Australian Dollar Keeps Short-Term Downtrend Despite Strong GDP; US Jobs, ECB Eyed

Despite stronger-than-expected GDP data on Wednesday, the Australian dollar is stuck to its short-term downtrend channel, and traders expect the currency to trade in ranges ahead of ECB rate decision and US nonfarm payrolls due this week.

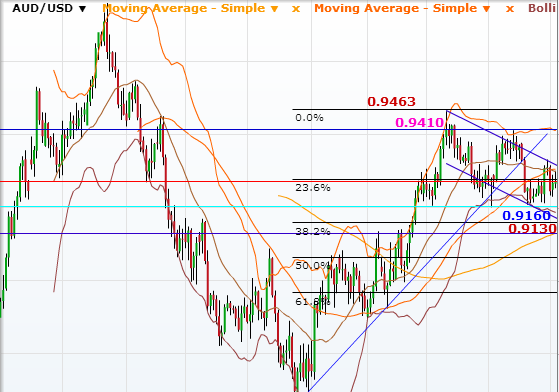

An IB Times UK technical analysis sees strong support at 0.9164 for AUD/USD and shows that only a jump above the 0.9400 mark will resume a medium-term uptrend the pair lost mid-May.

Australia grew 3.5% y/y in Q1-2014 compared to analysts' expectations of 3.3% growth and sharply higher than 2.7% in the previous quarter. On a quarterly basis, the GDP growth was 1.1% versus market's number of 1.0% and 0.8% last.

AUD/USD made a quick jump at the release but gave back the entire gains shortly. After rallying to 0.9300 from near 0.9255, the pair traded at 0.9257 within about an hour.

Also, iron ore exports to China from Australia's Port Hedland, which accounts for about a fifth of the globally traded market, rose by 3.5% m/m in May to reach another record, Reuters reported. It was another positive for the Australian currency but that too did not help it significantly.

Technically, AUD/USD has strong support at 0.9164, the 38.2% Fibonacci retracement of the 1 January to 10 April uptrend. The next level on the downside is 0.9130 ahead of 0.9070, near the 50% retracement. There seems to be not much topside targets until 0.9410 and a breach of that should take the pair to 0.9463. (See the chart)

AUD/USD had gained on Tuesday after the RBA took a neutral stance and left rates unchanged but lost ground in the US session later as the focus shifted to US jobs data and ECB rate decision.

© Copyright IBTimes 2025. All rights reserved.