Cairn Energy Remains Well Poised For Next Phase Of Growth

Cairn Energy, the independent oil, gas exploration and production company is excited by the potential of its multi-basin acreage in Greenland offers and the management team is focused on accessing new opportunities that provide material growth for the company and its stakeholders. The group is scheduled to report its 2011 preliminary results on March 20, 2012.

Cairn was fully funded to complete its exploration programme offshore Greenland for the FY 2011 and is investigating possible new opportunities. The Vedanta transaction represents a key milestone for the group. The resulting reduction in equity base will re-gear the group to future exploration success and continues Cairn's strategy of creation, realisation and return of value to shareholders.

By retaining a significant stake in CIL, Cairn will lock in the value of both current and future production from Rajasthan. This positions the group to take advantage of its asset base in Greenland and to consider further opportunities that will enhance and sustain its portfolio model and strategy, maintaining its focus on material growth potential and hidden value.

The group reported a revenue of INR 30,968 million (US$ 610 million) for the third quarter ended on 31 December, 2011 with EBIDTA of INR 23,692 million (US$ 467 million). Profit after tax was estimated at INR 22,619 million (US$ 446 million) with net cash of INR 64,602 million (US$ 1,214 million).

Commenting on the recent developments Rahul Dhir, Managing Director and Chief Executive Officer, Cairn India said: "The commencement of production from the Bhagyam field is yet another significant milestone for the Cairn-ONGC Joint Venture in Rajasthan. With the support of the Government of India and the Government of Rajasthan, the Cairn-ONGC Joint Venture is well placed to further develop the hydrocarbon-rich Barmer Basin in Rajasthan, increase of production and create value for our Nation."

"Our successive discoveries in Sri Lanka have established a working hydrocarbon system in the frontier Mannar Basin. This success demonstrates Cairn India's strong skill set, which we will continue to leverage for future opportunities. We have also notified the Sri Lankan Government about our intention to enter the second phase of exploration. With the new board now in place, Cairn India remains well poised for the next phase of growth," Rahul Dhir added.

ONGC and Cairn have commenced production in Januray, 2012 from the Bhagyam Field in Rajasthan. The commissioning of Bhagyam is a key milestone towards achieving the target production rate of 175,000 bopd by end FY 2011-12. The group's joint venture is well placed to further increase production from Rajasthan.

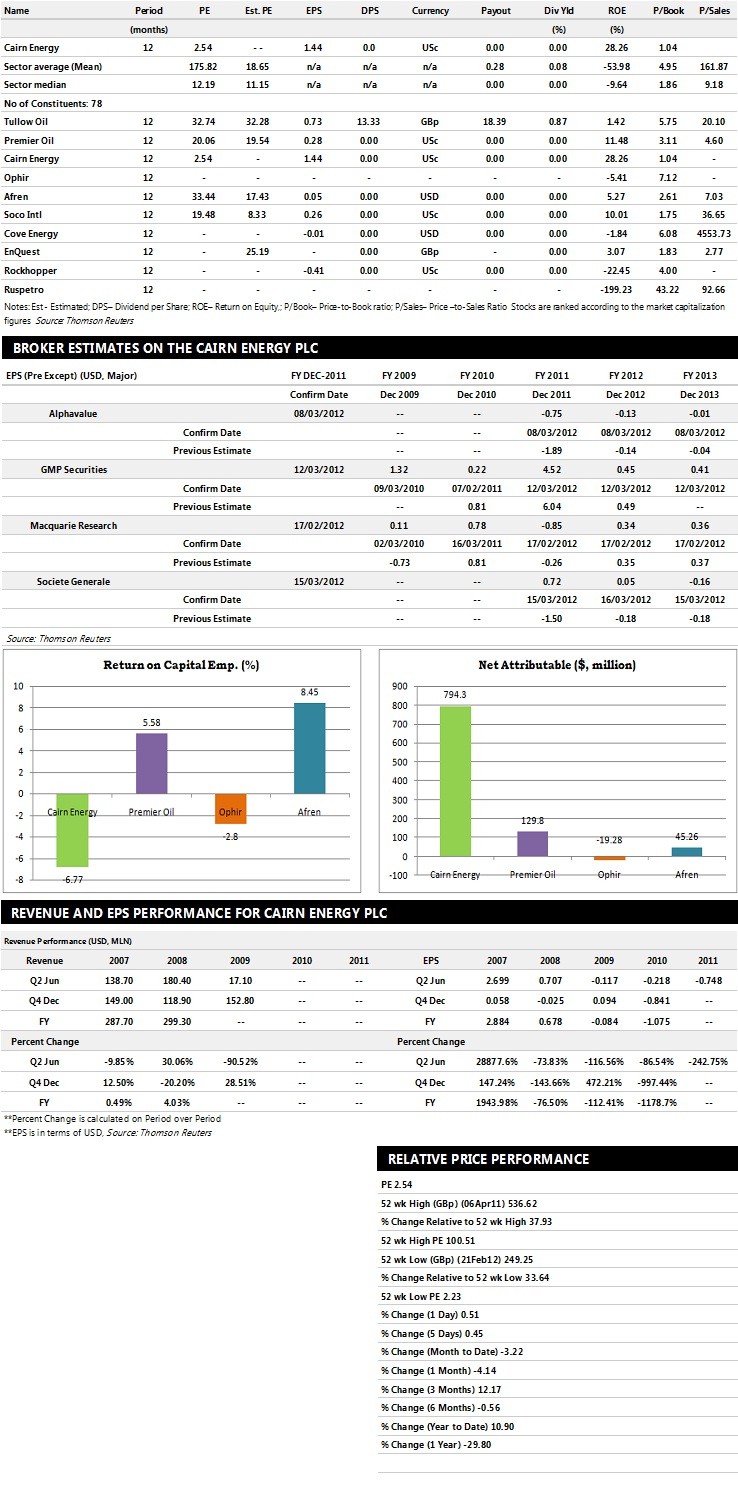

Brokers' Views:

- Societe Generale recommends 'Out Perform' rating on the stock

- Sanford Bernstein assigns 'Buy' rating

- Nomura Securities gives 'Out Perform' rating

- GMP Securities assigns 'Out Perform' rating

Earnings Outlook:

- GMP Securities estimates the company to report revenues of $1,204.40 million and $645.90 million for the FY 2011 and FY 2012 respectively with net profits (pre-except) of $93.91 million and $93.17 million. Earnings per share are projected at $4.52 for FY 2011 and 45 cents for FY 2012.

- Macquarie Research projects the company to record revenues of $1,722.50 million and $458.65 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of $132.02 million and $188.44 million. Loss per share is estimated at 85 cents for the FY 2011 and profit per share is estimated at 33 cents for the FY 2012.

- Societe Generale expects Cairn Energy to report pre-tax profits of $498 million and $26 million. EPS is projected at 72 cents for FY 2011 and 5 cents for FY 2012.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents ten companies based on market capitalisation.

© Copyright IBTimes 2025. All rights reserved.