Fenner Upbeat on 2012 Outlook; Investec Recommends Outperform Rating

Fenner, a world leader in the field of reinforced polymer and textile technology, says in spite of the growing uncertainty over the macro economic outlook, trading and demand levels are in line with the group's expectations for 2012.

Fenner has a highly motivated team of people in place, strong positions in attractive markets, well invested infrastructure, strong fundamental drivers of end user markets, ability to respond to the external environment puts the group in strong position.

The group released its pre-close trading statement for the six months ended 29 February 2012 on March 8, 2012. The group reported strong trading in the Q2 of 2012 with operating profit for H1, significantly ahead of the comparable period last year. It experienced good trading conditions, sustained by gradually growing demand from the mineral extraction/energy sectors, and market share gains.

Fenner is confident of further growth in the second half of the year, given a healthy order book. Trading in the second quarter of the financial year has continued to be strong, with operating profit for the first half significantly ahead of the comparable period last year.

Global demand for energy and in particular for electricity, is only marginally affected by general economic weakness and with growth in the emerging economies, these will remain heavily dependent on coal for the foreseeable future. However, according to Fenner, recovery in the global economy and the Western economies in particular, will be both inconsistent and slow but the underlying drivers which are most significant for the group remains strong.

While commenting on the trading update, Jon Lienard, analyst from N+1 Brewin said: "Keeping a 'Conviction Buy' rating on the company's stock, Fenner has an enviable element of sales whose end markets we consider to be resilient or growing, i.e. thermal coal production, shale gas & oil and medical."

"Having spoken to management, and based on our analysis, we see incremental revenue and margin accretion this year and next. We think the stock has further to run over the next 12 months," said Chris Dyett from Investec Securities. He also assigned a 'Buy' rating on the stock.

For the full year ended August 2011, Fenner reported a 30 per cent rise in its revenues to £718.3 million, compared to £552.5 million for 2010. Underlying operating profit increased by 60 per cent to £91.4 million with earnings per share at 28.1 pence.

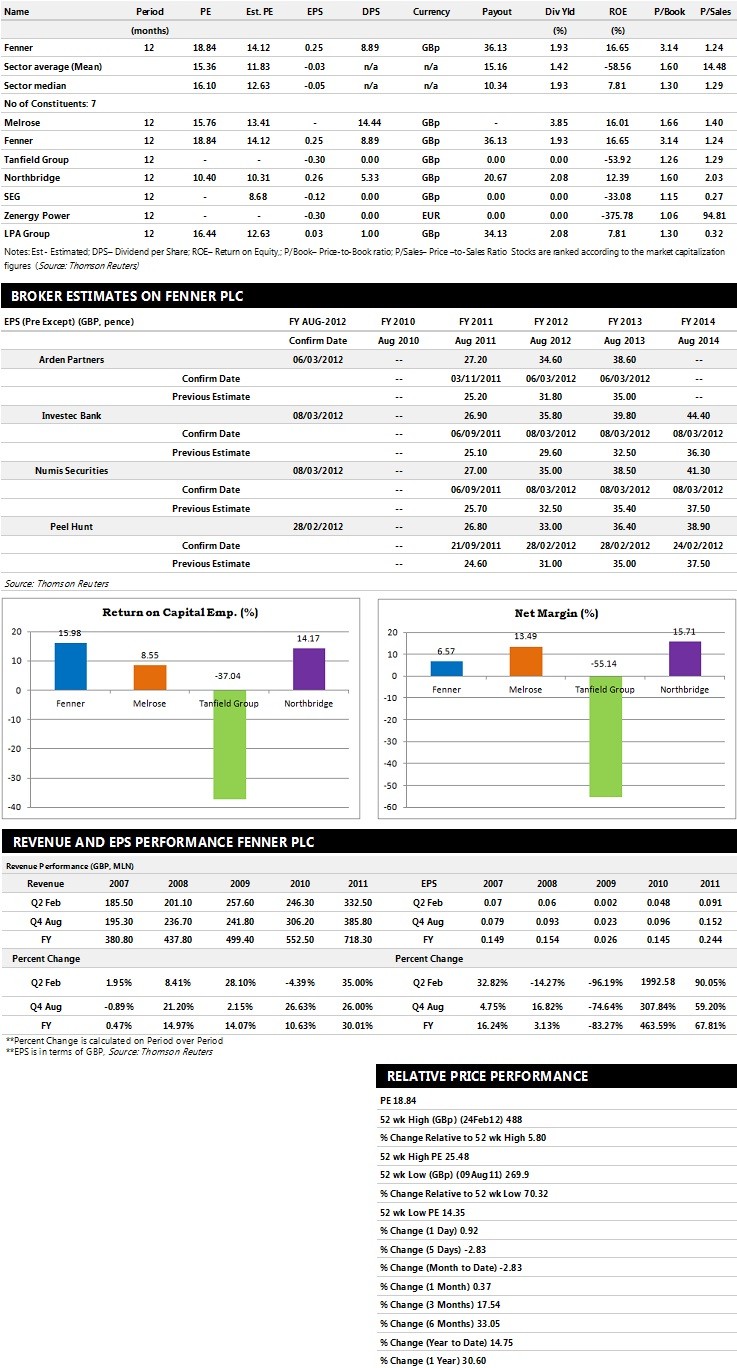

Brokers' Views:

- Investec Bank recommends 'Outperform' rating on the stock with a target price of 500 pence per share

- Numis Securities assigns 'Buy' rating with a target price of 560 pence per share

- Peel Hunt gives 'Hold' rating - Arden Partner assigns 'Buy' rating

- Jefferies & Co assigns 'Buy' rating with a target price of 505 pence per share.

Earnings Outlook:

- Investec Bank estimates the company to report revenues of £839.20 million and £893.60 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £104.40 million and £115.60 million. Earnings per share are projected at 35.80 pence for FY 2012 and 39.80 pence for FY 2013.

- Numis Securities projects the company to record revenues of £810.30 million for the FY 2012 and £859.00 million for the FY 2013 with pre-tax profits (pre-except) of £99.50 million and £110.50 million. Profit per share is estimated at 35.00 pence and 38.50 pence for the same periods.

- Peel Hunt expects Fenner to earn revenues of £794.80 million for the FY 2012 and £828.90 million for the FY 2013 respectively with pre-tax profits of £95 million and £105 million. EPS is projected at 33 pence for FY 2012 and 36.40 pence for FY 2013.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents top seven companies based on market capitalisation.

© Copyright IBTimes 2025. All rights reserved.