Bernard Madoff's Brother Pleads Fifth Amendment over 50 Times in British Court

Bernard Madoff's younger brother refused to answer questions over the details of the largest Ponzi scheme in history after pleading the Fifth Amendment over 50 times in the High Court in London.

Testifying via a video link from a US prison, Peter Madoff invoked his Fifth Amendment right against self-incrimination under US law as liquidators try to retrieve billions of dollars in investors' money.

He refused to discuss payments totalling $300m (£199m, €232m) from a Madoff-owned UK unit to his brother's family and his duties at the London-based subsidiary. He even pleaded the Fifth Amendment when asked about his own plea bargain to US criminal charges.

Other defendants, Bernard Madoff's son Andrew, former Bank Medici chairwoman Sonja Kohn and former SG Warburg executive Stephen Raven have all denied any knowledge of any wrongdoing and have stated that they are also victims of the scandal.

Madoff Securities International is based in London and served as the fraudster's proprietary trading unit.

Liquidators in Britain say that more than $910m was transferred between the London unit and Bernard L. Madoff Investment Securities in New York, from 1983 until firm's collapse in December 2008.

UK liquidators are seeking to recover about $50m, including payments for a luxury yacht.

US prosecutors have estimated that the scheme by Bernard Madoff, 75, who is serving a 150-year sentence in a North Carolina prison, is valued at $64.8bn.

Peter Madoff, 67, is serving a 10-year sentence in the US for conspiracy and falsifying records.

Liquidators and investors around the world are trying to reclaim as much cash possible from the world's largest Ponzi Scheme.

Last month, US authorities ruled that the Bernard Madoff trustee charged with trying to recover billions of dollars for duped Ponzi scheme investors, Irving Picard, is not allowed to sue some of the world's largest banks.

Picard described Madoff Securities International as a "critical piece of the facade of legitimacy that Madoff constructed."

The case is Madoff Securities International Ltd. v. Raven, 10-1468, High Court of Justice, Queen's Bench Division (London)

What is a Ponzi Scheme?

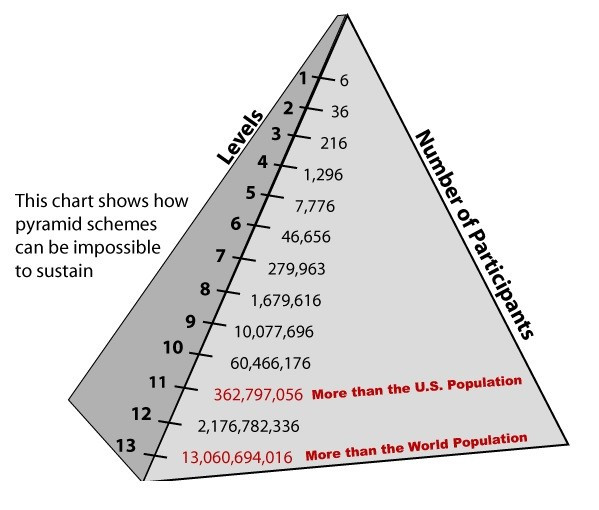

A Ponzi- or pyramid- scheme uses cash from new investors to pay artificially high returns to existing ones.

Give Me An Example

Imagine a pyramid and there is one person at the top. That person promises you that you'll get paid 20% return on any investment you give to him.

You gladly give him £100. However, while he pockets your cash, he has to make sure he returns £120 to you in a year's time.

He then has to make sure he brings in new investors that will pay you the money but on the same promise of a high return.

When Does is Go Wrong?

Without a genuine source of income, they can collapse without new customers.

The pyramid can also crumble if investors start withdrawing money.

© Copyright IBTimes 2025. All rights reserved.