China's Demand to Bolster Gold Prices in 2014, Say Analysts

Gold demand will remain steady in China as incomes rise, keeping prices hovering between $1,000 and $1400 an ounce, according to analysts' predictions.

Gold is on track for the first back-to-back monthly gain since the two-month advance last August. It traded at $1,340 an ounce at 10:34GMT in London after rising to $1,345.46, the highest price since 30 October, 2013.

Cuts to US stimulus and an expected increase in bond yields are predicted to restrain gold below $1,400 an ounce. However, the movement of gold from west to east means it's unlikely to return to $1000 an ounce, Davis Hall, Credit Agricole's global head of foreign exchange and precious metals advisory, told Bloomberg. Hall has studied precious-metals markets for 12 years.

"The market hasn't quite fathomed the scale of annual Chinese buying just because of the wealth effect in China over the next coming years," said Hall.

"Nothing clears the mind more than the absence of alternatives. The west doesn't want gold but the east is just starting to gain this appetite and I don't think it's going to change," Hall added.

Commerzbank Corporates & Markets said in a note to clients: "Gold is continuing its upswing of the past few weeks and this morning has achieved around $1,345 per troy ounce, its highest price for nearly four months. Since the beginning of the year, gold has now risen by almost 12%, i.e. $140. In euro terms, gold costs nearly €980 per troy ounce. Because the technically important 200-day moving average was also exceeded in euros recently, this will doubtless prompt technical follow-up buying, which should allow the price rise to continue.

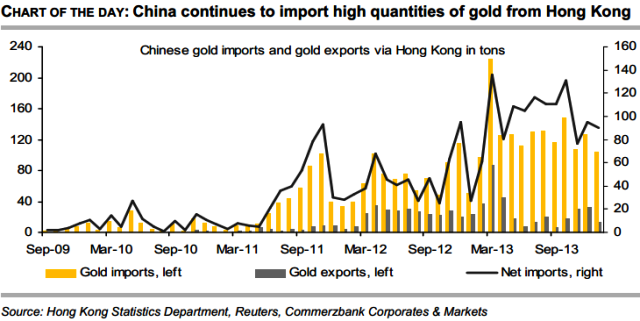

"[25 February] saw inflows into the gold ETFs for already the fourth consecutive day of trading. Thus the headwind from this side is clearly abating further, which likewise points to at least stable and possibly even higher gold prices. The ongoing high level of Chinese gold demand played a major part in January's price increase, as the trading figures between Hong Kong and China revealed when they were published [on 25 February]."

"According to the Census and Statistics Department of the Hong Kong government, China imported 90 tons of gold net from Hong Kong last month. Although this was five tons less than in December, it was more than three times the year-on-year figure. If China were to import 90 tons of gold every month in 2014, the import volume would almost reach last year's record level.

"Contrary to media reports, gold demand in China has not cooled noticeably in our view. Chinese demand will continue to serve as a key crutch for the gold price in 2014, too..." the German bank added.

Growing Asian Appetite

China overtook India as the largest gold consumer, in 2013, as the biggest price drop in more than three decades attracted buyers, the World Gold Council (WGC) said last week. Gold consumption in China hovered at a record 1,176.4 tonnes last year.

Conflicting Views

Hall's view counters bearish predictions from several gold forecasters, despite the fact that the metal logged its best start to a year since 1983.

Westpac Banking's Justin Smirk, the second most-accurate forecaster tracked by Bloomberg over the past two years, forecast bullion at $1,011 in December, according to a 20 February report. Prices would drop, pulled down by the US economic recovery and a stronger dollar, Smirk told clients.

Swiss Exports

More than 80% of Switzerland's gold and silver bullion and coin exports found their way into Asia in January, the Swiss Federal Customs Administration said on 20 February, the first breakdown of gold-trade data since 1980.

The flow of bullion from the west to the east was emphasised by the WGC in November 2013, citing higher activity at refiners in Switzerland that were recasting bullion into the higher-purity, smaller-sized bars preferred by Asian buyers.

Bullion's safe-haven investment allure has been buoyed this year by rising consumption in Asia, emerging-market turmoil and concerns about the pace of the US economy recovery.

Prices crashed 28% in 2013 to end a 12-year rally as the US Federal Reserve prepared to pare its monthly bond buying stimulus.

© Copyright IBTimes 2025. All rights reserved.