Barclays charged with conspiracy to commit fraud over Qatar fundraising

Serious Fraud Office charges bank and former executives over lender's moves to raise cash during the financial crisis.

The Serious Fraud Office (SFO) has charged Barclays and four former executives with conspiracy to commit fraud relating to the lender's dealings with Qatar during its £11.8bn fundraising in the financial crisis.

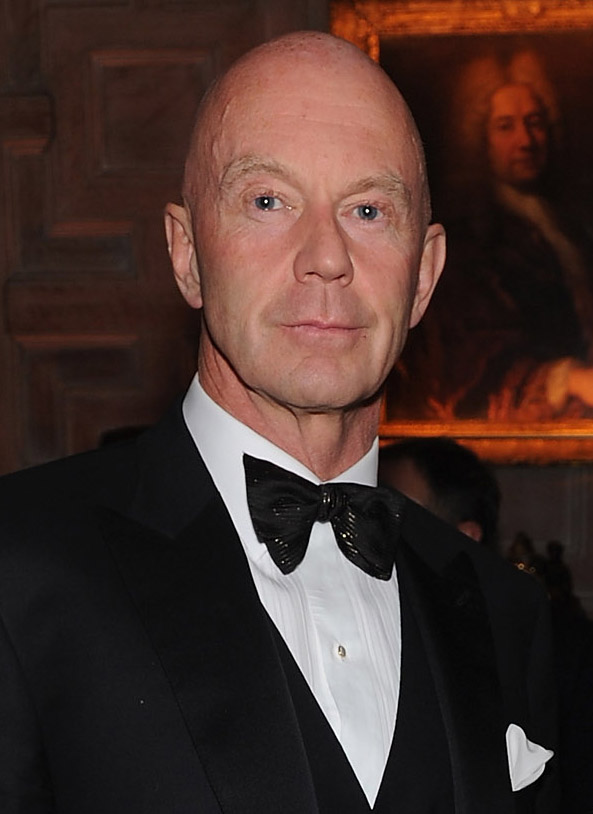

The UK's top prosecution service has brought charges against the lender as well as its former chief executive John Varley. It has also charged senior executives at the time Roger Jenkins, Thomas Kalaris and Richard Boath. The maximum penalty for the executives is 10 years in prison. A fine would be determined for the bank.

It has also charged the bank, John Varley and Roger Jenkins with the provision of unlawful financial assistance contrary to the Companies Act 1985. The maximum sentence for the executives is two years in prison. For the company, a fine would be determined.

The SFO said the charges relate to Barclays "capital raising arrangements" in Qatar "which took place in June and October 2008, and a $3bn loan facility made available to the State of Qatar acting through the Ministry of Economy and Finance in November 2008."

The SFO said the defendants will appear before Westminster Magistrates' Court at 2pm on 3 July 2017. Barclays said it is "considering its position in relation to these developments".

The announcement by the SFO will mark the culmination of a five-year probe into the emergency actions that Barclays bosses took in 2008 to avoid a bail-out of the lender when Britain's banking system was on the verge of collapse. The move by the SFO is hugely significant as they are the first criminal charges brought against either a bank or top executives over events during the 2008 crisis, which brought the banking system to its knees.

Barclays undertook two cash calls in 2008, raising £4.5bn in June and a further £7.3bn in October from investors in Qatar, Abu Dhabi and elsewhere.

The Qatari investors included Qatar Holding, which is part of the state's sovereign wealth fund, and an investment of the former prime minister, Sheikh Hamad bin Jassim bin Jabr al-Thani.

At the centre of the SFO's probe – which began in 2012 – are £322m of payments made by Barclays to Qatari investors, which were dubbed "advisory services agreements", during the fund-raisings. Also, earlier in November 2008, Barclays agreed to provide a $3bn loan facility with the state of Qatar.

Jenkins will "vigorously defend" himself against the charges, his lawyer told Reuters.

"As one might expect in the challenging circumstances of 2008, Mr Jenkins sought and received both internal and external legal advice on each and every topic covered by the SFO's accusations," said Brad Kaufman from American firm Greenberg Traurig.

Boath, who last year took Barclays to an employment tribunal on the grounds of wrongful dismissal, also pledged to defend himself.

He said in a statement: "The SFO's decision to charge me is based on a false understanding of my role and the facts. I was not a decision-maker and had no control over what the bank did in 2008."

© Copyright IBTimes 2025. All rights reserved.