Electrocomponents Keen on Tight Cost Control and e-Commerce Initiatives to Boost FY Earnings

With the widen international businesses, established strategy and well-built balance sheet, Electrocomponents, the world's leading high service distributor of electronics and maintenance products, is investing in its planned proposals and being aware of the ongoing economic situation, it is continuing to maintain tight cost control, therefore the group anticipates current second half operating costs to be in line with the second half of FY 2011.

The group says it is well positioned for the future and is scheduled to release its pre-close trading update for the year ended March 31, 2012 on Friday.

With its applied electronics, maintenance and e-Commerce initiatives the group's business continues to deliver year on year sales growth and it is also gaining market share, mainly from smaller opponents who are not able to match its broad product range, high customer service and e-Commerce capability.

Electrocomponents continues to expand its service and product offers in China as well.

"The group is performing well in the current macroeconomic environment. The implementation of our electronics, maintenance and e-Commerce initiatives is driving business performance, with all regions delivering revenue growth. Our multichannel approach, with e-Commerce at the heart of our business, has driven 16 percent e-Commerce growth and channel share of 55 percent. We are focused on implementing our strategic initiatives and, being mindful of economic conditions, we are continuing to keep tight control of costs. We have a well invested global infrastructure with market leading positions and a strong balance sheet, and we are well positioned to take advantage of the structural growth opportunities available to us internationally in highly fragmented markets," said CEO Ian Mason while commenting on groups' interim performance,

As at January 31, 2011 the group has a strong balance sheet, there have been no major changes to its financial position and has performed well against strong comparatives.

The group is expected to release its full year results ending March 31, 2012 on May 24, 2012.

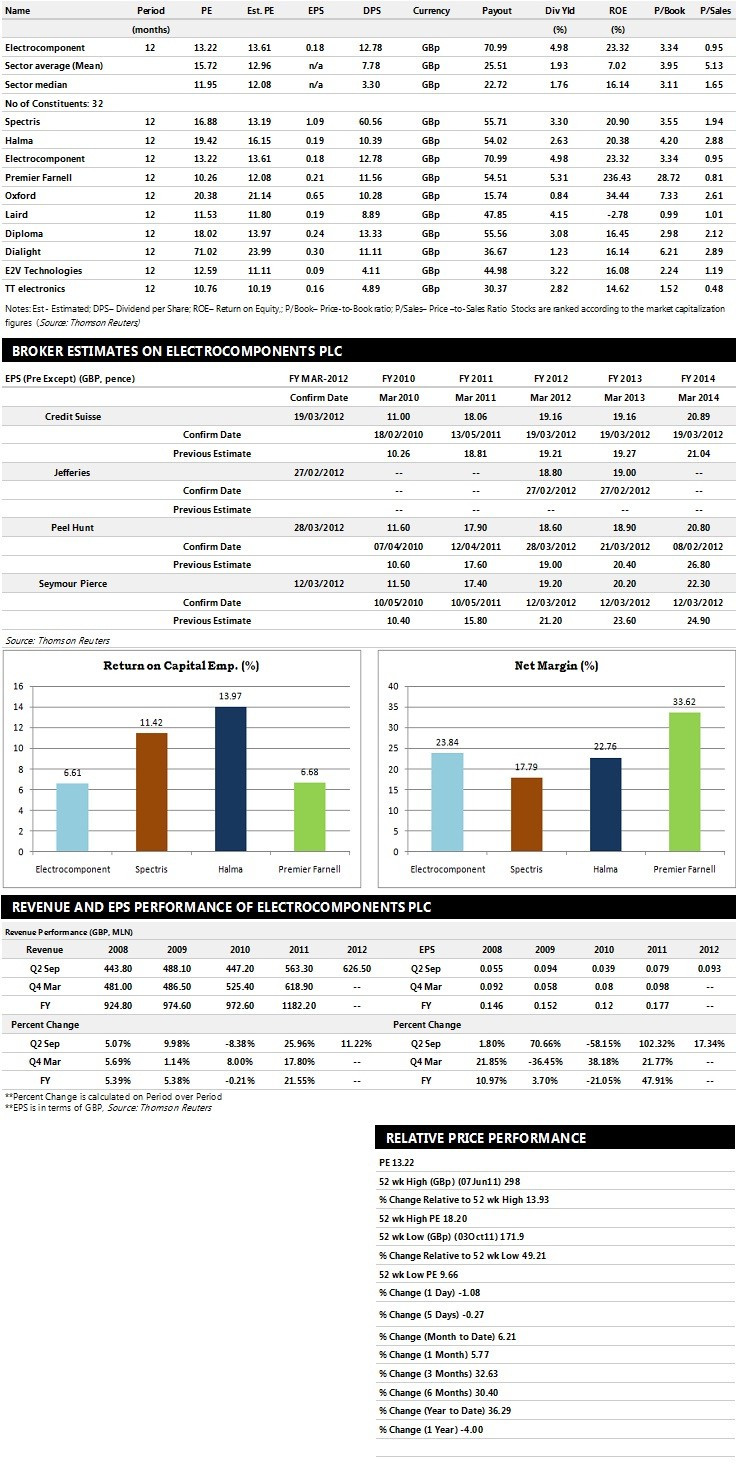

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents top ten companies based on market capitalisation.

Brokers' views:

- Peel Hunt recommends 'Sell' rating on the stock

- Credit Suisse assigns 'Hold' rating

- Numis Securities gives 'Hold' rating

- Jefferies assigns 'Hold' rating

Earnings Outlook:

- Peel Hunt estimates the company to report revenues of £1,240.00 million and £1,217.20 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £117.60 million and £119.60 million. Earnings per share are projected at 18.60 pence for FY 2012 and 18.90 pence for FY 2013.

- Credit Suisse projects the company to record revenues of £1,266 million for the FY 2012 and £1,282 million for the FY 2013 with pre-tax profits (pre-except) of £122 million for both the periods. Profit per share is estimated at 19.16 pence for the FY 2012 and FY 2013.

- Seymour Pierce expects Electrocomponents to earn revenues of £1,263.50 million for the FY 2012 and £1,357.60 million for the FY 2013 with pre-tax profits of £122.10 million and £129.90 million respectively. EPS is projected at 19.20 pence for FY 2012 and 20.20 pence for FY 2013.

© Copyright IBTimes 2025. All rights reserved.