Morrison Supermarkets Cautious on 2012 Outlook; Secures 'Buy' rating from Jefferies

Wm Morrison Supermarkets, a food retailer grocer, expects the consumer environment in Britain during 2012 to be cautious despite anticipated reduction in inflationary pressures and expects the full year results to be on par with the original assumptions. It is expected to release its preliminary results for the year 2011 on Thursday.

According to the group, the retailing chain is well positioned against the cautious consumer environment through its growing customer base.

While commenting on the half yearly results, Chief Executive Dalton Philips said: "In a tough economy shoppers are looking for unbeatable value on fresh food, great deals on national brands and the best prices at the petrol pump. Our "Price Crunch" campaign has delivered these for our customers throughout the period. In addition to growing sales and delivering good profit growth, we also made great strides in developing the business for the future. We have opened our first convenience store, invested further in our unique production capabilities, increased efficiency across the group, gained valuable insights from our trial stores and taken our first steps towards becoming a multichannel retailer. I am confident we will make further good progress in the second half."

During the H1 2011, Morrison reported a total turnover of £8.7 billion, an increase of 7.4 percent over the last year, whereas, excluding fuel, store turnover was up 4.1 percent, with a contribution of 1.9 percent from new stores. The group posted profit before tax of £449 million for the same period.

Morrison grew 0.8 percent more than the grocery market in the UK. It said the company outperformed larger rivals for several quarters, mainly due to its lower exposure to discretionary non-food goods. The group also said it is benefiting from producing more of its own fresh food.

According to company reports, it is targeting a greater share of the mother and baby products market after grabbing the leases of 10 former Best Buy stores from Carphone Warehouse. It would invest 15 million pounds converting the stores to the Kiddicare.com brand that it acquired last year. The company also expects to open its own first store before autumn this year.

Brokers' Views:

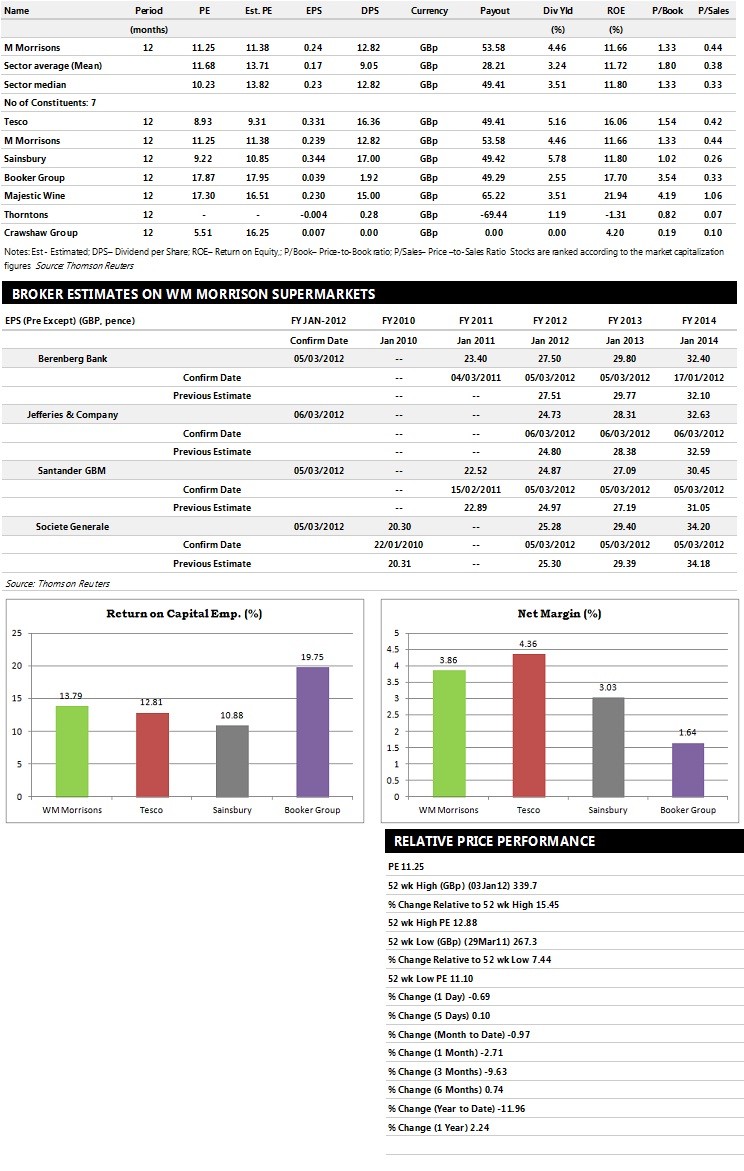

- Jefferies recommends 'Buy' rating on the stock with a target price of 350 pence per share

- Santander GBM assigns 'Buy' rating with a target price of 310 pence per share

- Societe Generale gives 'Hold' rating with a target price of 315 pence per share

- Berenberg Bank assigns 'Hold' rating with a target price of 310 pence per share.

Earnings Outlook:

- Jefferies estimates the company to report revenues of £17,618 million and £18,472 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £917 million and £975 million. Earnings per share are projected at 24.73 pence for FY 2012 and 28.31 pence for FY 2013.

- Santander GB projects the company to record revenues of £17,644.30 million and £18,519.20 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £917.00 million and £924.00 million. Profit per share is estimated at 24.87 pence and 27.09 pence for the same periods.

-Societe Generale expects Morrison to earn revenues of £17,678 million for the FY 2012 and £18,650 million for the FY 2013 respectively with pre-tax profits of £931 million and £997 million. EPS is projected at 25.28 pence for FY 2012 and 29.40 pence for FY 2013.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents seven companies based on market capitalisation.

© Copyright IBTimes 2025. All rights reserved.