China's Yuan Tumbles Amid Band Widening Speculation

The Chinese yuan dropped the most in two decades on rumours the nation's central bank would widen the currency's trading band, allowing greater volatility against a backdrop of slowing growth in the world's second-largest economy.

The yuan slid as much as 0.86% to a 10-month low of 6.1808 against the US dollar in Shanghai, the biggest intra-day loss in China Foreign Exchange Trade System prices going back to 2007.

The drop was the largest since China combined official and market exchange rates in early 1994. The currency can trade up to 1% on either side of the central bank's daily reference rate, which was set at 6.1214.

The yuan was 0.27% weaker to close at 6.1450 to the greenback in Shanghai, down 1.7% from the 20-year high of 6.0406 struck on 14 January. The currency is still up 34% since a dollar peg ended in July 2005, the most among 24 emerging-market currencies tracked by Bloomberg.

The yuan is forecast to gain 2.9% in the remainder of 2014, according to a Bloomberg survey.

Beijing is looking to loosen exchange-rate controls and internationalise the currency.

The People's Bank of China (PBoC) is expected to double the yuan's trading band by the end of June, according to the majority of 29 analysts polled by Bloomberg.

Chinese lawmakers are due to meet next week to debate major economic policies and government data due out on 1 March could show that February's factory expanded at the slowest pace since June 2013.

"China looks determined to proceed with financial reforms, and so a wider band in the near term looks likely," said Daniel Chan, a Hong Kong-based strategist at China Silver Global Investment Consultant.

"As yuan selling pressure is still on, a wider band will mean further declines. That's obviously among the concerns in the market," Chan told Bloomberg.

Barclays Capital said in a note to clients: "The policy shifts of the past week have also been noteworthy, with the CNY and CNH having uncharacteristically depreciated, prompting a sharp unwind of levered carry trades in both. We think this depreciation was due to the PBoC trying to inject more volatility into the CNY ahead of future currency and capital account liberalisation. However, the currency shift could also mean the PBoC is more worried about growth and that markets will need to re-think the assumption of trend CNY appreciation (which had been indirectly supporting other EM Asia currencies).

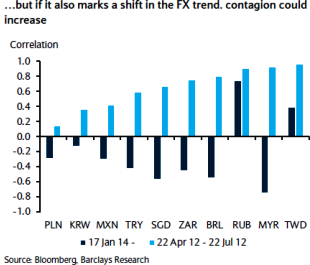

"So far, the latter has not been on investors' radars and the correlation between USD/CNY and USD/EM Asian currencies has been low to negative. The CNY last had a significant depreciation, of 2%, in Q2 2012, coinciding with a widening of the FX fluctuation band. Following that band-widening and depreciation, other EM Asian currencies also fell."

"The correlation with USD/CNY was especially high for USD/TWD, USD/MYR and (surprisingly) USD/RUB. The latter probably stemmed from Chinese growth concerns, which at the time weighed on oil prices. In our view, the lesson is that a blend of CNY volatility and new concerns about China's growth could weigh on other EM currencies (and not just those in North Asia).We will be following the China's National Party Congress (5 March) for additional clues on the macro framework behind FX policy," Barclays added.

Standard Chartered said in a note to clients: "China will release February's official manufacturing PMI on 1 March. Despite recent weakness in both the official and the Markit PMI, we expect a further mild expansion in the sector, with the February reading likely to be relatively flat at 50.6. We believe the recovery will be stronger in March, when most manufacturers will be back at work.

"Our indices suggest that producers' outlook remains firm, despite some cautious re-stocking. The recent recovery in export demand and still-solid economic growth momentum should support continued industrial-sector expansion. The combined growth indices for January and February will be released in mid-March, which should provide more detail on growth momentum."

© Copyright IBTimes 2025. All rights reserved.