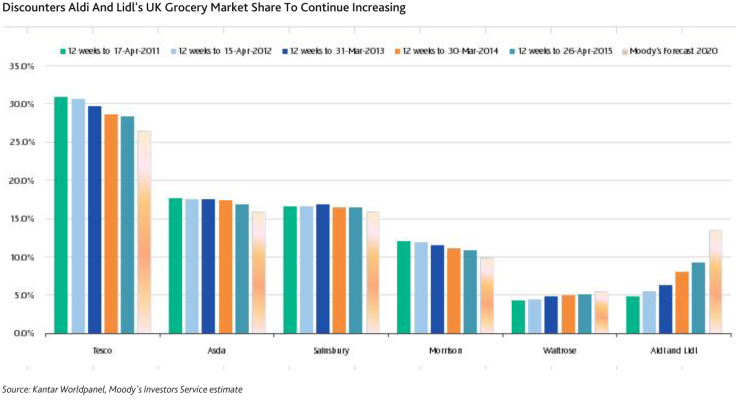

Aldi and Lidl to consume 4% more of Tesco, Morrison, Asda and Sainsbury's marketshare by 2020

Cut-throat retail discounters Aldi and Lidl are expected to eat into more of the big four supermarket's share – some 4% by 2020, according to Moody's.

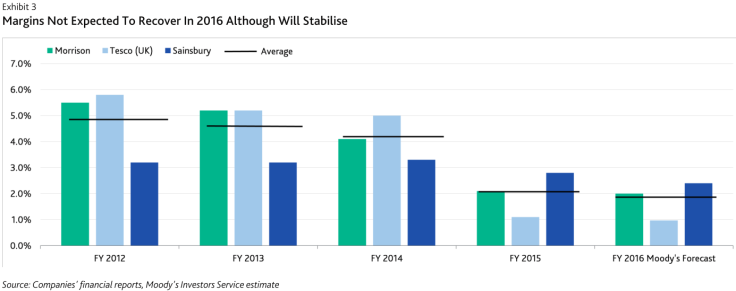

That said, there could be light at the end of tunnel for Tesco, Morrison, Asda and Sainsbury's: the ratings agency said margins will start to recover from 2016-2017.

For the next 12 to 18 months the big four will remain entrenched in a grim supermarket price war but the impact of the discounters on them will diminishing gradually. Morrisons reported that the decline in terms of items per basket slowed to 0.1% in the first quarter of fiscal 2015/16 from a decline of 2.4% in Q3 2014/15, and a decline of 5.9% in the first quarter of the previous fiscal year.

Tesco also reported positive transaction and volume growth after successive quarters of declines.

Sven Reinke, Moody's vice president and senior analyst, said: "We expect Aldi and Lidl's combined share of the UK market to reach 12%-15% by 2020.

"Although the discounters' sales densities have caught up with the big four retailers, Aldi and Lidl could continue to gain around 1% market share every year supported by their store expansion plans at a time where the Big Four selectively close unprofitable stores in order to save costs."

"However, the UK's economic growth, rising real wages and improving consumer sentiment could support the big four's gradual recovery from fiscal 2016/17," he said.

Moody's said the continuing rounds of price cuts will become less pronounced, but that food price deflation will hit like-for-like sales over the next year and a half. It said growing online businesses are still "margin dilutive" and sales densities at larger stores are continuing to decline.

The agency warned that an intensifying price war is risky if the big four are not able to develop strategies to operate successfully with lower market shares.

With the exception of Asda none of the other three players really has the capacity to engage in many more rounds of price cuts. Consolidation among the big four is also very unlikely given their market shares, noted Moody's.

© Copyright IBTimes 2025. All rights reserved.