COP28 Puts Spotlight On State Oil Giants

Western energy firms are the usual suspects when it comes to criticism about the sector's role in climate change, but a less visible lineup of powerful state companies dominates the industry.

Western energy firms are the usual suspects when it comes to criticism about the sector's role in climate change, but a less visible lineup of powerful state companies dominates the industry.

They will all share the limelight at the UN climate talks that opened Thursday in Dubai, as COP28 president Sultan Al Jaber is also the head of ADNOC, the national oil and gas company of the United Arab Emirates.

The future of fossil fuels is at the heart of the two-week conference, with countries under pressure to agree to phase out oil, gas and coal in order to meet the Paris Agreement goal of limiting warming to 1.5 degrees Celsius.

"While attention often focuses on the role of the majors, which are seven large, international players, they hold less than 13 percent of global oil and gas production and reserves," the International Energy Agency said in a report last week.

National oil companies, or NOCs, "account for more than half of global production and close to 60 percent of the world's oil and gas reserves," the Paris-based watchdog added.

The NOCs and the oil majors -- which include the likes of BP, Chevron, ExxonMobil, Shell and TotalEnergies -- will all be "critical to efforts to achieve net zero" emissions by 2050, the IEA said.

National companies range from Saudi Aramco, the world's biggest oil company, to Russia's Rosneft, Chinese firm CNOOC and Petrobras in Brazil.

Some explore resources in their own soil while others, known as "international national oil companies", go beyond their own borders.

"These are companies that have very large-scale resources," said Ben Cahill, senior fellow on climate and energy security at the Center for Strategic and International Studies (CSIS).

They also "generally have low production costs which means that they're likely to continue producing oil for a long time to come because they have scale and low-cost resources," Cahill added.

Their countries, such as Saudi Arabia or Russia, have a major influence on world oil prices as they can make them fall or drop by leading production cuts in their OPEC+ alliance of major producers.

Their operations and products are major contributors to greenhouse gas emissions, but very few national companies have made climate targets.

The exceptions include the larger companies such as Saudi Aramco, ADNOC, PetroChina and Petrobras, which have set targets for their operations to be carbon neutral by 2045 or 2050.

Only five out of 21 NOCs "have publicly stated they have strategies related to the energy transition and the need to mitigate associated risks", according to the Natural Resource Governance Institute (NRGI).

"In some of the petro-states oil is hugely powerful politically and so the oil industry doesn't want electric vehicles on the road and they don't want renewable energy competing against their gas," said David Manley, lead economic analyst at NRGI.

NOCs are also less sensitive to social pressure than their Western peers which must answer to investors who are increasingly climate-conscious.

"Because they're not on a stock exchange, they don't have activist shareholders" on their boards, Manley said.

"Most of them are quite opaque. There's very little information published about them. So there's very little public or even government accountability of the states of these companies."

Nicolas Berghmans, an energy and climate expert at the Institute for Sustainable Development and International Relations think tank in Paris, said NOCs account for a huge part of their countries' revenue even in more diversified economies.

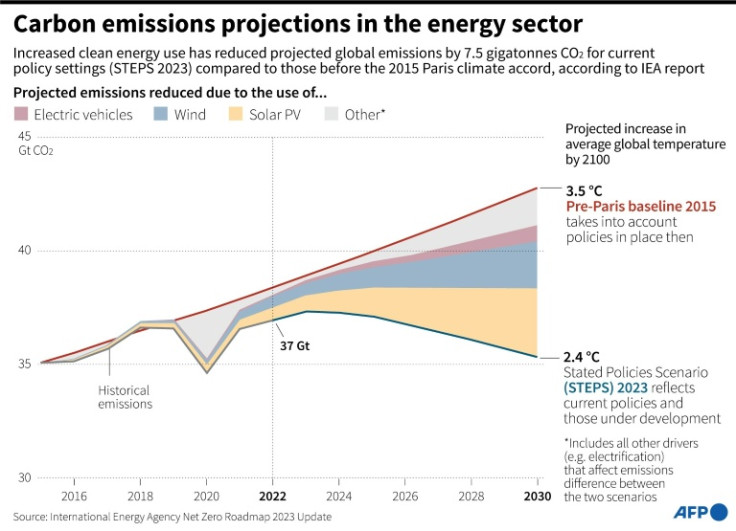

But the IEA has forecast that demand in fossil fuels will peak this decade due to the "spectacular" growth of cleaner energy technologies and electric cars.

"The prospect of falling oil and gas demand adds a new dimension to the need for these countries to diversify their economies," said Christophe McGlade, the head of the energy supply unit at the IEA.

Tim Gould, the IEA's chief energy economist, said that a "non-negotiable element" was for oil companies, including NOCs, to reduce emissions from their operations.

He said companies such as Saudi Aramco or ADNOC "have a very important leadership role there, and they can really set the tone for what is possible, what's on the agenda."

© Copyright AFP 2025. All rights reserved.