Pearson agrees to sell Financial Times Group to Nikkei in £844m deal

Nikkei, one of the largest media corporations in Japan, is in talks to acquire the Financial Times from publishing giant Pearson for $1.31bn (£844m, €1.19bn) on 23 July.

News of the acquisition comes just hours after the FT confirmed Pearson was in talks with German media company Axel Springer, which owns newspapers die Welt and Bild.

Pearson is disposing of its FT division in order to streamline the company to focus on its educational publications.

It said in a statement: "Pearson will now be 100% focused on our global education strategy."

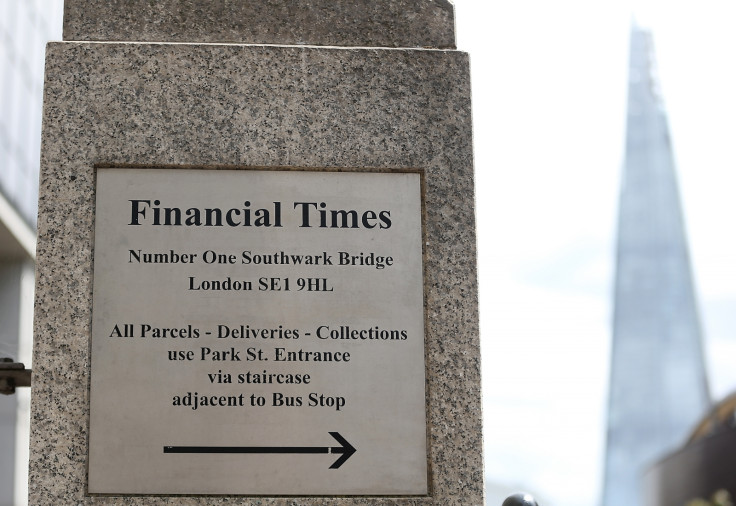

The sale does not include the publisher's stake in the Economist, nor does it entail the sale of the FT's headquarters at One Southwark Bridge in London, but FT's secondary publications such as Investors Chronicle, the Banker and MandateWire will be sold to Nikkei.

.@fastFT: Nikkei to buy the FT Group for £844m http://t.co/MJLkDDqOPi

— Financial Times (@FinancialTimes) July 23, 2015Here's the key "why I'm selling the @FT" part of @Pearson CEO @JohnFallon's note to employees pic.twitter.com/VKTgPzbN7X

— Peter Spiegel (@SpiegelPeter) July 23, 2015FT meeting pic.twitter.com/PULNrQC4VL

— John Gapper (@johngapper) July 23, 2015"We've reached an inflection point in media, driven by the explosive growth of mobile and social," Pearson CEO John Fallon stated. "In this new environment, the best way to ensure the FT's journalistic and commercial success is for it to be part of a global, digital news company."

Nikkei is a major news media company in Japan. It publishes Nikkei Asian Review, Nikkei Business Weekly, and is affiliated with CNBC Japan and National Geographic.

Business news network Bloomberg and newswire Thomson Reuters had previously been tipped as possible buyers of the FT. Even internet media hype Buzzfeed has been named as a possible player, but it denied any interest in the salmon coloured paper.

Nikkei was not named as a possible buyer but has many financial publications and affiliates.

The Japanese publisher's CEO and chairman Tsuneo Kita said: "Nikkei is a major news media company in Japan. It publishes Nikkei Asian Review, Nikkei Business Weekly, and is affiliated with CNBC Japan and National Geographic."

Mostyn Goodwin, Partner at OC&C Strategy Consultants said that Pearson eyeing a sale of the Financial Times does not come as a surprise.

He said: "The title's strong digital revenue and powerful international brand makes it a very attractive business for the right owner – and there are more logical owners than Pearson for what is an attractive, trophy asset."

Goodwin added that, wherever the FT would end up, it would have little to no impact on the publication. "Business as usual," he said.

The sell is conditional to some regulatory approvals and is expected to be completed in 2015.

© Copyright IBTimes 2025. All rights reserved.