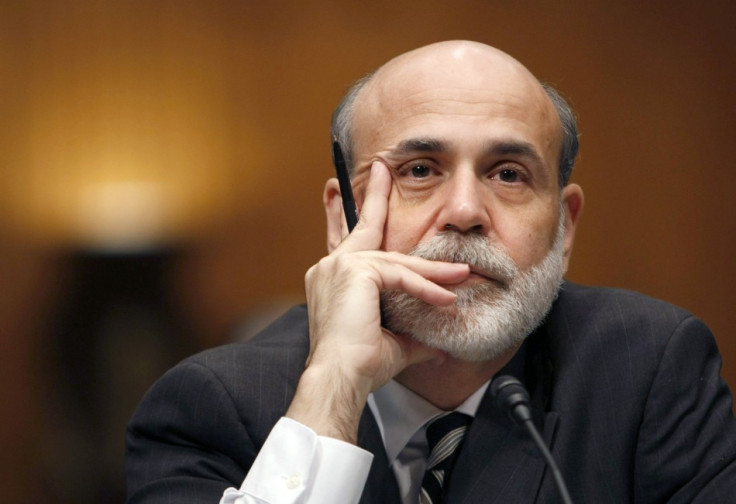

Ben Bernanke: Handling a financial crisis is 'not an experience that I would voluntarily repeat'

Ben Bernanke said governing a central bank during a financial crisis is like trying to keep control of a car before it is about to crash; he added it was "not an experience that I would voluntarily repeat".

The former chair of the US Federal Reserve said central bankers have faced a "whole new level of need to communicate" with the public they serve, because of the crisis.

Bernanke, who was in charge of the Fed when the crisis struck in 2007, said the old adage of the former Bank of England governor Montagu Norman rang true when it came to making monetary policy decisions before the crisis: never explain, never apologise.

But the crash meant he and other central bankers across the world had to do "complex and scary things" as they tried to bring the wayward financial sector back under control, all of which needed explaining to the public and businesses, especially because uncertainty harms economies.

"Trying to explain what's happening and why people are doing it only adds to confidence and is good for the economy," Bernanke said on BBC Radio 4's Today programme in an interview with the former Bank of England governor Mervyn King.

Though some of those decisions were unpopular and caused problems of their own, such as pumping billions of dollars into the economy through quantitative easing programmes to buy government bonds, he said the Fed had to explain why they were necessary.

"By stabilising the financial system we avoided much, much worse consequences for our economy," Bernanke said.

He added that he "tried not to think about the consequences for the world of these decisions" as a way of coping with the great responsibility of the role.

The financial crisis was sparked in 2007 when the sub-prime mortgage bubble burst in the US. For several years while the economy was booming, US banks had been approving mortgages for people who could little afford them.

In July 2006, the Fed raised interest rates for the 17<sup>th successive time to 5.25%. This was the tipping point for holders of sub-prime mortgages and many defaulted in the aftermath because of the higher debt repayments.

Not only were banks hit by the direct losses from the sub-prime mortgage defaults, but they had been used to underpin trillions of dollars' worth of financial securities being traded across the entire world.

The value of these mortgage-backed securities tumbled and many became worthless, tearing a giant hole in bank balance sheets and sparking the credit crunch as banks stopped lending. A deep recession followed from which governments are still trying to heal their economies and financial sectors.

Bernanke was chair of the Fed from February 2006 until February 2014. He was replaced by his Fed colleague Janet Yellen.

© Copyright IBTimes 2025. All rights reserved.