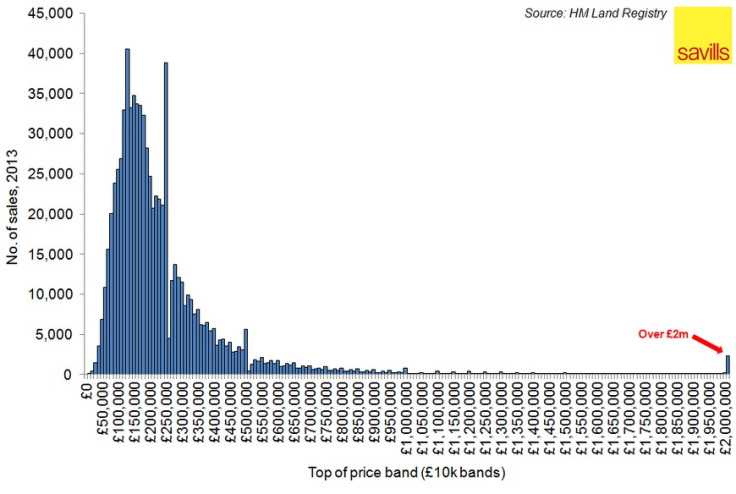

Budget 2014: Osborne Slaps 15% Stamp Duty Tax on Residential Properties Worth Over Half a Million

Chancellor George Osborne has slapped a 15% stamp duty tax on residential properties worth over £500,000 that are purchased through companies.

In the Budget 2014 announcement, Osborne said "we will expand the tax on residential properties worth over £2m to those worth more than £500,000. "

Initially, Britons hoped to hear about whether the government would allow sellers to deduct the value of stamp duty paid by their buyer from the stamp duty they pay on their next home.

On 17 March, the UK's largest independent estate agent Haart, said Osborne was considering stamp duty tax credits.

"Stamp duty is an unjustified burden on middle income families, especially in London and the southeast. It is also preventing the proper functioning of the housing market, exacerbating the shortage of housing supply," said Paul Smith, a manager at Haart.

"We are proposing a workable solution which would transform stamp duty from the tax on transactions that it currently is, with all the economic inefficiency this suggests, into a fairer tax based on the incremental increase in the value by which buyers are stepping up in the market. With each buyer in a chain now paying stamp duty, the exchequer is getting many bites from the same cherry – this cannot be justified."

UK Housing Market

Much-needed house building in the UK has hit its highest level since the dawn of the financial crisis, but is still falling far short of ever-growing demand.

The volume of new homes registered with the National House Building Council (NHBC) hit 133,670, up 28% on the year before and the most since 2007.

This came as the domestic economy began its recovery from the post-crisis slump, construction firms rebounded from a collapse in output in 2012, and mortgage-easing stimulus such as the Help to Buy scheme fuel demand.

However, the government's National Housing and Planning Advice Unit says the UK needs 290,500 new homes a year until 2031 if it is to meet current demand.

Meanwhile, Halifax said UK house prices rose sharply across the year in February amid the housing market recovery.

According to the building society's monthly index, the average price of a UK home was 7.9% higher than a year before, at £179,872.

Case Study

Bob Brown is selling his London home for £450,000 and is moving to a property for which he is paying £600,000.

Under the current system, Brown would pay 4% stamp duty tax on his new home of £24,000. However, under the proposed system the 3% stamp duty tax paid by Brown's buyer (£13,500) is credited or rolled over to Brown, reducing his stamp duty by £13,500 to £10,500.

If Brown's buyer was also selling a property they too would enjoy a credit at the appropriate stamp duty rate.

© Copyright IBTimes 2025. All rights reserved.