Biofuels Market To Transform in 2013: Q&A with Beta Renewables CEO

The biofuels market has underperformed in terms of production over the last decade but with new technology coming on-line, new physical proof of output and production plants, the leader of one of world's largest producers of biofuels says the industry is at a turning point.

Speaking with IBTimes UK, Beta Renewables CEO Guido Ghisolfi says that a range factors have led to increased appetite for financing, as well as a growing confidence that the industry can expand production and meet new output targets that have not been met before.

"In the energy industry, there has been a strong call for sustainable alternative energy, as well as demand for biofuels to meet supply demand for a number of different markets. But the biofuels market, from the outset, has unfortunately been subject to the philosophical problem of whether it is physically, economically and environmentally sustainable," said Ghisolfi.

"This initially led to a lack of investment from the finance industry and companies, such as Beta Renewables, had to rely on their own cash to fund research and development (R&D) and to build plants. Many biofuels companies do not rely on project financing, like entities do in the oil and gas industry. Since biofuels was a relatively new and evolving industry, banks and finance companies were not confident that it would be a sound investment at the outset."

The types of advanced biofuels and advanced chemicals that Beta Renewables produces is living biological material which can be used as fuel and also as part of making consumer products.

Ghisolfi emphasised that without previous benchmark data, and comparable examples of output across very specific fields, financing was difficult, which inevitably contributed to a struggle for the industry at the start.

At the end of February this year, the US Energy Information Administration (EIA) revealed that the US produced only 0.004 percent of the 2012 cellulosic biofuels production target, set by the Energy Independence and Security Act of 2007.

Companies produced about 20,000 gallons of cellulosic biofuel using wood waste, sugarcane bagasse and other biomass, although US law set a target level of 500m gallons of cellulosic biofuels for 2012 and 1bn gallons for 2013.

While financing was difficult for a lot of the industry, the Chemtex engineering division of Gruppo Mossi and Ghisolfi, along with a slice of venture capital investment from TPG, decided to create the joint venture Beta Renewables to make non-food cellulosic biomass for the production of advanced biofuels and biochemicals. Beta Renewables' parent group has operations in Brazil, Mexico, China, India, the USA and Italy and its annual turnover is approximately $3bn, according to its website.

After investing £250m of its own cash in R&D, Beta Renewables decided to go ahead and build the world's first commercial-scale cellulosic ethanol facility in Crescentino, Italy, which started operations in the fourth quarter of last year.

"This is a turning point for us but also the rest of the industry. When we first came to the market, biofuels and the procedures used was not completely recognised and convincing financiers that capital expenditure would be low, once we were up and running, was difficult. Meanwhile, the wider industry was trying to get to grips with creating and implementing new technology in very rural areas," said Ghisolfi.

"The people who have had success and sustainable economic growth are the ones who adapted new technology to the territory they were targeting, not the other way around. You cannot enter an established agricultural area and tell farmers to completely change the way they work and nor can you trample on their way of life, you have to adapt," he added.

This problem has led to a number of commercial biofuels projects in the industry being cancelled, before the start of construction, including one from BP Biofuels in Highlands County, Florida.

Brazil is one of the key areas for biofuels production and growth and Ghisolfi used the country as an example of how the wider company designed and implemented new technology to compliment the region's abundance of sugar cane, while also expanding output by targeting gaps in the market.

"New regulations in Brazil where burning to remove the cane straw from fields of sugarcane, have been banned, has allowed us to use new technology to create biofuels from the newly discarded leftovers. We now have new technology that allows us to use the leftover leaves and stalks from sugarcane and therefore increase production by 40 percent without causing an upheaval in the way Brazil does business," said Ghisolfi.

With a number of plants coming online around the industry and with established technology being implemented even the independent energy agencies are predicting a surge in growth over the next few years.

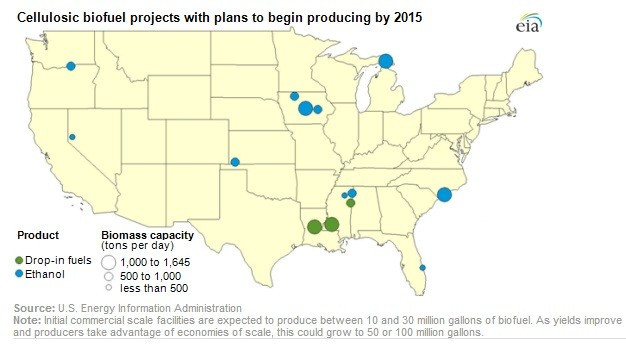

The EIA estimates cellulosic biofuels output could grow to more than 5m gallons in 2013 as several commercial-scale facilities are ramping up operations.

"Even more plants, with proposed capacity of about 250 million gallons, could begin production by 2015," said the report [Fig 1.]

In the Independent Energy Agency (IEA) benchmark World Energy Outlook 2012 report published November last year, in 2035 the share of renewables, including traditional biomass will see world primary energy demand increase by 18 percent.

"This rapid increase is underpinned by incentives to overcome market barriers, falling technology costs and rising fossil fuel prices," said the group.

In terms of biofuels production, the IEA forecasts an increase to 4.5m barrels per day in 2035, from 1.3m barrels per day in 2011.

"This year will be an absolute turning point for the industry and for appetite for investment as we will have evidence of proven technology, output and therefore demonstrate the economical sustainability for a company," said Ghisolfi.

"We are definitely seeing a market for biofuels investment as banks and finance firms can now reap the benefit of investing with the return but not having conversion risks and costs, which is the combination of direct labour costs plus manufacturing overhead costs," he added.

Beta Renewables' commercial-scale production at the Crescentino plant in Italy is one of the first to use processes that keep costs to a minimum.

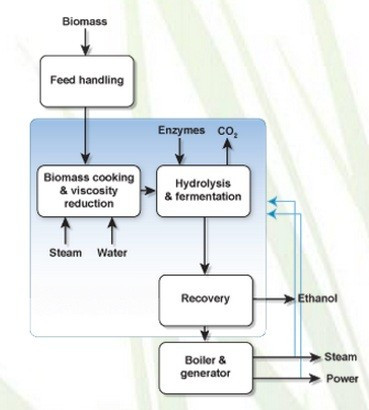

Beta Renewables uses a 'second-generation' cellulosic biomass technology called Proesa, which takes non-foodchain crops, or feedstocks, like giant reed or agricultural waste material like sugarcane bagasse, and 'softens them up' to turn them into separate streams of different types of sugary liquids. The Italy plant will use the region's different agricultural harvest each season, by producing biofuels from wheat straw iand corn straw in the summer, rice straw in the winter and in between Winter and the summer, eucalyptus

These processed sugars can then be used to produce biofuels and biochemicals that meet emerging national requirements and have a smaller environmental footprint than fuels and chemicals made from oil or natural gas [Fig 2.]

With 21 patents pending for their technology, Beta Renewables said the the efficiency of the process, allows the company to deliver market-leading cost of sugars without subsidies, helping speed widespread adoption of bio-products.

"We are convinced that now we have proven technology in place, production turned on, we and the rest of the industry will see a real change and appetite for biofuels for the long term," said Ghisolfi.

Guido Ghisolfi, Chief Executive Officer, Beta Renewables will be a keynote speaker at this year's World Biofuels Markets 2013 conference

© Copyright IBTimes 2025. All rights reserved.