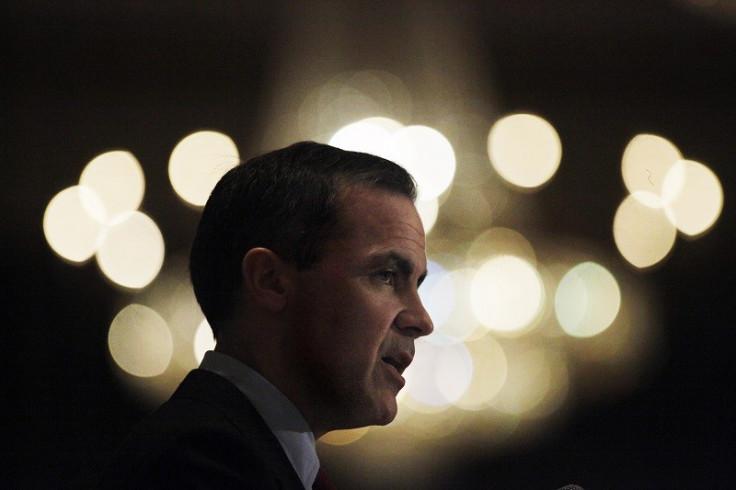

BoE's Mark Carney Slams Banker Bonus Caps but Eyes Deferrals

Bank of England Governor Mark Carney has slammed the cap on banker bonuses as "crude" and has instead called for a deferral of reward payments over a period of at least five years.

Speaking at a UK Parliamentary hearing, Carney said the central bank was looking into the possibility of deferring bankers' bonus payments beyond five years and reducing up-front cash payments for performance instead of setting a rigid cap on how much extra a financier can take home on top of their basic salary.

"We would rather see more deferral, more equity and this ability to take it back when those risks come to light," said Carney.

"What we are most focused on is the structure of compensation, not the level of compensation. [Banker bonus curbs] are absolutely too crude."

The European Commission installed a new limit on bankers' bonuses, which means extra pay will be capped at 200% of their salary.

The law, which comes into force from January 2014, will apply to bonuses paid in 2015.

However, a number of banks have already started to hike basic salaries to retain and hire talent and therefore stop the flight of employees moving to the US or Asia.

When bankers are paid bonuses, clawbacks can be used to retrieve the rewards in the event of market scandals, civil or criminal wrongdoing, or mis-selling. However, in the event of the same scandals, the return of basic salary is much more difficult and usually voluntary.

The Prudential Regulation Authority (PRA), the BoE's regulatory arm, will consult on whether to go further and implement a recommendation by a parliamentary commission on banking standards for a 10-year deferral period.

Last year, the Parliamentary Commission on Banking Standards (PCBS) printed a 500-page report on how to clean up the banking industry after taking evidence between 21 September 2012 and 6 March 2013.

Among a variety of recommendations, in terms of pay, the PCBS suggested that the banking industry adopt a new remuneration code. This would include a new power to cancel all bonuses and pension rights not yet paid, in the event that the banks need to be bailed out by the taxpayer.

"Taxpayers and customers have lost out. The economy has suffered. The reputation of the financial sector has been gravely damaged. Trust in banking has fallen to a new low," said PCBS chairman Andrew Tyrie at the time.

"Senior bankers who seriously damage their banks or put taxpayers' money at risk can expect to be fined, banned from the industry, or, in the worst cases, go to jail."

© Copyright IBTimes 2025. All rights reserved.