E. Pihl & Søn's Bankruptcy Opens Up FDI Opportunities in Danish Public Contracts

On 26 August, 2013, 126-year old Danish construction group E. Pihl & Søn filed for bankruptcy; after months of negotiation, a financial solution to ensure the company's continued operation could not be found.

Pihl is a giant in Denmark's construction industry, responsible for the assembly of prestigious national projects such as the Great Belt Bridge and the Danish Opera House. Accounts for 2012 indicate that the company employed approximately 2,300 workers, with a turnover of DKK 5.5bn, however it turned into a sudden loss of DKK 473m.

Pihl's 2012 annual report outlined three main causes of the company's financial straits. The company had embarked some years previously on a course of aggressive expansion across Scandinavia, and abroad. This strategy was enacted without sufficient balance in contract terms, without sufficient verification of customer and sub-contractor credit quality, and without making sure that the qualities of the work processes and the risk management procedures were sufficient to support the increase in activity level. Pihl had subsequently claimed substantial claims against third parties as income, and the company incurred costs that had not been provided for, relating to post-completion work on a number of projects.

Law firms Kromann Reumert and Holst have been appointed trustees of the Pihl estate. The first creditors' report indicates that liabilities of the estate exceed the assets significantly, with estimated liabilities at DKK 2.2bn, and assets at DKK 291m. The trustees announced the continuation of a number of arbitration proceedings in order to considerably increase the company's assets.

At time of writing, Pihl is still engaged in more than 90 building projects, in Denmark and abroad. A number of the major projects are public works; contracts were awarded following pan-EU tender processes. Major undertakings in Denmark alone include Nørreport Station, the UN City, the Frederikssund motor way, 111 owner-occupied/rented accomodation units and several canal bridges. Trustees have indicated that ongoing contracts may be assigned to new constructors without retender.

Danish Building and Construction Market

The Danish economy is slowly recovering from the credit crisis; however, the Danish economic climate remains volatile in certain sectors, and bankruptcy filings have doubled, or even tripled, since 2008. Danish banks maintain the restrictive lending policies instituted in 2008, and as a result, a significant number of businesses, and consumers, are dependent on extremely low interest rates; even a relatively minor change could potentially lead to a new spate of rises in bankruptcy filings.

Recently, however, there have been green shoots of recovery. Whilst Denmark narrowly avoided recession in 2012 the Trade-Outlook analysis of the Danish Construction Association, February 2013 points in the direction of growth rates of approx 1% in 2013 and approx 1.5% in 2014.

Whilst bankruptcy has typically befallen businesses in Denmark's retail sector, there have been two high-profile bankruptcies in the construction sector during August 2013 alone. It is likely that these insolvencies will have ramifications for other developers, subcontractors and financial institutions.

However, the DCA's Trade-Outlook analysis states that economic growth is hardly strong enough to generate cycle-induced progress in Danish construction activities.

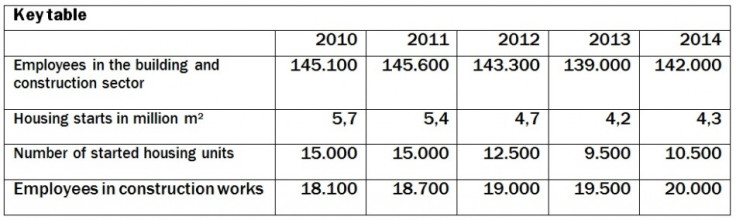

For 2014, there are indications of an increase of approx 3,000 employees in the sector. This is due to growth in the building of new hospitals and social housing renovation.

Generally speaking, the trade-outlook development in the Danish building and construction sector may be viewed as follows:

The estimated progress in the Danish building and construction sector is primarily due to the Danish Government's focus on kick-starting the economy by large spending allocations for building hospitals and university buildings as well as for social housing. In addition to this, a new prison is being built, and there have been additional investments in municipal institutions, such as kindergartens and schools.

At the time of bankruptcy, Pihl was the third largest construction group in Denmark. Pihl's economic collapse therefore changes the ground rules, particularly for large public works projects.

