our view is that they will end the year higher].

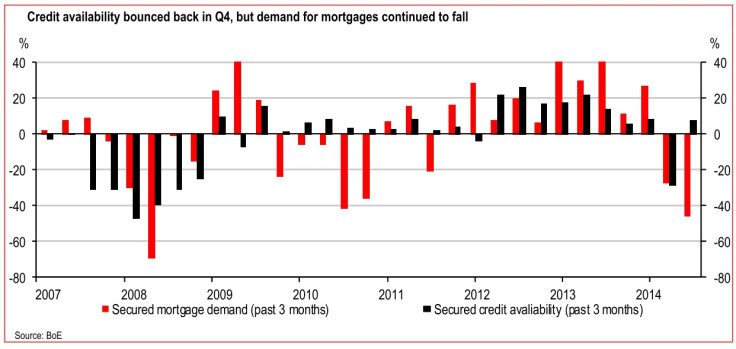

"The price indices are volatile and may be yet to catch up with the decline in activity. Much also depends on the drivers of the downturn. The BoE's Credit Conditions Survey for Q4 2014 was taken before the stamp duty reforms [Figure 4], so may not give the most up to date picture.

"But it does show a shift in trend towards the end of the year: while the slowdown had been both a supply and demand issue in the middle of last year, it was demand that was continuing to drive the slowdown – indeed, increasingly so – in Q4."

So what can we expect?

The chronic shortage of British housing supply and increasing demand has meant property prices, on average, have rocketed by 56% nationally since 2004, with a 90% increase in London.

For this reason, as well as others above, many analysts see a certain upwards move for prices over 2015.

On the more conservative end of the scale, Savills expects just 2% house price growth on average for the UK this year, while HSBC sees property prices rising between 2-5% higher in 2015.

"We find it hard to get too negative on the UK housing market. Clearly, it has slowed significantly, and sentiment is much more cautious. The economic backdrop is not as buoyant as it was this time last year, and confidence is diminished," said Martins.

"Uncertainty over the election and interest rates may continue to weigh on demand for housing. For high-end property in London, the combination of extremely elevated prices, higher stamp duty, diminished foreign demand and the threat of a Mansion Tax make further correction probable.

"But outside of that particular segment of the market, the supply-side constraints, coupled with the still low cost of borrowing and stamp duty cuts, suggest to us that prices do not have far to fall.

"Indeed, while the year-on-year growth rates are likely to dip further, we would expect UK house prices on aggregate to end 2015 higher, probably in the region of 2-5%."

© Copyright IBTimes 2025. All rights reserved.