WPP hikes dividend but warns industry optimism is misplaced

Advertising giant WPP shrugged off currency headwinds to record an increase in annual pre-tax profit but warned geopolitical issues were curbing its clients' appetite to take risks and invest. In the 12 months to 31 December 2015, WPP posted a 2.8% year-on-year increase in pre-tax profit to £1.49bn (€1.93bn, $2.11bn) despite suffering from disadvantageous currency movements, as profit would have climbed 7.3% on a constant currency basis.

Revenue grew 6.16% from the corresponding period in 2014 to £12.24bn, with billings rising 3.12% to £47.63bn as strong growth in North America drove like-for-like revenue higher across all WPP's regions.

The FTSE 100 group said it has started 2016 on the front foot, with like-for-like revenue growing 4.2% year-on-year and net sales up 2.3%, although it warned the optimism surrounding the industry was misplaced amid what it described as "tepid" growth worldwide.

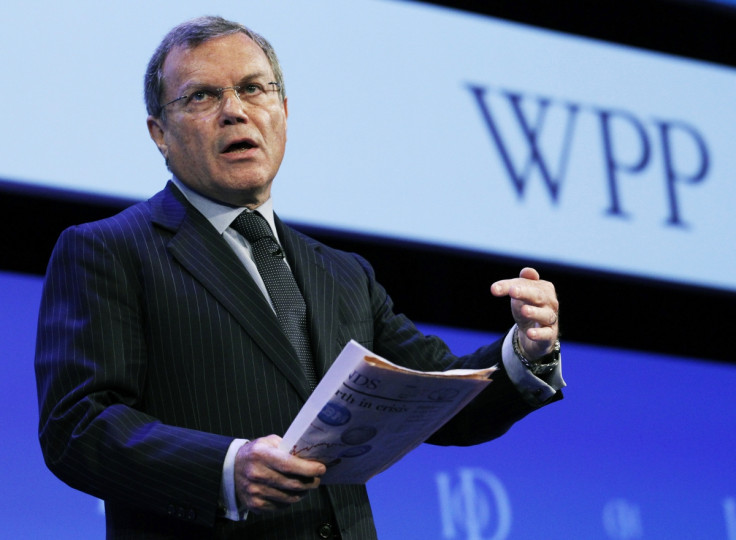

"Despite this strong performance, the always-on, Don Draperish general industry optimism seems misplaced," said group chief executive Sir Martin Sorrell.

WPP said it will pay a final dividend of 28.78p per share, up 8.3% year-on-year, meaning its total dividend will rise 17% from the same period in 2014 to 44.69p, which the group indicated represents a payout ratio of 47.7%, up from 45.0% last year and on track to reach the group's target payout ratio of 50% for 2017.

The London-listed group added it will focus on faster growing markets and aims to expand its business via strategically targeted acquisitions, indicating it will place particular emphasis on balancing revenue growth with headcount increases and improvement in the staff costs/net sales ratio to enhance operating margins.

"There is still a very significant pipeline of reasonably priced small- and medium-sized potential acquisitions, with the exception of Brazil and India and digital in the United States where prices seem to have got ahead of themselves because of pressure on competitors to catch up," it said in a statement.

"This is clearly reflected in some of the operational issues that are starting to surface elsewhere in the industry, particularly in fast-growing markets like China, Brazil and India."

© Copyright IBTimes 2025. All rights reserved.