Bank of England reveals biggest investment banks operate largely outside 'real economy'

Major investment banks generate the vast majority of their revenues from dealings within the financial system, according to research by the Bank of England.

Three quarters of revenues made by the biggest investment banks comes from services provided to the financial system, while only a quarter comes from services provided to the real economy, the data shows.

The report breaks down the way in which the world's biggest investment banks functioned in 2013 and has revealed a heavy reliance on the financial sector.

Of course this will come as no surprise to people that work in the industry, but it shows just how reliant investment banks have become on the financial system for their survival.

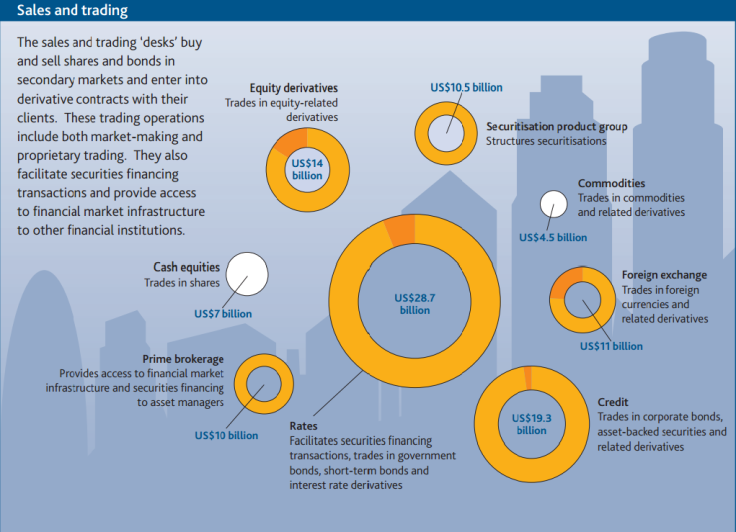

In its report, the Bank of England splits the investment banks' activities between "Underwriting and advisory" and "Sales and trading", the more profitable sub-section.

In underwriting and advisory activities, banks mostly deal face-to-face with the real world economy, working with businesses to make deals happen.

However, the trading and sales arms of the business involve less interaction with other parts of the real economy. The Bank of England's research shows that most of these massive revenue-generating activities involve far less than a quarter interaction with the real economy.

Revenues from rates (trades in bonds, derivatives) dwarf revenues made from trades in equities (shares.)

Of $140bn in revenues generated overall in 2013 by investment banks, only $35bn came from interactions with the real economy while $105bn came from interactions with the financial system.

The Bank of England's research investigated revenues at the 10 biggest investment banks in 2013.

© Copyright IBTimes 2025. All rights reserved.