Chinese Equities Drop to Four-Month Low on Cash Crunch Fears

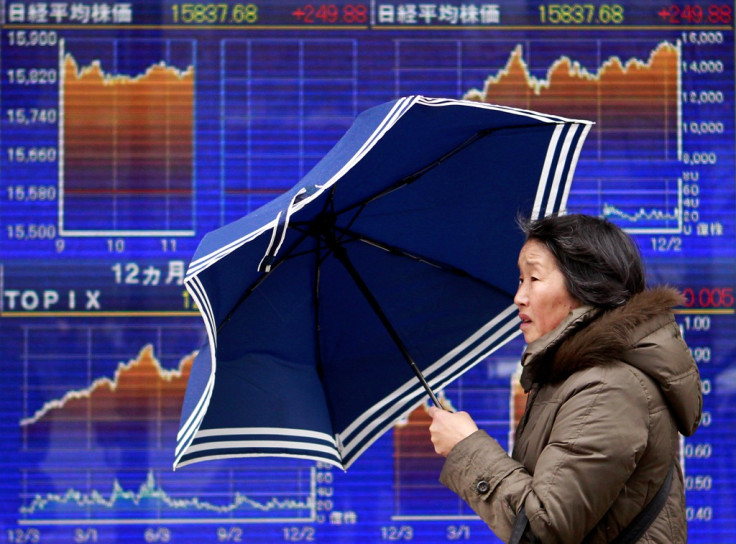

Asian markets outside China traded higher on 20 December as investors took in the US Federal Reserve's decision to trim its massive monthly asset buys in stages.

In China, fears of a liquidity crunch weighed down on stocks, with the benchmark Shanghai composite index finishing at a four-month low.

The Japanese Nikkei finished 0.07%, or 11.20 points, higher at 15,870.42.

Australia's S&P/ASX finished 1.21%, or 63.00 points, higher at 5,265.20.

South Korea's Kospi finished 0.39%, or 7.70 points, higher at 1,983.35.

The Shanghai Composite finished 2.02%, or 43.00 points, lower at 2,084.79.

Hong Kong's Hang Seng was trading 0.37%, or 85.08 points, lower at 22,803.67.

India's BSE Sensex was trading 1.01%, or 209.18 points, higher at 20,917.80.

Chinese money market rates rose for a third straight session on 20 December, with the benchmark seven-day bond repurchase rate hitting its highest level in nearly six-months.

Rates increased even after the People's Bank of China's took emergency steps on 19 December, injecting liquidity into selected banks in order to ease concerns about a cash squeeze.

Evan Lucas, market strategist at IG, said in a note to clients: "Trade [on 20 December] will be interesting from an Asian-centric point of view, as the Chinese repo rates continue to react to policy changes around banking. The changes by the PBOC and the central government are very positive steps towards a more liberal and freely floating interbank lending rate, and provide insight into the steps that may be taken to see a freely floating CNY in years to come."

Elsewhere, the Bank of Japan left its ultra-easy monetary policy unchanged and said that the world's third-largest "economy is recovering moderately."

Wall Street Mixed

On Wall Street, most indices ended lower on 19 December as market players digested mixed economic data.

The Dow finished 11.11 points, or about 0.1%, higher at 16,179.08, a record finish for the benchmark index.

The S&P 500 ended 1.05 points, or about 0.1%, lower at 1,809.60.

The Nasdaq closed 11.93 points, or 0.3%, lower at 4,058.13.

Fed data showed that factory activity growth in the US mid-Atlantic region inched up in December. The Philadelphia Fed said its business activity index hovered at 7.0 points in December from 6.5 in the preceding month.

Meanwhile, a gauge of future economic activity inched up in November, suggesting the US recovery was gaining momentum. The Conference Board said its Leading Economic Index rose 0.8% to 98.3 in November, beating expectations.

Data also showed that US home resales dropped to their lowest level in about a year in November. The National Association of Realtors (NAR) said sales of previously owned homes dropped 4.3% to an annual rate of 4.90 million units.

Company Stock Movements

In Tokyo, automaker Nissan and telecoms firm KDDI lost over 2% each after investors took profits.

In Shanghai, Hua Xia Bank fell 4% while rival Merchants Bank dropped 3.5%.

Gold miner Shandong Gold lost over 5% while rival Zhongjin Gold shed 4% as gold prices traded near six-month lows.

In Hong Kong, HKT shot up 3.9% on news that it had acquired Sydney-based Telstra's local mobile business for $2.43bn.

China Everbright Bank lost 5% on its trading debut after raising $3bn in the Hong Kong Stock Exchange's largest IPO so far this year.

In Sydney, banking major ANZ jumped 2% while Telstra added 1.7%.

In Mumbai, IT firm Tech Mahindra surged 4.29% while rival Wipro added 2.5%.

Reliance Industries, owner of the world's biggest refinery complex, gained 2.18% on news that New Delhi has allowed the company to charge higher prices for gas from April 2014.

In Seoul, Kia Motors and part-owner Hyundai Motor added 2.2% and 1.8% respectively.

© Copyright IBTimes 2025. All rights reserved.