Bank of England: UK Banks Must use Capital Buffers to Lend if Economy Worsens

UK banks should use their vast cash buffers to bolster lending if the recession bites harder, the Bank of England has recommended, because they will be supported by the latest credit easing schemes that offer cheap loans to financial institutions.

Britain's future economic prospects are worsening because of the ever-intensifying eurozone crisis, according to the Bank's latest Financial Stability report, as the country wallows in its second recession in four years.

"The outlook for financial stability has deteriorated, particularly in light of heightened uncertainty about how, and when, euro area risks will be resolved," said the report from the Bank's financial policy committee (FPC).

Banks have had to shore themselves up with significant capital buffers under Financial Services Authority (FSA) rules, as insurance to the threat of another sudden and catastrophic crisis in the global economy.

The FSA needs to make it clearer that "in the event of a liquidity stress" banks are able to dip into these buffers to keep money flowing into the economy and fight back against a deepening recession, said the FPC.

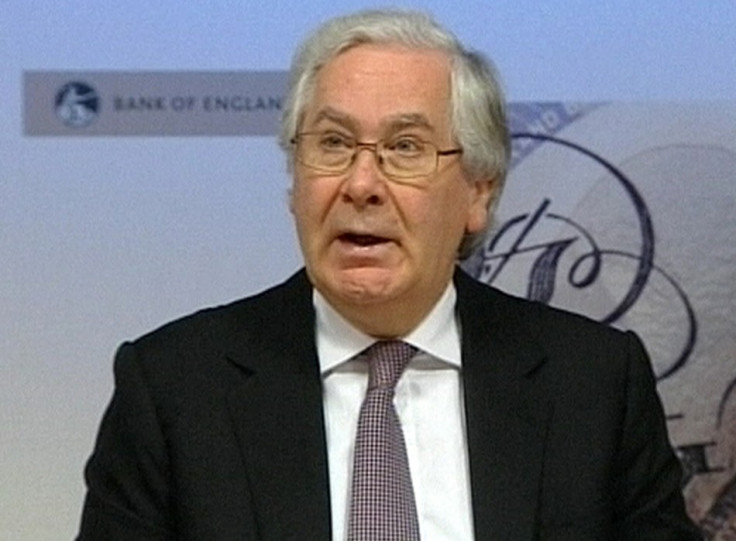

Under two new Treasury-approved schemes announced by the Bank's governor Mervyn King, called the Extended Collateral Term Repo and Funding for Lending, around £100bn will be made available to banks in the form of cheap loans.

It is hoped this will incentivise cheaper and increased lending to the wider economy, including businesses and consumers, as it will help absorb some of the risk associated with offering credit.

However King has admitted that there are "no guarantees" these efforts to get the economy moving will work.

King: UK banking culture must change

At a press conference to launch the FPC report, King poured scorn on the culture of UK investment banking, as the Libor rate-fixing scandal engulfs Barclays.

"We can see that we need a real change of culture in the industry," King told reporters.

It will require leadership of an "unusually high" standard and structural changes to the industry, King added.

Barclays traders conspired with rate submitters, who report the rates at which the bank has been able to borrow cash from other institutions, in order to fix rates to improve trading positions and boost profits.

The bank was handed a record fine for the City of London and individuals may face criminal charges. Other banks, such as RBS, Lloyds, and HSBC have been accused of the same tactic and are expected to face similar probes by finance regulators.

King refused to join the chorus of commentators calling for Barclays chief executive Bob Diamond to go, saying he does not want to comment on individuals and certain banks, reiterating the need for a culture shift.

He also said the Bank urges the government to bring in "all of the Vickers report".

"I would hope that parliament will legislate on that as soon as they see fit to do so," King said.

The Vickers report stems from by the Independent Commission on Banking, led by Sir John Vickers, which probed the financial sector in the aftermath of the 2008 crisis.

At the heart of the report's recommendations on banking reform is the total separation of the "casino" style investment side and the retail portion, which is used by everyday consumers.

King said the two styles of banking are "completely different" and "need to be separated".

Vickers also suggested a 20 percent capital buffer for ringfenced retail banks.

The government's white paper on banking reform has broadly taken on board the recommendations, though Vickers has himself accused the proposed reforms in the legislation of not going far enough.

© Copyright IBTimes 2025. All rights reserved.