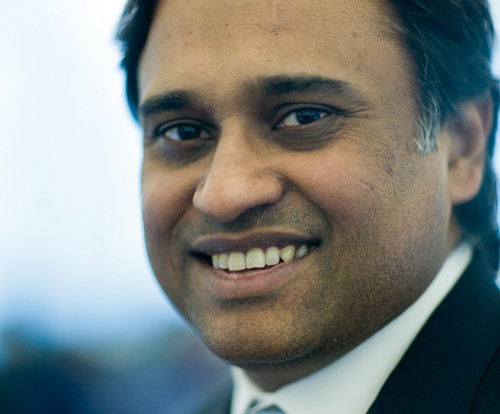

Citi's Head of FX Anil Prasad Exits Amid Fixing Scandal

Citi's global head of foreign exchange, Anil Prasad, will leave the investment bank in March but sources say his departure is "entirely unrelated" to the global investigations into the potential manipulation of currency rates.

According to an internal Citi memo seen by IBTimes UK, Prasad is leaving the bank and his successor will be announced within the next few weeks.

A source familiar told IBTimes UK: "Prasad's decision is his own and entirely unrelated to the ongoing FX investigations."

Prasad's exit follows closely after Citi's firing of its head of European spot foreign exchange trading, Rohan Ramchandani.

Citi declined to comment.

The daily $5tn (£3.1tn, €3.7tn) currency market is the largest in the financial system and is pegged to the value of funds, derivatives and financial products.

Morningstar estimates that $3.6tn in funds, including pension and savings accounts, track global indexes.

FX rates are calculated are compiled by using data from a variety of submitted provisions on a number of platforms, such as Thomson Reuters.

It is then calculated by WM, a unit of State Street, to form WM/Thomson Reuters at 1600 GMT daily.

Unlike stocks, futures or options, currency trading does not take place on a regulated exchange and is conducted in the over-the-counter derivatives market. All members trade with each other based on credit agreements and there is no arbitration panel to adjudicate disputes.

A number of banks around the world have revealed that they have launched internal reviews into their FX trading procedures, after America's Department of Justice and the Federal Bureau of Investigation launched a criminal investigation into whether the world's biggest banks attempted to manipulate the currency markets.

Switzerland's Financial Market Supervisory Authority (Finma) and FCA are also looking into whether FX market rigging has occurred.

Who is Anil Prasad?

In February 2007 Prasad was appointed global head of foreign exchange & local markets for the newly formed Fixed Income, Currencies and Commodities (FICC) group.

Prasad initially began his career with Citibank India in 1986 in Treasury marketing and sales.

He subsequently relocated to New York in 1988 to work on the Currency and Metals Options desk.

In 1992 he was made head of the options business. In 1994 he was also asked to run the short term Interest Rate trading business in addition to the Options business.

In 1996, Prasad came to London and took over responsibility for the interest rate options business.

He left the bank in 1997 to join Natwest Capital Markets in their newly formed Propriety trading activity.

He returned to Citigroup in 2000 in the role of regional head of central eastern Europe Middle East & Africa trading. In July 2003 he was appointed Head of Sales & Trading for CEEMEA.

The S & T trading activity in CEEMEA is spread out over 33 countries and is the most diverse emerging market group.

© Copyright IBTimes 2025. All rights reserved.