Debenhams Keen on Tight Cost Control and Profit Maximisation

Debenhams, the seller of fashion clothing, accessories, cosmetics and products, expects to benefit from lower input prices in the H2 of FY 2012. Britain's No 2 department store group is scheduled to release its H1 trading update on Tuesday.

Given the uncertain economic outlook, Debenhams remains cautious regarding the consumer confidence for next year. The group will therefore continue to run the business with tight management of costs and stocks, retaining as much flexibility as possible in the supply chain to enable it to deal with whatever market hold for it in future. A practical approach will be taken by the group for trading and also it will continue to focus on maximising cash profit.

Overall Debenhams is optimistic about its prospects and believe that it has a clear strategy for growth and to meet its aim of being a leading international, multi-channel retailer.

While commenting on the interim management statement for 18 weeks to 7 January, Chief Executive Michael Sharp said: "I am pleased with this performance. We traded well despite the difficult environment as evidenced by strong sales in December, including record sales in the final week before Christmas. Looking forward, we are cautious about the strength of the economy and its impact on consumer behaviour over the remainder of the financial year. We will continue to manage the business tightly with an ongoing emphasis on cost and margin management. We are confident that the design, quality and value offered by our spring/summer 2012 product ranges will find favour with customers and expect to see some benefit from lower input prices in the second half of the year."

The group reported a 2.7% increase in revenues to £2,176.4 million for FY 2011 with profit before tax of £151.9 million, an increase of 8.6% compared to £139.9 million in 2010. Basic earnings per share for 2011 were 8.6 pence. According to the group, the new stores performed ahead of or in line with its expectations. Also one new store is scheduled to open in 2012. Further, the store pipeline consists of nine contracted stores, the first of which in Chesterfield will open in 2013, and nearly 30 more possible new stores are under discussion.

Espirito Santo says: "With Debenhams trading on 6.1 times its calendar 2012 earnings per share forecast, and a dividend yield of 5.3 percent, it is attractive in the context of resilient trading, not just over the last few weeks but through the recession, and a strong financial position." The broker retains "Buy" rating on the stock.

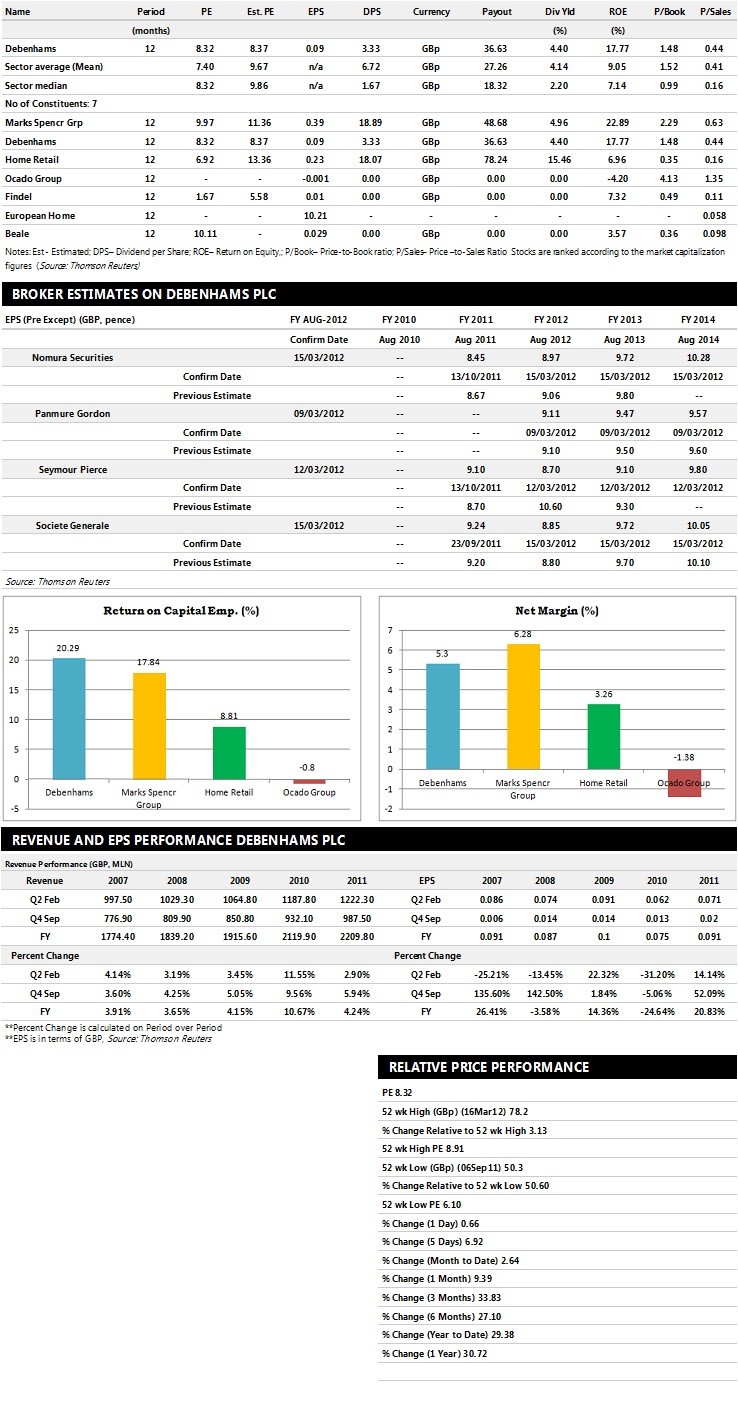

Brokers' Views:

- Societe Generale recommends 'Hold' rating on the stock

- Nomura Securities assigns 'Hold' rating with a target price of 81 pence per share

- Seymour Pierce gives 'Outperform' rating

- Panmure Gordon assigns 'Hold' rating

Earnings Outlook:

- Societe Generale estimates the company to report revenues of £2,192 million and £2,243 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £148 million and £163 million. Earnings per share are projected at 8.85 pence for FY 2012 and 9.72 pence for FY 2013.

- Nomura Securities projects the company to record revenues of £2,202 million for the FY 2012 and £2,268 million for the FY 2013 with pre-tax profits (pre-except) of £159 million and £169 million. Profit per share is estimated at 8.97 pence and 9.72 pence for the same periods.

- Seymour Pierce expects Debenhams to earn revenues of £2,607.00 million for the FY 2012 and £2,646.10 million for the FY 2013 respectively with pre-tax profits of £155.80 million and £163.90 million. EPS is projected at 8.70 pence for FY 2012 and 9.10 pence for FY 2013.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents top seven companies based on market capitalisation.

© Copyright IBTimes 2025. All rights reserved.