Analysis: China's metals traders offload stockpiles as bleak demand outlook bites

China's army of metal processors and traders has flipped from buyers to sellers amid a sharp downshift in economic activity in the world's top manufacturer, heralding a potential warning sign for steel, aluminium and other key industrial commodities.

China's army of metal processors and traders has flipped from buyers to sellers amid a sharp downshift in economic activity in the world's top manufacturer, heralding a potential warning sign for steel, aluminium and other key industrial commodities.

Chinese buyers drove the global surge in metals prices from mid-2020 through end-2021 as they scoured the world for ores and metals to feed its mammoth industrial engine and build inventories in anticipation of further price rises.

That order flow has reversed since March, as recurring outbreaks of COVID-19 have triggered extended factory and store shutdowns, choking purchases of metals-intensive products from cars to appliances, and pressuring prices of manufacturing inputs.

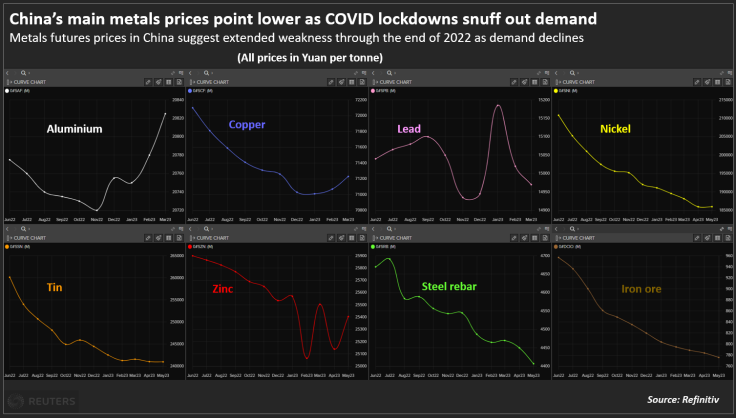

Metals futures prices illustrate the selling pressure. Futures forward curves for aluminium, zinc, steel rebar and iron ore show prices trending steadily lower through the rest of 2022.

(Graphics:

)

Weakness in the construction sector - which accounts for roughly half of all steel and around 30% of aluminium used in China - has further undermined metals sector sentiment, prompting some processors and trading firms to sell inventories into a weakening domestic market rather than store it for later sale to end-users.

"Downstream demand had been postponed again and again by each round of the pandemic outbreak across the country. Some people said it could pick up in July, but the rainy season will arrive then," said Qi Xiaoliang, a Beijing-based steel trader.

Unwilling to hold onto his depreciating metal stockpile until demand recovers, Qi has started to sell off inventories at 150-200 yuan ($22.56-30.09) below his purchasing costs.

Other producers of intermediate metal products have followed suit, reversing typical trade patterns and clouding the near-term outlook for metals demand in China.

"The issue is complex, since China is a net exporter of some metals, such as steel and aluminium, and net importer of others, such as nickel, copper and battery metals," John Johnson, CEO of CRU China told Reuters.

"Short-term changes in demand and relative prices may change these flows temporarily at the margin, but China is unlikely to change its longer-term strategy of adding value to exports."

STUNTED STIMULUS

Beijing has unveiled a series of measures from cuts to benchmark lending rates to allowing delays to loan repayments to soften the blow from the economic slowdown, but its commitment to a zero-COVID policy has precluded more direct steps to revitalise economic activity.

"Supportive policy measures in China are yet to offset stringent COVID-19 measures. Lending and key property indicators remain subdued," analysts with ANZ Research said.

Lockdowns and movement restrictions have curtailed factory and construction activity just when it typically peaks, depriving metals producers of a key window to sell their products.

Output of several key metals-intensive products from shipping containers to refrigerators has fallen behind 2021's production pace, and looks set to stay weak as long as movement restrictions remain in place.

Similarly, construction sites that are typically abuzz in the run-up to summer are now largely desolate as workers stay home.

The property sector's credit crunch has also stifled building activity, with new construction starts falling 26.3% year-on-year in the first four months.

That's resulted in reduced demand for metals in appliances, plumbing and wiring. The amount of copper used in appliances is set to fall around 2% in 2022 from 1.79 million tonnes last year, according to Che Guojun, analyst with state-backed consultancy Antaike.

Vehicle production and sales have slumped in the world's top auto market. As a result, auto sheet output at leading producer Beijing Shougang Co Ltd fell 17.6% in January-April from the same period a year earlier.

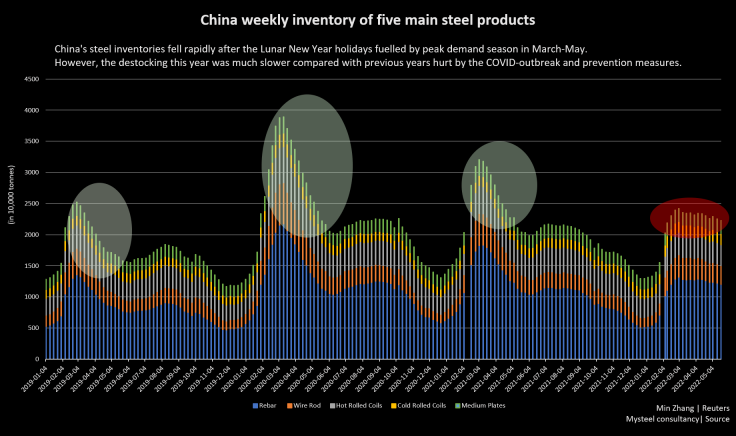

Reflecting this downturn in demand, steel product inventories have bucked their traditional decline since the end of the Lunar New Year holiday, instead climbing 9.4% from a year ago as of May 19, according to Reuters calculations based on Mysteel consultancy data.

(Graphics:

)

In response to the downbeat activity across China, Goldman Sachs lowered its 2022 growth forecast to 4%, compared with China's official target of around 5.5%.

"Although infrastructure stimulus should be overall positive for commodity demand, we believe its net impact should be slightly smaller... as projects could be less commodity intensive than in the past," the bank said in a recent note to clients.

BRIGHT SPOT

While most major industrial commodities are under pressure from China's slowing usage, analysts remain more upbeat on certain specialist products.

"New energy vehicles and batteries still remain high growth and awaiting demand resumption... sentiment towards new energy sector is still promising," said Yu Mengxue, analyst with Shanghai Dalu Futures.

Others anticipate demand will pick up later in the year on Beijing's vow to stabilise the economy.

"Government support has worked in the past, the exact benefit is hard to pinpoint but we are hopeful," said Malan Wu, research director at Wood Mackenzie.

($1 = 6.6475 Chinese yuan renminbi)

Copyright Thomson Reuters. All rights reserved.