Election 2015: Conservatives gung-ho economic strategy will push Britain into new recession

There are only a few short days to go until we vote in the UK general election. The latest polls are still neck and neck; one day the Conservatives come out on top, the next, Labour. This lack of a clear winner is starting to rattle business leaders. But economically, how much difference will it really make who is in power after 7 May?

It's worth remembering that in our economic climate no government can afford to alienate, or fail to support, the business community. It is the private sector that pays the vast majority of taxes on which public expenditure depends. Every government is eventually judged by the success or failure of the economy under their watch. It's their job to create the conditions for economic growth. No growth, no success.

So businesses large and small are vital to a government. Therefore, expect a Labour government to be just as concerned with the welfare of the business sector as one led by the Conservatives.

In their manifestos, the parties all want to demonstrate their support for economic growth. They all espouse better training, more apprentices, improved infrastructure, a fairer and less complicated tax regime, and support for investment and innovation. But despite a history of belief in this country that the Conservatives always trump Labour on business, in reality, there is a lot more than just these commitments in Labour's 2015 manifesto.

More comment on the election

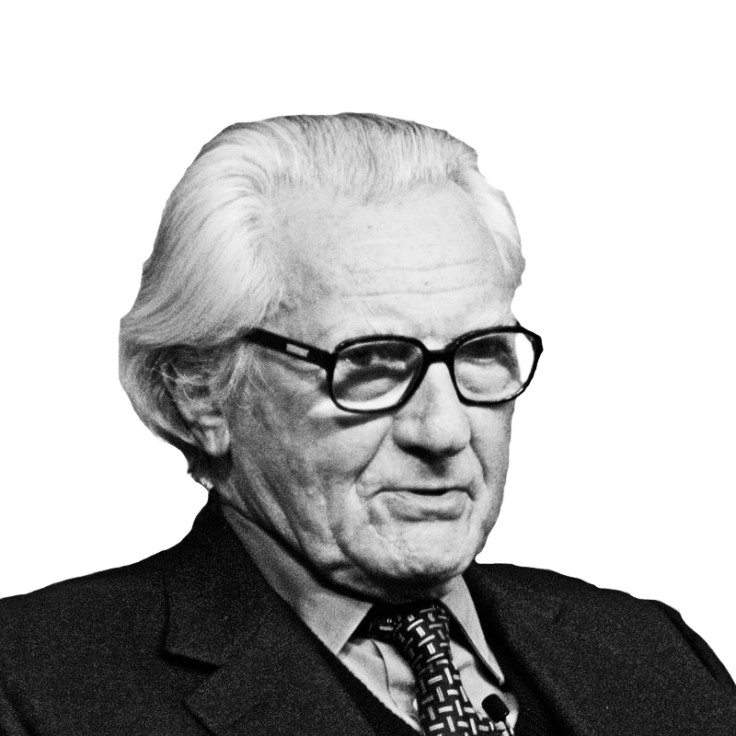

Michael Heseltine: Labour might want my help but I can't see Miliband winning

Simon Walker: Cameron and Miliband both guilty of taking Uk Plc for granted in their campaign.

James Caan: Next government simply can't fail Britain's start-ups

Joanna Shields: Labour's retro economic policies would damage Britain's economic recovery

The Labour Party is committed to business and its pledges include improved access to finance, tackling late payments, reducing business rates, specific policies for enhancing skills and fair controls on energy prices.

It states: "We value all our businesses as organisations of innovation and wealth production, and we will work strategically with them to create wealth."

Labour clearly has the right intentions. The problem is whether the economy over the coming years is going to be strong enough to support any of our political parties' business agenda.

This country has seen some reasonable growth over the past year or two. But is it going to last? The UK has major structural imbalances that make it difficult for growth to be sustained.

As a result of coalition policies, the proportion of our national income we invest every year, especially net of depreciation, is pitifully low; we are so deindustrialised that we don't now have enough goods to sell abroad to pay for our imports, and because of this and other reasons we have a balance of payments problem that is spinning out of control.

We have mounting government and national debt and too much of the growth we have seen is supported by quantitative easing and ultra-low interest rates. Our situation is far from secure.

These are formidable problems. In fact, the biggest issue for business is going to be how successful the next government is in getting the UK economy rebalanced. And here there is a significant difference between Labour and Conservative policies.

Labour is determined to reduce the government deficit, but expects to do this relatively gradually. The Conservatives propose to take a much more fast-track approach. My fear is the Conservatives' aggressive strategy won't work, leading to much worse conditions for almost all businesses than is necessary.

Of course, everyone wants to see the government deficit reduced and it seems obvious that the way to do this is to cut public expenditure and reduce taxation. But what may seem obvious in the case of an individual does not, however, correspond with what happens to the economy as a whole. Because everyone's expenditure is someone else's income, what an individual does has a very different impact from that of the government.

Here, in a nutshell, is where the economic truth lies: the problem with the government deficit is not that it is caused by government overspending. It is there because our balance of payments deficit sucks demand out of the economy as payments go abroad instead of to domestic suppliers.

Major imbalance

This deficit has to be matched by lending from abroad to finance it, which has, in turn, to be matched somewhere else in the economy by borrowing. And if this is not done by either households or the corporate sector – which is the situation in the UK at the moment – the default outcome has to be government running a deficit to provide the borrowing needed to keep the economy in balance. This is why our current balance of payments deficit, at just under £100bn per annum, is matched by a government deficit of almost exactly the same size.

The problem with the government deficit is not that it is caused by government overspending. It is there because our balance of payments deficit sucks demand out of the economy

Armed with this analysis, it's easy to see the problem with the Conservative strategy to reduce the government deficit by implementing drastic austerity policies.

If anything, they will reduce household and corporation borrowing, while doing little, if anything, to improve the balance of payments. The obvious result will be that cutting government expenditure and increasing taxation won't reduce the deficit. Instead it will plunge the economy into a recession.

There is so much muddled thinking about what is really wrong with the UK economy and how vulnerable it is to misguided austerity policies. Do we really want to face more Conservative policies that are so counter-productive? Labour's more cautious policies to reduce the deficit gradually are much more sensible.

Ed Miliband's party is therefore a much better bet for business in the UK over the next five years. This is why there is such a strong positive business case for a Labour government for the next five years.

John Mills is founder of consumer products company JML and a prolific commentator on economics. He runs his own blog, which can be found here.

© Copyright IBTimes 2025. All rights reserved.