Could China Wrest Currency Control Within Brics?

The Brics group, which constitutes about 18% of global GDP, is able to announce a development bank of its own in the ongoing summit and will eventually float their planned $100 bn fund, for helping the members to manage their liquidity needs.

However, there could be a core-peripheral divide similar to the eurozone in the emerging group too, a study shows. Such a divide is clearly visible at least in the ability to keep the currency advantage, with the Chinese yuan at the core.

The New Development Bank (NDB) that aims better financial co-operation among the member countries will be headquartered in China, which will provide the largest contribution to the capital pool being created for the bank.

Many fear that China's track record of keeping the yuan exchange rate in support of their global trade and growth views suggests they will strive to keep the FX advantage within the Brics group as well, increasing risks of currency-related conflicts in it.

Chinese yuan is the most stable compared to the rest of Brics currencies thanks to a more effective state control of its exchange rate versus the US dollar.

China is able to steadily improve its FX-related export competitiveness over the past several years, but others are seeing their currencies becoming less helpful in boosting exports at a time of rising demand in their bigger import destinations like the US.

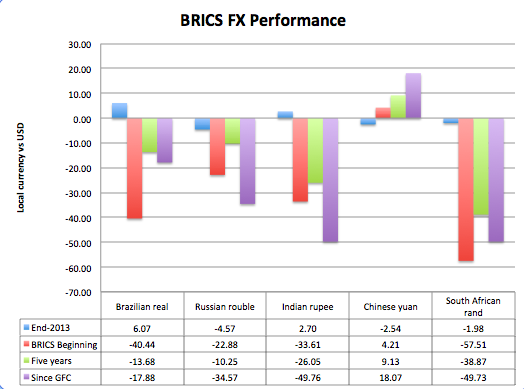

Currencies of all the Brics countries except China have declined significantly over the past five years, but Brazil's real and India's rupee have bucked the weakening trend, since the beginning of this year.

Yuan is 18% stronger from the level of August 2007, when the global financial crisis broke out, but is only 9.1% strong over the past five years. When compared to the Brics formation time, yuan is only 4.2% stronger, and from end-2013, it is 2.5% weaker.

At the same time, the rand and rupee, which are nearly 50% weaker when compared to the GFC breakout time are stronger 2% from end-2013. Brazils' real, which is 18% weak compared to August 2007, has rallied more than 6% so far this year.

The impact of the yuan keeping its core position within its Brics peers is yet to be seen. But for sure, the situation can only worsen, if the waiting members like Indonesia, Turkey, Argentina, Egypt, Iran, Nigeria and Syria are allowed inside, going forward.

© Copyright IBTimes 2025. All rights reserved.