Brent Crude and WTI at New Lows on Dim Demand Outlook

Global crude oil prices are southbound as economic data from around the world show a dim outlook for demand while charts suggest more downsides are likely in the prices in the near term.

Brent crude on Tuesday managed to reverse some of the recent losses and held slightly above the $100 mark, which it broke below on Monday after data from China showed import growth slowed more than expected in July.

Spot delivery Brent traded at $100.60, from the previous close of $100.19 and further away from Monday's low of $99.34, which was its lowest since April last year.

Brent Technicals

Brent crude for immediate delivery has fallen more than 11% from end-June when geopolitical tensions had kept supply worries high on agenda.

However, consumption indicators and production data later on switched the concerns to the demand side, helping the selloff.

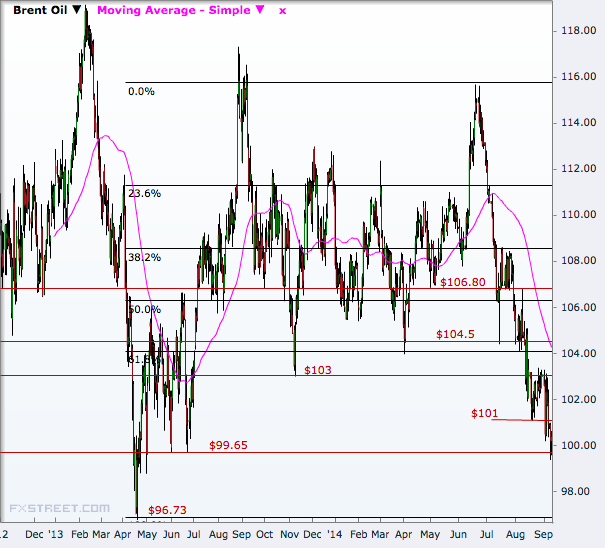

The commodity managed to break through the 23.6, 38.2, 50 and 61.8 Fibonacci retracements of the April 2013-June 2014 uptrend in less than two months, and is now testing the important medium term support line of $99.50.

A decisive break below that will open doors to $96.73, last year's low touched in April.

A reversal would find $101 as the first resistance and then $103 ahead of $104.50. A break above $106.80 will resume the uptrend and levels above $110 will be in focus afterwards.

WTI Technicals

The West Texas Intermediate had fallen below the $100 mark in early August itself and is now testing the medium term support line of $91.50.

At Tuesday's low of $92.7, the commodity was at an eight-month low.

A break below $91.50 will open doors to $86.0 and then the levels to watch would be $76.50 and $65.50.

On the higher side, spot WTI has its first target at the psychologically important $100, and then comes $105 and $110.

© Copyright IBTimes 2025. All rights reserved.