Dairy Crest Group Expects Tough Consumer Environment Ahead, Rely on Cost Cuts

Strong performance from food businesses will compensate for more challenging trading in Dairies division, says Dairy Crest Group, the UK's leading dairy foods company.

In its pre-close trading update for the year ending 31 March 2012, the group said its cost cuts were on track to meet its annual savings target of £20 million.

"These savings have partially offset higher input costs including milk. We will continue to focus on reducing costs into the new financial year and expect to achieve a similar level of annual savings," said Dairy Crest.

According to the group it has managed well in a challenging business environment and overall trading remains in line with its expectations this year. The group remains cautious about the economic environment, though it continues to manage the business upbeat to face challenges which lie ahead.

While commenting on the group's trading , CEO Mark Allen said: "This has been a year of progress for Dairy Crest in which we have continued to deliver against our strategy despite challenging trading conditions. Our business has faced sizeable inflationary input costs and we have dealt with these by focusing on our strong key brands and by driving efficiencies. We continue to proactively shape our business for the long term."

Dairy Crest reported revenues of £796.2 million for the first half of FY 2011-12, an increase of 2 percent from £776.9 million during the same period a year ago. The group's underlying profit before tax increased by 9 percent to £39.2 million with underlying earnings per share up by 13 percent at 22.4 pence.

The group has continued to benefit from being a broadly based business, and has also worked towards growing its key brands, reduce costs and control debt to follow its strategy.

Dairy Crest is focussing on initiatives that will deliver long-term value for all the stakeholders involved with its business. The group anticipates consumer environment to remain challenging and unpredictable. In spite of this, it is confident of delivering full year profits in line with its expectation.

The group is scheduled to announce its preliminary results for the year ending 31 March, 2012 on 24 May 2012.

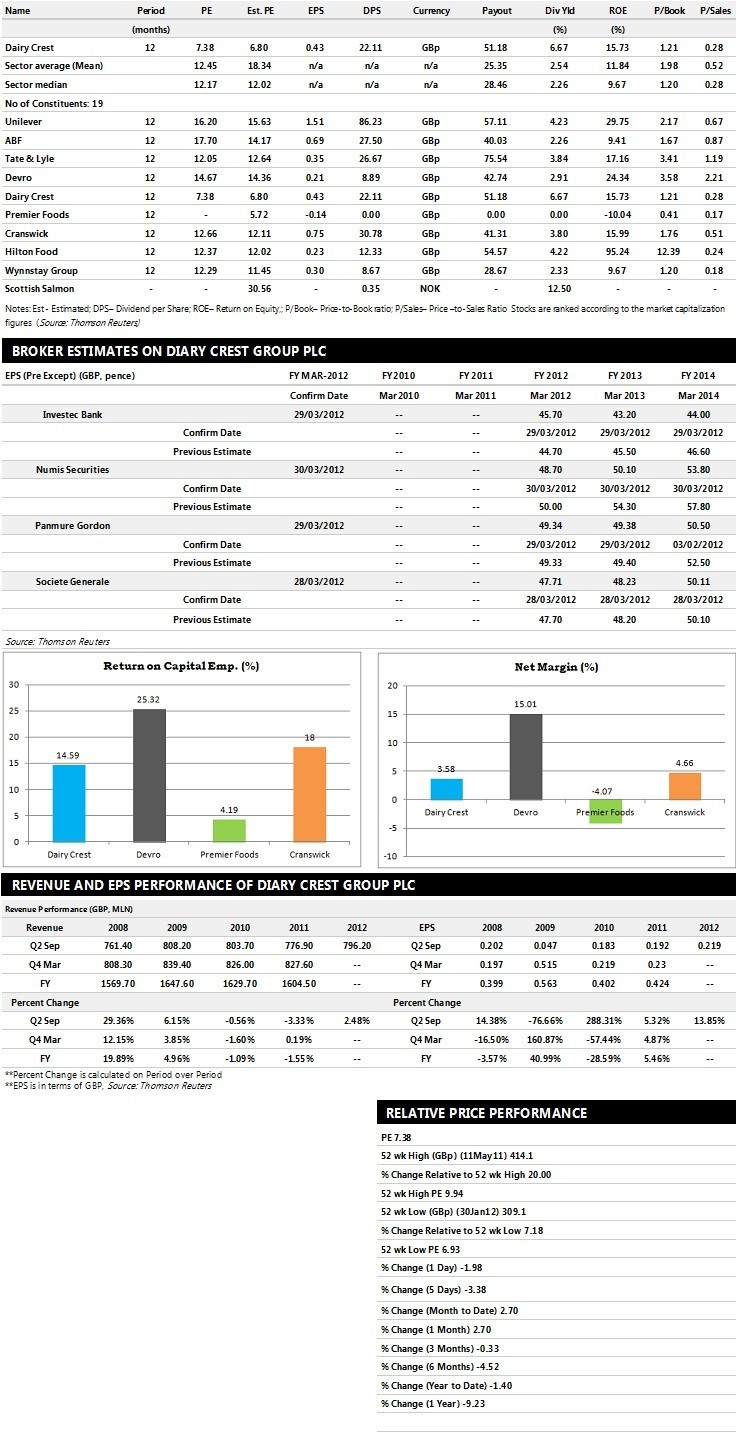

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents top ten companies based on market capitalisation.

Brokers' Views:

- Numis Securities recommends 'Outperform' rating on the stock with a target price of 403 pence per share

- Investec Bank assigns 'Hold' rating with a target price of 340 pence per share

- Panmure Gordon gives 'Hold' rating with a target price of 350 pence per share

- Societe Generale assigns 'Hold' rating with a target price of 360 pence per share

Earnings Outlook:

- Numis Securities estimates the company to report revenues of £1,657 million and £1,713 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £88 million and £90 million. Earnings per share are projected at 48.70 pence for FY 2012 and 50.10 pence for FY 2013.

- Investec Bank projects the company to record revenues of £1,630 million for the FY 2012 and £1,627.30 million for the FY 2013 with pre-tax profits (pre-except) of £87.20 million and £81.90 million respectively. Profit per share is estimated at 45.70 pence and 43.20 pence for the same periods.

- Panmure Gordon expects QinetiQ to earn revenues of £1,623 million for the FY 2012 and £1,641 million for the FY 2013 with pre-tax profits of £86.60 million and £87.70 million respectively. EPS is projected at 49.34 pence for FY 2012 and 49.38 pence for FY 2013.

© Copyright IBTimes 2025. All rights reserved.