In Iraq, China Finds A Reliable New Investment Partner

Over the past few years, Middle Eastern countries have continued to push for the diversification of their traditionally oil-rich economies. For instance, Saudi Arabia and Oman continue to focus their attention on large-scale tourism campaigns, while the UAE has looked to expand its industrial and green energy sectors while maintaining its reputation as a global business and tourism hub.

International investment has played a crucial role in the region's decision to move away from hydrocarbon-based sources of income. Although Foreign Direct Investment (FDI) in the region is still largely dominated by fellow Gulf States as well as western economies like the US and the EU, it is China who has emerged as a new reliable partner for investment and trade.

Since the conception of China's Belt and Road Initiative (BRI) in 2013, the Middle East has been the second largest recipient of BRI investments with an accumulated total of $8.1 billion allocated for critical infrastructure projects and energy initiatives, among others. Beijing is therefore continuing its mission of enhancing its global diplomacy efforts and continues to assess multiple investment climates traditionally ignored by other foreign players.

Chinese investors have shown greater risk appetite as they invest in large-scale medium to long-term projects in 'frontier markets' which often experience a high degree of political uncertainty. For example, Beijing is the largest FDI provider in Afghanistan and second largest in Iran.

Another country that has long struggled with instability and conflict, Iraq, has now emerged as one of the main regional markets sought by Chinese investors particularly with its newfound political stability and strong investment potential. Not only is Baghdad China's third-largest oil supplier, but it is also anticipated to experience the highest GDP growth in the Middle East in 2024, according to the World Bank.

In 2022, trade between Iraq and China reached $53.37 billion, nearly five times Iraq's trade with Washington which amounted to $10.99 billion in the same year. The Chinese Deputy Ambassador to Iraq, Xu Haifeng, recently told Iraqi media that the country is in a 'great economic position in the world and the Middle East' as he reiterated Beijing's interest in further deepening investment ties with Baghdad.

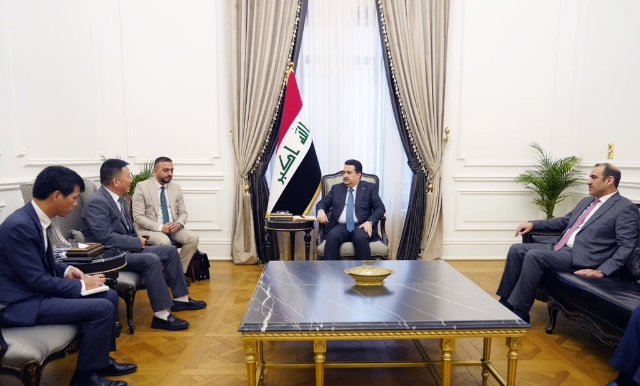

Such positive developments come as Iraq continues making significant strides towards becoming a more attractive investment destination. Under Prime Minister Mohammed Shia' al-Sudani's government, the country has rolled out comprehensive anti-corruption plans encompassing institutional reforms, the establishment of a new government watchdog and new financial transparency measures.

These developments are leading to greater investor confidence in the country, with a string of major recent investments including from France's TotalEnergies earlier this year where a $27 billion energy deal was signed with the government.

Given Iraq's vast natural resources, it should come as no surprise that the energy sector has been met with extensive investor interest. According to Haifeng, China has helped build electricity stations across Iraq including in Wasit Rumalia, Maysan, and Basra. China National Petroleum Corporation also holds substantial stakes in al-Ahdab, Rumaila, Halfaya and West Qurna oilfields, which account for more than half of Iraq's oil production.

Such investments are helping improve the resilience of Iraq's economy, with Chinese firms bringing their technical expertise to also expand the underdeveloped renewable energy sector – particularly in solar. Moreover, they are also helping Iraq continue to serve its growing populations' needs which are being exacerbated by ongoing climate change.

Crucially, Beijing is also looking at opportunities beyond energy in Iraq.

This year, China expressed its firm interest in Iraq's $17bn Development Road project designed to connect the Gulf with Europe. The project aims, amongst other things, to connect the Grand Faw Port to Turkey through a network of railways and roads to enhance movement of goods and people around the region, positioning Iraq as a regional hub.

Education is another area where China has seized the opportunity to fill the investment gap in Iraq. As part of the government's National Strategy for Education, China plans to help build 8,000 schools across Iraq to enhance equitable access to education.

The latest moves come following Iraq's passing of a record $153 billion public budget focused on job creation through development projects, with major public contracts available for foreign investors.

Although net Chinese investment in Iraq still lags behind the US and the EU, Beijing has shown a commitment to exploring opportunities in often overlooked markets such as Iraq. As such opportunities continue to manifest, it is extremely likely other major foreign players will follow suit looking to realise Iraq's vast investment potential.

As the US has looked in recent years to reduce its Middle East involvement as a whole, China has stepped in to fill the Washington-shaped gaps, capitalising on the many available opportunities. As long as Iraq maintains its renewed political stability, Beijing will likely remain a supportive economic partner for decades to come.

© Copyright IBTimes 2025. All rights reserved.