Eurozone Crisis: What Will the New Order Look Like?

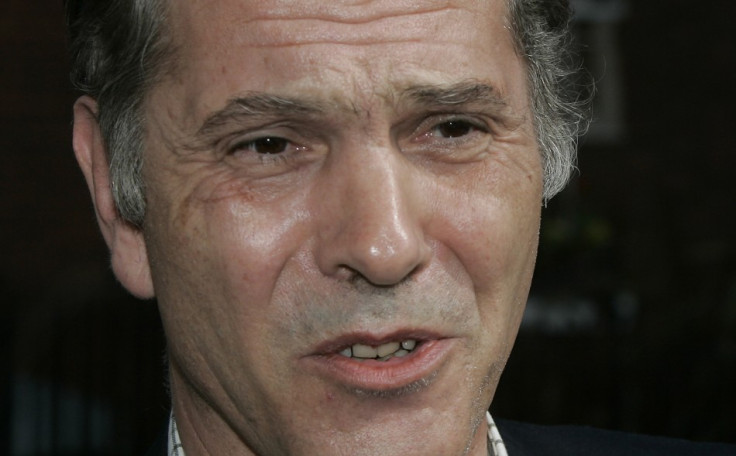

In an interview with International Business Times, Tory peer and former shadow treasury secretary Lord Flight described the current European Union model as corrupt. He offered three possible scenarios for a New Order.

The EU, as we know it today, is on course to change to adapt to the eurozone crisis. Italy, the eighth-biggest economy in the world, joined the "7 per cent club" along with Greece, Portugal and Ireland last week when its level of borrowing hit unsustainable levels which has put the country on a course to economic meltdown.

Over the next week, the newly appointed prime ministers in both Greece and Italy, Lucas Papademos and Mario Monti, will attempt to drive through more austerity measures in an attempt to advert this disaster. Not just locally, but on a truly global level.

Lord Flight describes the current EU model is "corrupt" and in need of modernisation.

Speaking to the IBTimes he has offered three possible scenarios:

Scenario One - A Full-Scale Breakup

Arguably the most unlikely scenario but still one that European leaders are facing over the coming weeks and months, will be the breakup of the euro where individual countries will resurrect their old currencies. Should this happen, the EU may well follow suit which will be an end to the single market, which the prime minister, David Cameron, has warned could have significant effects on UK trade.

The decisions made at the EU Summit and G20 over the past couple of weeks have not been detailed enough to give the region anything to cling to, which has caused concern.

"There are only short-term fixes in place rather than addressing the real problem," says Lord Flight. "Even if you look at the deal agreed at the EU summit on Oct. 27, many banks I talk to have not agreed to a 50 per cent Greek haircut, and no one has a clue of where the money will come from to fund the EFSF firewall."

The crisis in Italy, where bonds went into the 7 percent "red zone" last week, is very serious with its economy too big to be bailed out by other EU countries boasting debts of up to €1.9 trillion. If the euro were to break up completely, Italy would be one of the first countries to go.

"The European Central Bank is buying Italian bonds like mad to reduce the bond yield percentage," says Lord Flight. "They are the lender of last resort and not really allowed to do that. It's another short-term fix."

Scenario Two - A Two-Tier System

The stronger northern countries such as Germany would form a single currency and the southern nations such as Italy, Greece and Spain would form a weaker currency of their own. In effect there would be a dual currency in Europe as opposed to a single currency there is now.

According to the Centre of Business Development Research, although initially the weaker of the two currencies would fall drastically, it would eventually settle down to somewhere like 40 per cent. A similar relationship to the dollar and pound sterling.

"Prior to the U.S. Civil War in the 1860s, there was a strong Northern dollar and weak Southern dollar," says Lord Flight. "After the two currencies merges, 30 per cent of wealth from the richer Northern states has had to go to the poorer Southern states. If Germany wants to take this role on of redistributing wealth to difference parts of the eurozone, then it must get the consent of its voters. But this is highly unlikely."

"The other big problem is where you put France," says Lord Flight. "You would have to say that on current trends it would have to be in the second tier" - a political disaster for the French President Nicolas Sarkozy.

This system could well work, however, similar to a football league table with relegation and promotion from either division. Should economies such as Greece and Italy falter in the top division, they could be switched into the weaker southern currency to prevent contagion.

Scenario Three - Germany to Leave the Euro

Germany is, at present, the only country propping up the euro against other currencies such as the pound or dollar. The other economies need significant devaluation if they are to recover, and if Germany were to leave, the remaining economies would be of similar value which would then naturally come to a more realistic value for the euro.

"A single currency will only work if all the economies within the region are of a similar value," says Lord Flight. "The difference between Germany and Greece was huge, which is why we have seen such a disaster in the eurozone."

"The ball is very much in Germany's court," says Lord Flight. "It may decide to continue to lend to other countries, but if it left, it would probably save the single currency."

© Copyright IBTimes 2025. All rights reserved.