Digital mortgage adviser Habito on cusp of realtime lender approvals as it secures £5.5m investment

Daniel Hegarty, CEO of Habito, says it will be a "pretty big deal" for the mortgage industry.

Habito, the digital mortgage adviser which uses AI technology, has just raised millions in funding from investors in Silicon Valley – and says it is on course to have processed half a billion pounds' worth of mortgage applications by the end of 2017.

Ribbit Capital, which has invested in Funding Circle and Robinhood among other fintech companies, backed Habito with £5.5m. The funding round closed in around six weeks. Habito will use some of that funding to develop realtime mortgage approvals by lenders, which it expects within three or four months.

"We're really quite close now to realtime lender approvals," Daniel Hegarty, founder and CEO of Habito, told IBTimes UK.

"So you'd be able to come online and actually without having to wait or sit around we'll be able to get you all the way through to an agreement in principle with the lender while you're in front of your computer. That would be a pretty big deal for the industry and an order of magnitude quicker than anyone has done it before. So that's what's next and what we're excited about."

Hegarty said some of the funding will go towards expanding Habito's current headcount of 25 by 50-100% as more engineers are brought in. He is also sanguine about the impact of Brexit, despite wider fears that it could hurt the economy and spark a slowdown in mortgage lending, though he said it was discussed with Ribbit.

"The view is that it could certainly cause wobbles in house prices, but given our stage and the scale of what we're trying to do, we don't think Brexit is going to be massively impactful," he said. "To be honest, the biggest thing for us is if it limits our ability to hire great engineers who aren't UK based. That's a real frustration."

Habito has processed £50m in mortgage applications since it launched in September 2016 and is on course to have done £500m by the end of the year. The firm has assisted 20,000 people with their mortgages during that time.

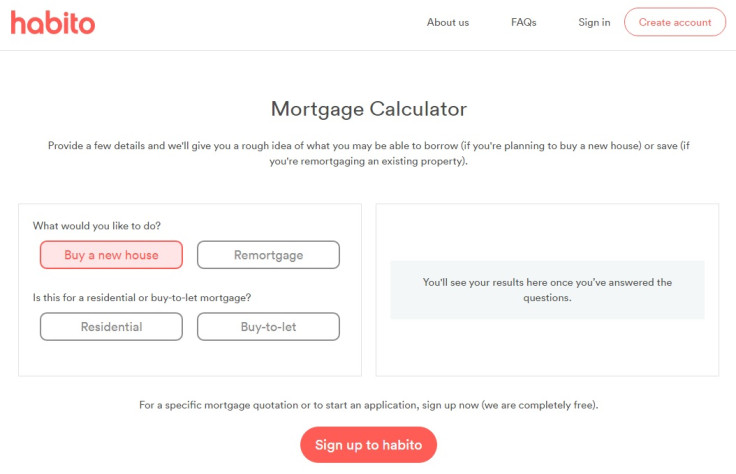

It works using an algorithm-powered digital mortgage adviser. Customers input various pieces of information about themselves, the property they want to buy, their financial circumstances, and so on, to the website.

Then Habito's algorithm – developed and refined by listening to hundreds of customer interviews by mortgage advisers – gets to work finding the mortgage products it thinks best suit.

Human advisers are also on hand if needed. And Habito receives the same flat "procurement fee" from all mortgage lenders, which varies depending on the type of product, ie. for home purchase or buy-to-let.

© Copyright IBTimes 2025. All rights reserved.