Ashmore Group Bets on Emerging Asset Classes for Significant Profitable Growth

Ashmore Group says that it continues to innovate with an ever deepening range of up-coming market products and its infrastructure and distribution platforms are progressing to plan. The investment management services firm is scheduled to release its interim management statement on Thursday.

The group continues to innovate based on its experience gained over twenty years since its first funds were established. There remains an extremely convincing vision for significant, long-term, profitable growth. The group just has to keep performing and delivering it.

"The growth of emerging markets as an asset class was reducing the firm's ability to earn performance fees. As an asset class becomes larger, more liquid, more invested in by more people, more mainstream, then typically the ability to earn a performance fee reduces. I think the outlook for the asset class of emerging markets, both debt and equity is good for 2012 and the beginning of 2012 has demonstrated that," said Graeme Dell, Finance Director at London-based Ashmore.

Many of the asset classes in emerging markets can now be considered as safer, while for debt is reflected as anticipated through rise for local currency, blended debt and investment grade bonds demands. However, in equities it is anticipating benefits of its deep bottom-up stock selection in broad global, small and mid cap products as investors begin to differentiate between the equity risks and returns available in emerging markets compared to developed ones.

"There are excellent investment opportunities within many of Ashmore's investment themes and performance across all of them in 2012 has started well as a result of maintaining and developing our positioning in the final quarter of 2011. The world in many senses looks similar to the same time a year ago, after a little hiatus, but emerging asset classes offer considerably more value than then, having been caught up in the Europe induced general "risk off" mentality of the last quarter of 2011," said Ashmore's Chief Executive Officer Mark Coombs.

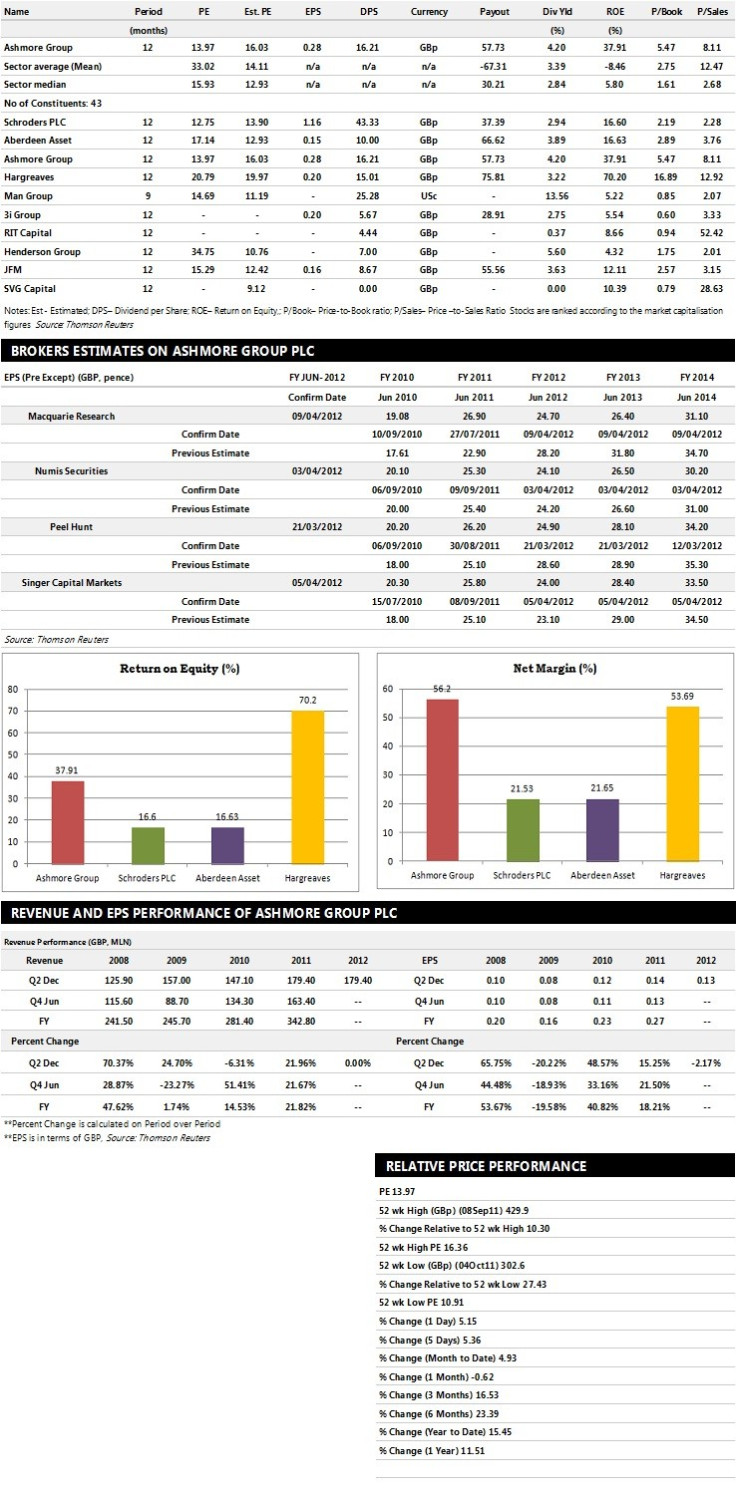

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents ten companies based on market capitalisation.

Brokers' Views:

- Macquarie Research recommends 'Neutral' rating on the stock with a target price of 420 pence per share

- Singer Capital Markets recommends 'Buy' rating with a target price of 445 pence per share

- Numis Securities assigns 'Hold' rating with a target price of 400 pence per share

- Peel Hunt assigns 'Buy' rating with a target price of 440 pence per share

Earnings Outlook:

- Macquarie Research estimates the company to report revenues of £336.18 million and £365.76 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £237.57 million and £251.08 million. Earnings per share are projected at 24.70 pence for FY 2012 and 26.40 pence for FY 2013.

- Singer Capital Markets projects the company to record revenues of £332.00 million for the FY 2012 and £397.00 million for the FY 2013 with pre-tax profits (pre-except) of £237.00 million and £280.00 million respectively. Profit per share is estimated at 24.00 pence and 28.40 pence for the same periods.

- Numis Securities expects Ashmore Group to earn revenues of £341.50 million for the FY 2012 and £373.70 million for the FY 2013 with pre-tax profits of £236.90 million and £254.60 million respectively. EPS is projected at 24.10 pence for FY 2012 and 26.50 pence for FY 2013.

© Copyright IBTimes 2025. All rights reserved.