From Credit Card Debt To Mortgage Trouble: 3 Money Mistakes Marco Rubio Made You Should Learn From

Rubio also leased a $50,000 Q7 Audi and bought an $80,000 boat with the money he earned from his books

US Senator Marco Rubio, who could be the first Latino to serve as Secretary of State under President-elect Donald Trump's administration, has a history of financial missteps that have come under the spotlight repeatedly over the years. Despite his role as a prominent political figure, Rubio's handling of his finances—from questionable credit card practices to mortgage defaults—offers some important lessons for managing money responsibly. Here are three key financial mistakes Rubio made and insights on how to avoid them:

1. Misusing a Business Credit Card for Personal Expenses

Between 2005 and 2008, while serving as Speaker of the Florida House, Rubio controversially used a Republican Party of Florida corporate credit card for personal expenses. According to New York Magazine, Rubio racked up nearly $100,000 on the card, much of it for personal purchases like wine, family dinners, and reunions. Although he reimbursed around $13,900 to the party for personal expenses, the remaining balance was absorbed by the party itself, raising eyebrows about his fiscal responsibility.

Rubio later defended his actions, insisting he took steps to prevent party funds from covering personal expenses. Yet, reports revealed inconsistencies, including instances where Rubio double-billed the party for flights. Though the Florida Commission on Ethics reviewed the case in 2012, it did not charge him with misconduct.

Using a business credit card for personal expenses is risky, especially if it breaches agreements with the card issuer. It can also complicate financial records, making accounting difficult and potentially affecting personal and business credit scores. To avoid this, keep business and personal spending separate, and if you accidentally charge personal expenses, notify your company and issuer to maintain accurate records.

2. Defaulting on Mortgages

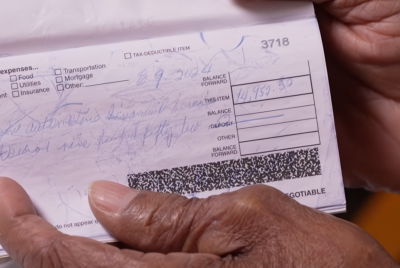

Rubio's financial challenges extended to real estate as well. In 2005, he and his wife purchased a $550,000 home in West Miami. Shortly after, they took a $135,000 home equity loan from US Century Bank, allegedly appraised at a generous $735,000. The appraisal and loan, backed by his supporters, raised questions, especially when Rubio omitted the mortgage from his 2008 financial disclosures, quickly updating the documents when questioned by the media.

Around the same time, Rubio bought a Tallahassee property with Florida legislator David Rivera. The property fell into foreclosure during Rubio's Senate campaign when mortgage payments lapsed for five months. Although Rivera later paid $9,000 to resolve the debt, the duo eventually sold the home at a loss.

According to Tallahassee Democrat, missed mortgage payments and foreclosures can significantly harm credit scores and lead to legal consequences. Mortgage delinquencies in the US have risen, with inflation pushing rates up. If you risk defaulting on mortgage payments, contact your lender about possible hardship plans or consider refinancing to lower monthly costs.

3. Liquidating Retirement Savings Prematurely

In 2014, Rubio made the financially questionable choice to withdraw $68,000 from his retirement accounts as he geared up for a presidential campaign. Despite having substantial checking and savings, he chose to cash out his retirement investments, incurring almost $24,000 in taxes and penalties. Critics noted that he had enough liquid assets and alternative income streams from book royalties to avoid draining his retirement fund.

The choice baffled financial experts, with Stephen Butler, president of Pension Dynamics Company, saying, "It's hard to imagine why somebody with substantial other income would cash in their retirement." According to New York Magazine, Rubio claimed that he wanted to ensure his family had sufficient cash for any immediate needs, even if he was focused on his campaign.

Withdrawing retirement funds early can lead to costly penalties and reduce future savings. Instead of dipping into retirement accounts for short-term needs, consider building an emergency fund to cover unexpected expenses without derailing long-term goals.

Learning from Rubio's Financial Missteps

Rubio's financial choices reflect common mistakes, from mismanaging credit cards to dipping into retirement savings prematurely. While he has weathered financial scrutiny, his story illustrates the importance of separating personal and business expenses, maintaining consistent mortgage payments, and safeguarding retirement savings. His experiences serve as reminders of financial prudence for anyone navigating both personal and professional financial landscapes. As Rubio potentially steps into a high-profile role in Trump's administration, his past financial decisions raise questions about his fiscal responsibility and readiness to influence national economic policy.

© Copyright IBTimes 2025. All rights reserved.