As a result, the Danish Building & Property Agency has cancelled the invitation to tender of a planned office building of 41,000m2 for public institutions on Kalvebod Brygge, Copenhagen. This office building should have been carried out as a Public Private Partnership (PPP); now however, the future of the project is uncertain.

Originally, there were four pre-qualified consortiums; two of them have now been hit by bankruptcy, and another has withdrawn their tender. In response, the Danish Building & Property Agency, cancelled the invitation to tender, citing an inadequate competitive situation. The Agency subsequently noted that many firms who wished to submit tenders encountered difficulties in securing the financing necessary for the building.

The Agency's cancellation of the building project at Kalvebod Brygge may well be a broad hint to foreign constructors and investors that now is the time to take a serious look at Danish public-works projects.

Possibilities for Assigning Ongoing Contracts

Contracting authorities' conclusion of contracts falls within the scope of the Procurement Directive and is subject to European law.

No clear case law, either from Danish courts or the European Court of Justice, provides for the assignment of a contract from an estate in bankruptcy without prior retender. The principles of equality of treatment, and transparency, may imply that an entity cannot make material subsequent amendments in an existing contract.

As regards the implication of assigning contracts from estates in bankruptcy, the Judgment in the so-called "Presse-text"-case[1] says that although the substitution of a new contractual partner for the one to which the contracting authority had initially awarded the contract must be regarded as constituting a material change to the essential terms of the contract in question, unless that substitution was provided for in the terms of the initial contract, the fact remains that an internal reorganisation of the contractual partner does not modify the terms of the initial contract in a fundamental manner.

This might indicate that the ECJ will accept debtor substitution in connection with company transfers and internal reconstructions. Provided that contract assignments due to reconstructions and company transfers are legal without

retender, it is not a far stretch to extend the possibility of contract amendments to include changing of contractual parties due to bankruptcy.

In a news release published 13 September 2013, the Danish Competition and Consumer Authority sanctioned the likelihood that ongoing works contracts with contracting authorities may be assigned to other constructors.

In conclusion, it is well within the realms of possibility that contracts from the Pihl estate in bankruptcy could be assigned to new contractual parties without prior retender, indeed this has already taken place several times, but at time of writing, building sites are quiet, and Pihl's trustees have yet to assign the 70 remaining building projects to new constructors on terms to which the contracting authorities could agree.

Conclusion

As a result of Pihl's bankruptcy - and that of the Sjælsø Group - the number of national players within the PPP-project market that feasibly undertake, or complete, the country's largest construction projects can be counted on the fingers of one hand. It is uncertain whether a sensible competitive situation for PPP projects will reassert itself in Denmark for the foreseeable future; as a result, the Danish construction market's competitive environment has changed considerably.

Whilst Pihl's bankruptcy opens up the possibility that new Danish and foreign construction groups and investors may participate in public tenders, it cannot be ruled out that, in large future construction tenders, Danish entities will focus more on creating arm's length contracts, and tender terms in order to ensure sufficient competition.

In addition, EU procurement rules and the news release of 13 September 2013 from the Danish Competition and Consumer Agency, provide for the possibility that contracting authorities may assign Pihl's ongoing contracts to new constructors; indeed, this has already taken place several times, and opens up the possibility that foreign constructors (perhaps in conjunction with foreign investors) may complete the remaining 70 projects from Pihl's estate which have still yet to be assigned.

However, the remaining projects are the most demanding, e.g. the Realdania Brewery site in central Copenhagen, which from the point of view of construction technology, is one of the most demanding projects in Danish construction history; completion of this project may well demand the participation of a major global construction player.

---

Kurt Bardeleben is a partner at LETT Law Firm engaged in public-sector activities, particularly relating to transactions between the private and public sectors and he is an adviser to public parties, including the Danish Government. He has advised on the Danish motorway project and the Faroese tunnel project, and drafted the state PPP standard contracts.

Lars Korterman is a Junior Lawyer at LETT Law Firm and is engaged in public-sector activities, particularly relating to transactions between the private and public sectors. He has s advised public and private parties on numerous PPPs as well as other large public works projects.

© Copyright IBTimes 2025. All rights reserved.