The algorithm that pounded sterling and prompted a Bank of England probe

An alleged rogue algorithm caused havoc in the foreign exchange market, but their deployment has grown exponentially.

An algorithm, without going into technological gobbledegook, is a set of rules to be followed in calculations, or for that matter solving other problematic operations, often used to execute a sequence of moves towards achieving an end goal.

While the concept of an algorithm dates back to the 13th century, its digital variant, conjured up by modern mathematicians, grabs the headlines in the finance world these days, or, as it happened on Friday (7 October), all the bad headlines in the foreign exchange markets.

While much of the UK was asleep, it seems one algorithm, allegedly deployed by a trading house in Asia, happened to be working overtime.

According to a plethora of traders interviewed by IBTimes UK, the algorithm programmed to pick-up overnight newsflow and execute trades, picked up the words "hard Brexit", French President François Hollande's quip that the British should not be given an easy ride over Brexit, and content in the Financial Times summing up the pound's woes.

It then deemed the sequence worthy of shorting the pound, i.e. placing bets that the British currency should trade lower, and caused what the market rather colourfully describes a "flash crash". If you are one for numbers, it sent the pound down 6.1% to $1.1819 against the greenback in a matter of minutes.

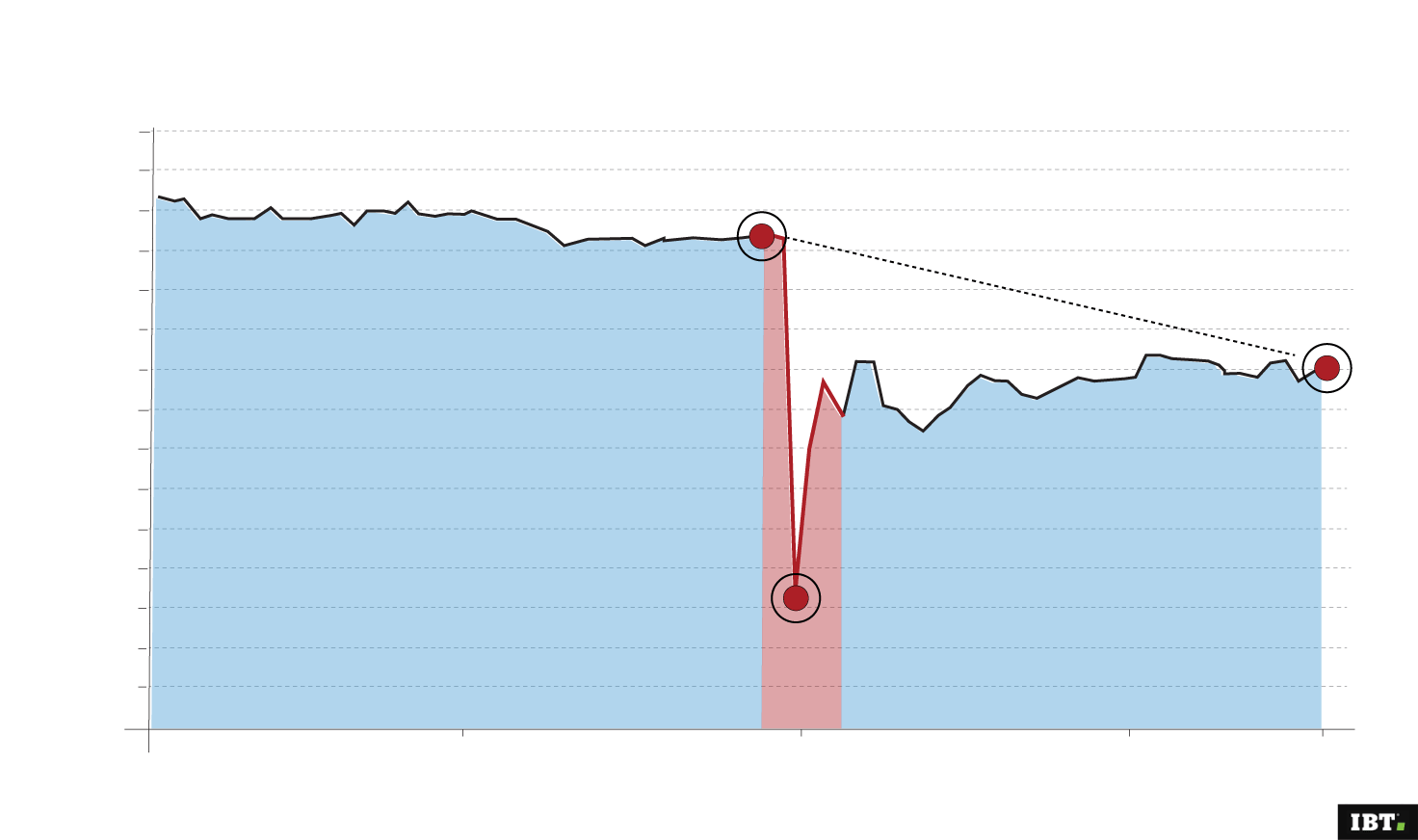

Algorithm sends pound tumbling

$1.2750

$1.2700

$1.2611

$1.2650

$1.2600

Intraday decline

$1.2550

$1.2429

$1.2500

$1.2450

$1.2400

$1.2350

$1.2300

$1.2250

$1.2200

$1.1818

Point of Asian

“flash crash”

$1.2150

-6.1%

$1.2100

$1.2050

18:00

6 Oct

00:00

7 Oct

06:00

7 Oct

10:00

7 Oct

Source: data aggregators

With the market scratching its head over what had suddenly escalated bearish sentiment on the pound, one panicked trader said: "Don't get me wrong, I am net short on the pound. But this is bollocks! The currency is trailing [Olympic diver] Tom Daley. "

Another, in Frankfurt, noted with characteristic German calm that: "No valid reason could be ascribed to this sudden, sharp fall."

Some industry veterans tried to infuse humour into the pound's Daley-esque dive towards its unfortunate 31-year low. Kit Juckes, head of forex at Societe Generale and an IBTimes UK columnist, said Arsenal football club's overseas players craving a pay-rise ought to be concerned.

"If the Times were to be believed, Arsenal's Mesut Ozil and Alexis Sanchez ought to be spooked. Both are asking for 40% pay increases in contract talks to £250k per week. More power to their elbow I say. I have nothing against other people getting huge pay increases.

