China Power: Samsung and Sony Feel the Pinch as Chinese Smartphone Manufacturers Strengthen

Ever heard of a company called Wiko? OnePlus perhaps? No, what about Xiaomi? Ok, you must have heard of Huawei? ZTE? CoolPad? TLC?

These names may not roll off the tongue like Sony, Samsung, HTC or Apple, but give it a couple of years and these are the companies which will be dominating the smartphone market in the way Samsung and Apple do at the moment.

On Wednesday Samsung announced that its smartphone sales had dropped 12% in the second quarter of 2014 compared to the same period last year. Worse still, profits from its highly lucrative mobile business had dropped 31%.

On Thursday, Sony cut its projected smartphone sales for the current fiscal year by 14%, reporting an operating loss for its mobile business for the second quarter of over £15.5 million.

Samsung blamed inventory mismanagement and a strong South Korean won for its smartphone woes, while Sony claimed the domination of Apple in the Japanese market as a contributing factor to its poor performance.

China rises

However for both Samsung and Sony, the biggest challenge is the same as the one facing almost every smartphone manufacturer and that is the increasing tide of cheap-but-premium smartphones coming from companies in China.

At the moment, three of the top six smartphone manufacturers in the world are Chinese. Lenovo, Huawei and ZTE occupy positions 3, 4 and 6 at the smartphone top table while companies like Xiaomi - often called the Apple of the East - are lying in wait, building up their production capabilities and marketing skills before launching globally.

For example, OnePlus is an eight-month old Chinese company which has gained a lot of attention for producing a smartphone with high-end specs that costs just £230, a fraction of what the flagship phones from the likes of Samsung, Sony and Apple cost.

Expansion

Xiaomi has a 27% market share in its native China compared to Samsung's 21% share. It has slowly begun to expand its reach, launching in Singapore, Malaysia and the Philippines while earlier this month its flagship smartphone sold out within 38 minutes when it went on sale in India.

The company plans to expand to Brazil and Indonesia later this year.

Huawei, the world's third biggest smartphone manufacturer nearly doubled its sales in the second quarter of 2014 compared to last year.

Lenovo is the world's fourth biggest smartphone manufacturer, mainly on the back of record sales in China. However the company is in the process of acquiring Motorola from Google and once this deal goes through, Lenovo could become a much bigger force on the global smartphone market.

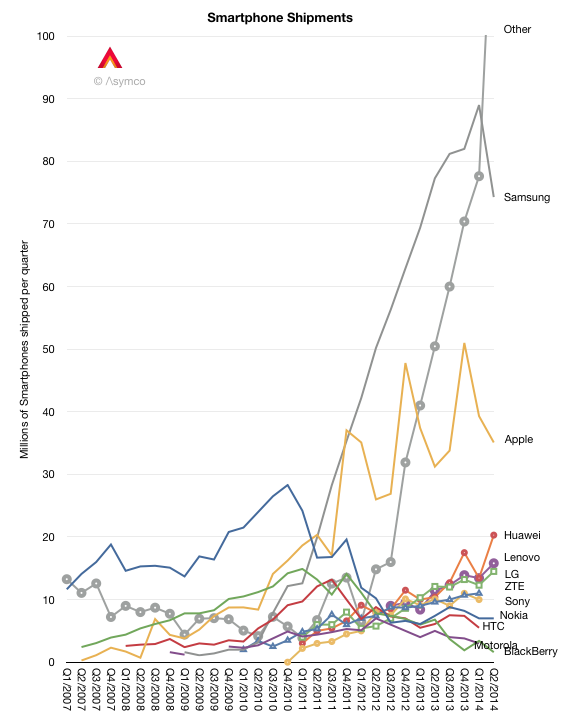

If you look at the graph (left) produced by Horace Dediu, you can see that smartphone sales by these smaller companies (grouped as Other) have exploded in the last six months, while during the same period sales by Apple and Samsung have dropped significantly.

While Samsung offers smartphones in virtually all segments of the market, the company is also lumbered with an annual marketing budget of over £8 billion, and trying to maintain the huge sales growth it has experienced in the last few years is proving a difficult challenge.

Apple

Apple is a slightly different case to the likes of Samsung, Sony and HTC. Apple's brand continues to be desirable and while the rest produce various versions of Android, the exclusivity of iOS and the quality of apps available on the platform mean Apple isn't as threatened by the Chinese manufacturers.

Apple is also about to launch two new larger iPhones which should see a huge spike in the company's sales for the next couple of quarters.

While Samsung can take some solace in the fact that along with Apple it continues to dominate in the US, the problem is the US is a saturated market and all the growth is coming in markets where Samsung is not dominant and where small, flexible and innovative companies like Xiaomi, OnePlus and Wiko can make significant gains.

© Copyright IBTimes 2025. All rights reserved.