Bangladesh Bank seeks to recover stolen $81m from NY Fed

Update:

Representatives of Bangladesh Bank, the NY Fed and Swift have issued a joint statement after a meeting in Basel, Switzerland on 10 May with regards to the $81m (£56m) stolen from the Asian financial institution in February. NY Fed president William Dudley and Bangladesh Bank governor Fazle Kabir attended the meeting and shared details of the cyber-heist and announced that they were committed to pursue the perpetrators of the crime.

The statement read: "The parties also agreed to pursue jointly certain common goals: to recover the entire proceeds of the fraud and bring the perpetrators to justice, and protect the global financial system from these types of attacks."

Previously, it was reported that the Bangladesh's central bank chief will meet with the head of the Federal Reserve Bank of New York as well as a senior representative from Swift – the global provider of secure financial messaging services – in efforts to reclaim the $81m that was stolen by hackers in a cyber-heist in February.

According to Reuters, two Bangladesh Bank officials claimed that the bank considers both the NY Fed and Swift to bear some of the responsibility for the $81m heist. Kabir, was slated to meet an unnamed Swift representative and NY Fed president William Dudley in Basel, Switzerland around 10 May.

One of the officials of Bangladesh Bank said, "There is a responsibility the New York Fed has to accept. If you stopped 30 transactions, why did you not stop the others? SWIFT also bears responsibility."

The official added, "It's supposed to be a closed system. Now you have seen they have disclosed that there have been attacks previously on its software."

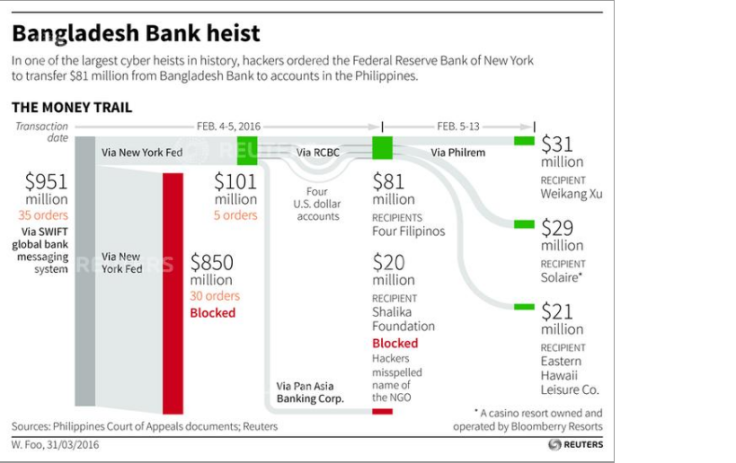

In February, Bangladesh Bank was hit by a massive cyber-heist which saw hackers attempting to steal nearly $1bn. Around 35 fake transfer orders from the bank's accounts at the NY Fed were sent via Swift, of which 30 were successfully blocked. However, four transfers for $81m went through to a bank in Philippines, while another, a $20m transfer was sent to a Sri Lankan company, which was later reversed as the hackers had misspelled the name of the company.

Following the heist, Swift confirmed that the cyberattack on Bangladesh Bank was not the first of its kind. The global secure messaging service provider added that it has noted a rise in cybercriminal activities that aim to exploit the service and cause financial chaos.

It is still unclear as to whether the Bangladesh Bank will file a lawsuit against NY Fed and Swift, despite reports suggesting that the bank's lawyer, Ajmalul Hussain, would be present at the meeting in Switzerland.

From the $81m stolen funds transferred to a bank in Philippines – which was again handed down to several casinos – $15m has been successfully recovered. One of the casino's operators, Kim Wong, turned over the amount to authorities in Manila, the Philstar reported. Bangladesh bank officials are reportedly optimistic about reaching a resolution for the dispute soon.

Editor's note: This article has been suitably updated as the NY Fed chief, the Bangladesh Bank head and Swift met on 10 May and have decided to jointly work to recover the stolen money.

© Copyright IBTimes 2025. All rights reserved.