"I was struck however, that one of the arguments for such a big pay rise was the pound's fall since June. A 14% fall versus the euro [for Ozil] and a 15% fall against the Chilean peso [for Sanchez] doesn't automatically point to a 40% pay increase, but in a world of scarce labour, I'm all in favour."

Of course, the market commentators in question did not know about the rogue algorithm then, something which came the world's attention in a matter of hours, as more mayhem ensued.

Thomson Reuters, which owns the Reuters foreign exchange brokerage platform RTSL, said an outlying trade in the pound, that resulted in a fresh 31-year low for sterling on Friday, had been cancelled. The cancellation saw the pound's low of $1.1378, captured on charts in early Asian trading, being revised to $1.1491.

Those shorting saw a subsequent recovery to $1.2468; though the pound is still at 31-year lows, and an intraday decline of 1.17%, and faced manic calls from scribes and clients alike. The Bank of England promptly announced it was probing the unusual fall.

Chances are President Hollande, the Financial Times and those calling for a "hard Brexit" never had a tete-a-tete with the, as yet unnamed, trading house that deployed the alleged algorithm in question. But it does illustrate how trading algorithms have exponentially penetrated every aspect of financial trading.

Away from the foreign exchange market, algorithms form the bedrock of the asset management industry's courting of Artificial Intelligence (AI) mechanisms – based on a hope for better returns and cheaper operational costs.

Of course, to quote Nick Hungerford, co-founder and non-executive director of online investment management company Nutmeg, the rosy prospect of computers generating better capital returns for clients, compared to human wealth managers, was less than clear cut.

"Although from a cost perspective, they might be cheaper to run as businesses, I am not sure computers will deliver massively better returns than physically-managed wealth funds," he told an event audience last month.

I suspect many in the forex markets, woken up by their GBP/USD $1.15 stop loss barriers being triggered, would undoubtedly agree, and to quote one industry blogger, perhaps scream: "What the f**k is my [sterling] position?"

Regrettably, even the algorithms appear confused on that one.

Gaurav Sharma is the Business Editor of IBTimes UK. He has been a financial journalist for over 15 years, with a core specialisation in macroeconomics and commodities. Follow Gaurav on Twitter here.

© Copyright IBTimes 2025. All rights reserved.