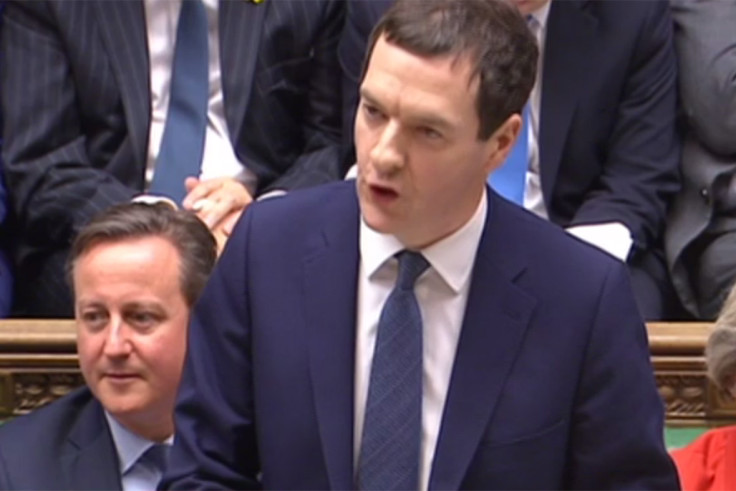

Budget 2016: Politics tramples over good economics as George Osborne charms Tories before EU vote

Four months is a long time in economics. That's how long it's been since the chancellor delivered the Autumn Statement. Then "Lucky George" said he had enough fiscal good news to abandon the plans to radically reduce tax credits to the low paid.

Unfortunately, the bad news has come thick and fast since then, causing a downgrade in the 2016 growth forecasts in today's Budget from 2.4% to 2.0%. Even worse, however, was the Office of National Statistics' discovery that GDP in cash terms was £18bn smaller than they had previously thought. This means less tax revenues are forecast to come in over the next five years.

The chancellor made three fiscal pledges to cap welfare, reduce debt as a share of GDP and deliver a budget surplus by 2019-20. The first two promises are out of the window, so to avoid meeting the third, he announced additional spending cuts today of £3.5 billion. These are all pencilled in for the end of the current parliament and Osborne is hoping that his luck will return, so they never have to be made.

But austerity upon more austerity raises the question of whether there is an alternative to the medicine of more cuts.

The answer to that question is "yes".

The self-imposed hairshirt of having a 1% surplus by 2020 makes little economic sense. It is calculated as tax receipts minus total public spending. This is not just current spending on things like the PM's salary, but also capital spending on projects like High Speed 3 upgrading transport links in the North and the Crossrail 2 rail line in London. I strongly support these investments and the National Infrastructure Commission that has been pushing them.

But why must such infrastructure projects be financed just by sales of public land and other government assets? The fiscal target should be on balancing the books on current spending over the business cycle – just as it was when the Office of Budget Responsibility was first set up in 2010. Otherwise there will always be too much pressure to under-fund public investment.

The chancellor did not restore the fuel duty escalator for one simple reason - fear of upsetting fellow Conservatives in the run up to the EU referendum

If a surplus must be achieved, there is another way of balancing the books, which is through tax rises. There have been plenty of these such as insurance premium taxes, the apprenticeship levy and the new sugar tax. But a very sensible way of raising more revenue would have been to raise fuel duty, which has been frozen for the sixth year running. Raising this tax would help tackle climate change and would be well-timed, as oil prices are so low.

But the chancellor did not restore the fuel duty escalator for one simple reason - fear of upsetting fellow Conservatives in the run up to the EU referendum. So, like the fiscal laws, here is yet another example of one bad policy – the PM's 2013 decision to a referendum to win back Ukip supporters – delivering even more bad policy. The politics tramples over good economics.

Perhaps the most eye-catching policies were on education, extending the school day and the pledge to make every school an academy by 2022. Academies are independent from local authority control and can set teachers' pay and parts of the curriculum. There is strong evidence that the first academies set up to turn around failing schools really worked in improving results for kids. The second wave of academies in 2010, however, were set up in wealthier areas and there is scant evidence that they were big improvements over their predecessors.

The chancellor has warned of big uncertainties on the economic horizon with stock market gyrations and China's slowdown.

But the biggest near-term uncertainty is June's decision over Brexit. He was right to look Tory backbenchers eye to eye and remind them that the OBR forecasts assumed the UK would remain in the EU and that they had warned that leaving "would result in a period of potentially disruptive uncertainty".

That's an understatement.

If Britain votes to leave, it's going to make the current wobbles feel like the gentle rocking of a baby's cradle.

John Van Reenen, Director of the Centre for Economic Performance at London School of Economics and Political Science (LSE)

© Copyright IBTimes 2025. All rights reserved.