BowLeven Positive on Exploration Programmes But Analysts Expect Losses for Coming Years

BowLeven, the oil and gas exploration company, said that it is more convinced than ever about the exploration and development potential of its acreage and it looks forward to pursuing the opportunities its Cameroon acreage position holds.

The group is scheduled to report its interim results on 26 March, its achievement of exploration and appraisal activities took it closer to sanctioning the growth of its discoveries offshore Cameroon and reaching its target of moving resources to reserves.

BowLeven says it requires around a year of commitment, hard work and focus as it struggles to complete the work required to make the final investment decision. The group also continues to explore the outstanding potential of its onshore and offshore acreage in the Douala Basin.

FY 2011 was an operationally active and exciting period for the group with exploration and appraisal drilling and seismic activities in abundance and the same operational momentum is expected to continue with an extensive work programme planned for the current year.

While commenting on the exploration programme, CEO Kevin Hart said: "It has been an exciting year of intense operational activity for Bowleven during which considerable progress has been made across our Cameroon acreage. The initial discovery of oil and gas condensate with the Sapele-1 exploration well was a key event for the company. The subsequent three Sapele wells drilled all encountered hydrocarbons and we are particularly encouraged that at every location where these intersected the Deep Omicron interval we have encountered oil. These results highlight the significant prospectivity and potential of our acreage in the Douala Basin. As we continue to successfully explore and appraise our acreage we have been actively progressing integrated development options for the entire Etinde Permit. The conversion of resources to reserves remains a priority for the group as we seek to create value for our Shareholders."

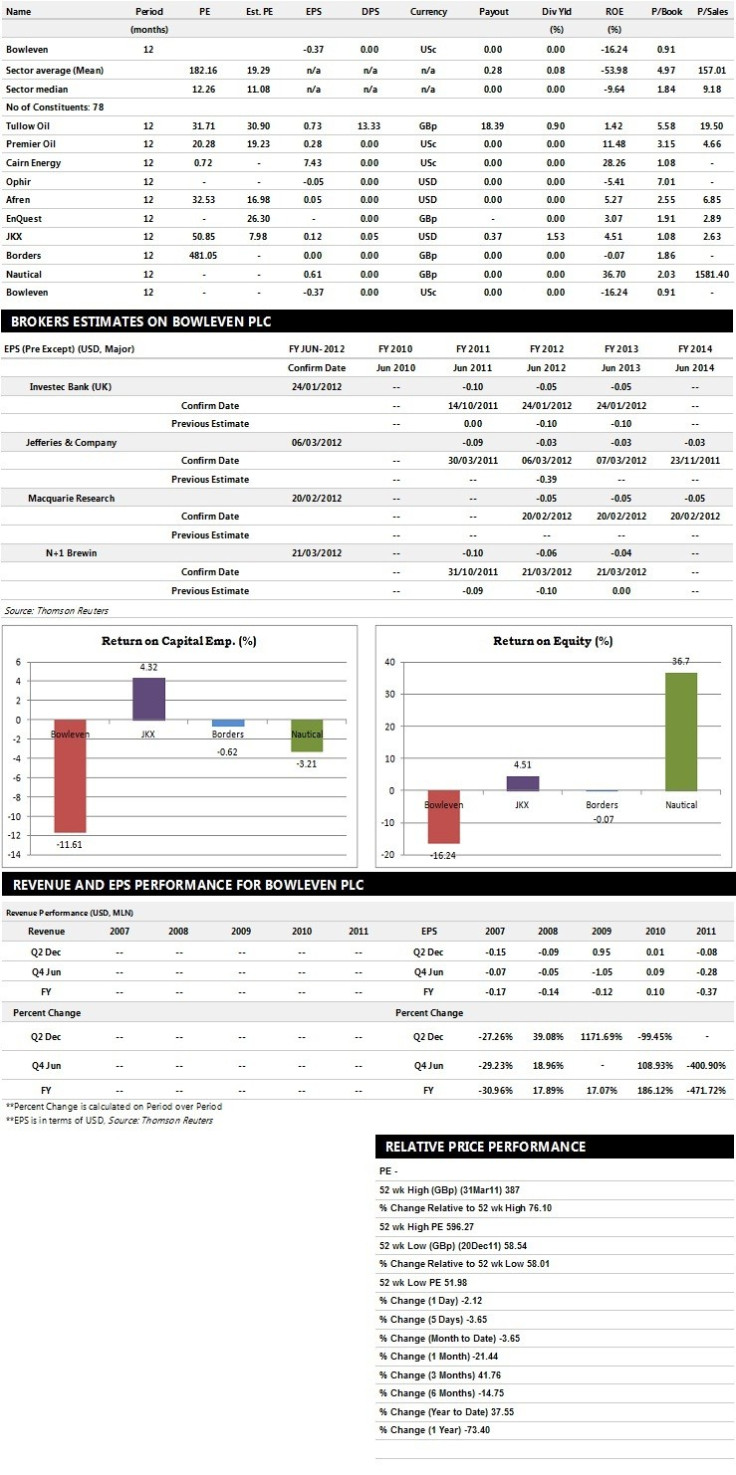

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents ten companies based on market capitalisation.

Brokers' Views:

- N+Brewin recommends 'Buy' rating on the stock with a target price of $3 per share

- Macquarie Research recommends 'Hold' rating with a target price of $2.09 per share

- Jefferies assigns 'Buy' rating with a target price of $3.05 per share

- Investec Bank gives 'Buy' rating with a target price of $1.46 per share

- Canacord Genuity assigns 'Buy' rating with a target price of $2.46 per share

Earnings Outlook

- N+Brewin estimates the company to report pre-tax loss (pre-except) of ($17.00) million and ($18.80) million for the FY 2012 and FY 2013 respectively with loss per share of 6 cents and 4 cents.

- Macquarie Research projects the company to report EBITDA of ($6.84) million for the H1 2012 and ($6.84) million for the H2 2012 respectively with pre-tax loss (pre-except) of ($6.41) million and ($6.55) million. Loss per share is estimated at 2 cents for both the periods.

- Investec Bank expects BowLeven to earn pre-tax loss of ($13.7) million for the FY 2012 and ($14.2) million for the FY 2013 respectively with loss per share of 4 cents for the both the years.

© Copyright IBTimes 2025. All rights reserved.