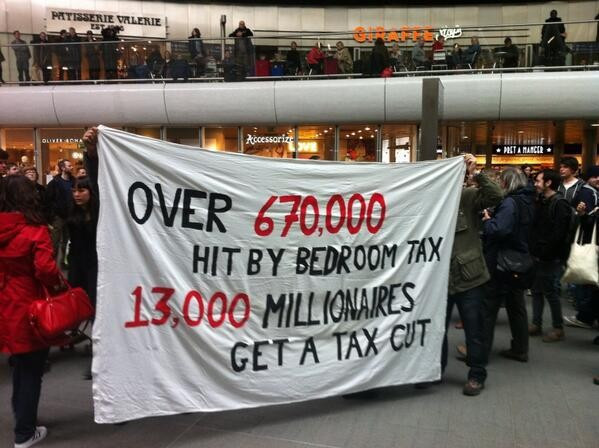

Bedroom Tax One Year On: What is the Real Cost of the Controversial Policy?

Bedroom tax was initially introduced to "save the taxpayer money" much like every other thing the government introduces.

It wasn't so much a tax, but actually a change in housing benefit entitlement.

Bedroom tax was a term that was coined by the Labour party and it stuck – probably because it's a catchier title than 'a change in housing benefits entitlements'.

It meant that people who received housing benefit would get less if they lived in a housing association or council property that had one or more spare rooms – vis-à-vis, more space than they needed.

This meant that if a tenant had one spare room, then they would lose 14% of their housing benefit, two or more spare rooms and they were hit with a 25% reduction.

Ministers said that people in council homes had an unfair advantage over those in privately owned establishments.

The 14% or 25% reduction is based on the rent eligible to be paid by Housing Benefit, not the amount of housing benefit that is actually paid.

This means that if someone receives partial housing benefit, they will have exactly the same reduction for under-occupancy in cash terms as someone receiving full housing benefit.

They also said that it would encourage people to downsize and help cut the annual housing benefit bill that stood at £23bn (€28bn, $38bn) at the time of the introduction.

According to the Department of Work and Pensions, this cutback has saved almost £1m per day.

But who were the ones who were most affected by all of this?

The Human Cost

People who opposed the change in housing benefits suggested that it was designed to hit the poor. It's interesting to note, however, that only 6% of people who claim housing benefits have been forced to downsize.

Let's take a look at the arguments for and against it.

On the plus side, it has saved the taxpayer money, the only problem with that is that as the taxpayers, we don't really get to see any of those savings.

"But they are there. Promise!"

Iain Duncan-Smith stated that the reform had ensured that social tenants received taxpayer support only for the number of rooms their household actually needed and had freed up much-needed space for tenants stuck on waiting lists or living in overcrowded accommodation.

It's also argued by some that it has created a fairer field in the housing market. Houses don't come cheap.

"Why should someone who claims benefits be entitled to a bigger house than someone who rents or owns privately?"- as the right wingers would suggest.

Fair point. But there are slight complications to that.

Caveats

If a child has a main address elsewhere, if the parents are separated for example, then they are not counted as residents at the secondary address, and a bedroom that they use at that secondary address will not count as occupied.

Children have been a big factor when it comes to criticism of the bedroom tax.

Two children under the age of 10, or two children of the same gender aged 11 to 15, are expected to share one bedroom.

So, for example, a family in a 3-bedroom property with a boy aged 7 and a girl aged 9 will also be under-occupying one bedroom for housing benefit, but not when the daughter turns 10.

Grant Shapps, Chairman of the Conservative party, caused controversy when trying to justify this rule by stating that his two sons shared a bedroom.

The problem with that statement was that his children could have had their own rooms, had he not converted one of the four spare bedrooms in his multi-million pound house into a study.

Critics have also argued that the cut in housing benefits has forced many into rent arrears, and it is claimed that rent arrears are the fastest growing debt problem in the UK.

According to a recent survey by the National Housing Foundation, 66% of people who claim benefits were in arrears, with 15% stating that they have been threatened with eviction.

These statistics are worryingly high for a country that has been crippled by debt for the past few years.

If reports are to be believed that bedroom tax will save £1bn a year from next year onwards then that's surely a positive, but is it at the cost of the less fortunate?

© Copyright IBTimes 2025. All rights reserved.