HSBC Earnings Expectations From Credit Suisse, Nomura

HSBC Preliminary FY Results

The outlook for the worldwide economy is quite challenging as problems in the developed markets have started to affect growth rates across the world. Faster-growing markets clearly possess significant potential for growth, however, and continue to offer attractive business opportunities. With respect to mainland China, the Group believes that the economy will make a soft landing and already it has seen inflationary pressures easing and growth buoyed by domestic demand. In these uncertain times the Group is reassured by the fact that its business, while remaining diversified, is more cohesive and strategically focused for growth, with a strong balance sheet and a high level of liquidity.

The Company has made a good progress against its strategic goals on what will be a long journey. The Board remains committed to meeting its targets and is responding to the more challenging environment with even more determination and a greater focus on implementation. By the end of 2013, it will have reshaped HSBC.

Last month, HSBC's indirectly wholly owned subsidiary, The Hongkong and Shanghai Banking Corp Ltd, agreed to sell its Retail Banking and Wealth Management business in Thailand to Bank of Ayudhya Public Company Ltd. The value of the gross assets being sold was approximately THB17.5bn (approximately US$553m) at December 31, 2011. The Group's other subsidiary HSBC Bank (Panama) has also agreed to sell its whole banking operations in Costa Rica, El Salvador and Honduras to Banco Davivienda, a Colombian-listed banking group, for a total consideration of US$801m in cash. The transaction is subject to regulatory and other approvals and is expected to complete in the fourth quarter of 2012.

Last year, the Group agreed to sell its card and retail services business in the United States to Capital One Financial Corporation. Based on figures as at June 30, 2011, the total consideration would be approximately US$32.7bn, including a premium of approximately US$2.6bn. The deal is expected to close in the first half of 2012. It has also agreed to sell the full-service investment advisory business of HSBC Securities (Canada) to a wholly-owned subsidiary of National Bank of Canada. As at August 31, 2011, the gross assets of the Business were C$199.3m and assets under administration of the Business were C$14.2bn.

HSBC has committed US$15 million for next five years to develop Future First, the Group's flagship global education programme that aims to deal with child poverty through education projects. US$10 million will be allocated to projects developed in partnership with NGOs around the world with US$5 million set aside for SOS Children's Villages projects, the world's largest NGO for orphans, including in the African continent.

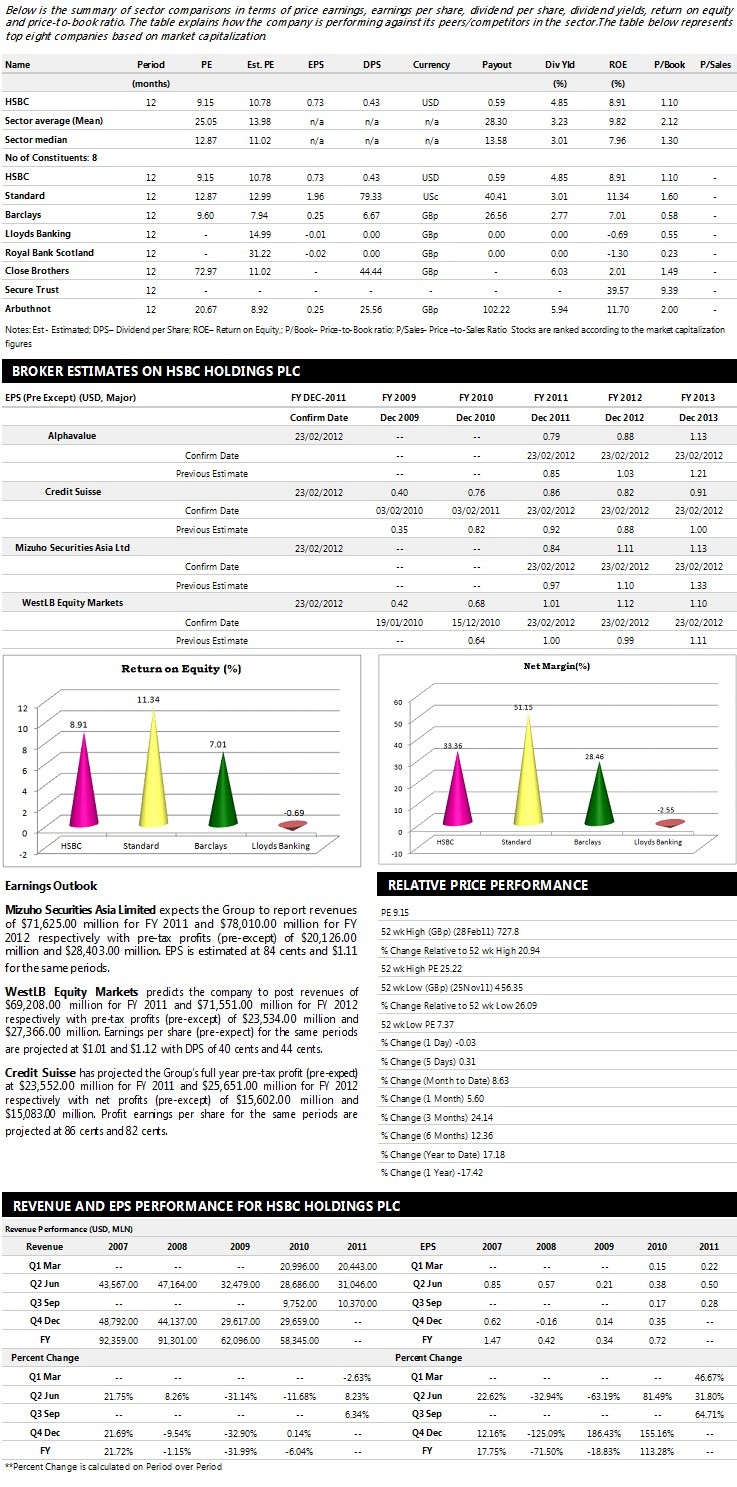

Brokers' Views:

- Credit Suisse recommends 'Neutral' rating on the stock with a target price of $9.10 per share

- Nomura Securities recommends 'Buy' rating on the stock with a target price of $10.85 per share

- Mizuho Securities Asia Limited gives 'Underperform' rating on the stock with a target price of $7.92 per share

- WestLB Equity Markets assigns 'Add' rating on the stock with a target price of $9.31 per share

© Copyright IBTimes 2025. All rights reserved.