American Dream Accounts Act: New Bill Proposes $25K For Every US High School Graduate Via Social Security Investment

The new bill also calls for a $10,000 bonus to individuals participating in the Peace Corps or AmeriCorps

US Representative Dean Phillips, serving the 3rd congressional district of Minnesota, floated a new bill under the Social Security program that would offer approximately $25,000 to all US citizens when they graduate from high school or receive their GED certificates. Those with disabilities could be exempt from the high school diploma or GED requirement.

Investment Accounts For All

If the US Congress approves the new Social Security bill called the American Dream Accounts Act, investment accounts will be opened for every newborn in the country with a balance of $5,000 invested in index funds. Considering average annual returns of 10%, the bill projected that the initial investments would grow to $25,000 by the time individuals become eligible to use the funds. The proposed program under the Social Security Administration will also offer a potential $10,000 bonus to individuals participating in the Peace Corps or AmeriCorps.

"Fulfilling the promise of our great nation requires that everyone have a chance at the American Dream. This legislation provides every American child the opportunity to flourish and realise their full potential," Phillips stated. "Investing pays dividends, and it is time to bet on the American values of self-determination and opportunity for all by passing the American Dream Accounts Act."

Prioritising Financial Literacy From Early On

Financial illiteracy is among the leading factors of today's economic crisis in US households. According to a National Financial Educators Council 2023 survey, Americans lost over $388 billion due to a lack of essential financial knowledge, with each individual losing an average of $1,506. However, the new Social Security program can offer younger generations a headstart in understanding how money works, growing wealth, and spending responsibly.

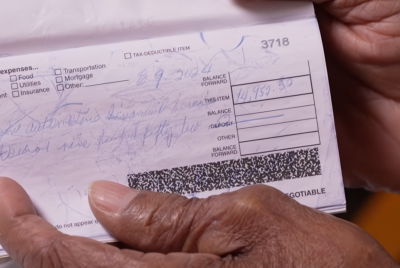

The bill enables students to monitor investment portfolio performance via apps, which can help them plan how to spend the money in adulthood, like a down payment for a house or college fees. The program is expected to offer a gateway for young Americans to have adequate cash in their formative years to invest and clear any liabilities, as more people have been increasingly tapping into credit over the years due to easier accessibility, flexible repayment terms, and high living costs.

Funding The Bill Can Be Challenging

"The American Dream Accounts Act will empower every child with the resources to pursue their aspirations, levelling the playing field for long-term prosperity," stated Jim Pugh of the Universal Income Project. While the initiative hopes to level the playing field for Americans from all walks of life by giving each an opportunity to achieve financial freedom, funding the program can meet several roadblocks.

The Social Security Administration offering $5,000 to each US newborn could take time and significantly impact the Social Security Trust Fund, which will be severely depleted by 2037 if the US Congress doesn't make changes. If no decisions are made, retirees and those with disabilities receiving Social Security checks can expect to receive only 76% of scheduled benefits. The Social Security Board of Trustees believe that immediately trimming benefits by 13% or increasing the combined payroll tax rate to 14.4% would be adequate to ensure total benefit payments for the next 75 years.

© Copyright IBTimes 2025. All rights reserved.