Four companies that confounded the Brexit doom-mongers

Solid UK economic activity after EU referendum has boosted retail, housebuilding and leisure sectors.

We were supposed to go into a deep depression following the shock Brexit vote, weren't we? And the UK economy was forecast to go into a tailspin as we all stopped spending? That was the conventional wisdom, at least.

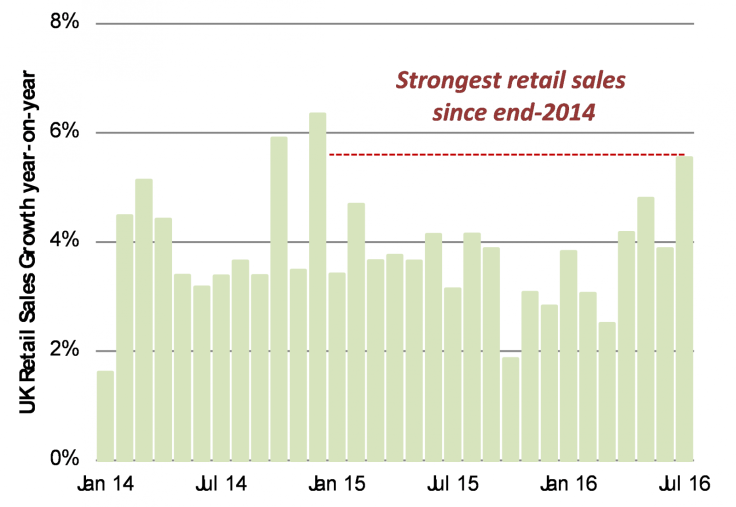

So what happened? Why are we not all hoarding tins of baked beans and hunkering down for the post-vote apocalypse? Instead, it would seem that we continue to spend money with abandon, judging by July's retail sales numbers, which showed the strongest growth since end-2014 (Chart 1).

Surprising economic news doesn't end there

If this were the only statistic showing surprising resilience in the UK economy, then we could perhaps dismiss it as a rogue statistic, a bizarre anomaly that would soon be corrected in subsequent months.

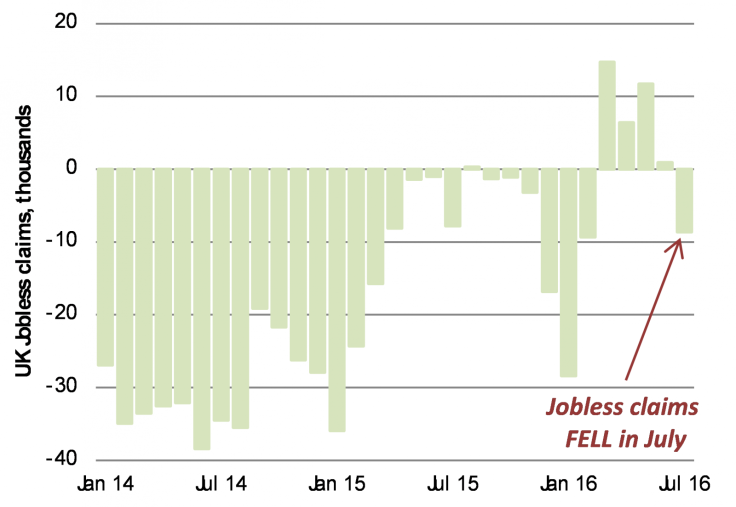

But no: there are other signs that economic activity post-EU referendum remains solid. The number of people claiming unemployment benefit also surprisingly fell in July, by more than 8,000 claimants, after 4 months of rising claim counts (Chart 2).

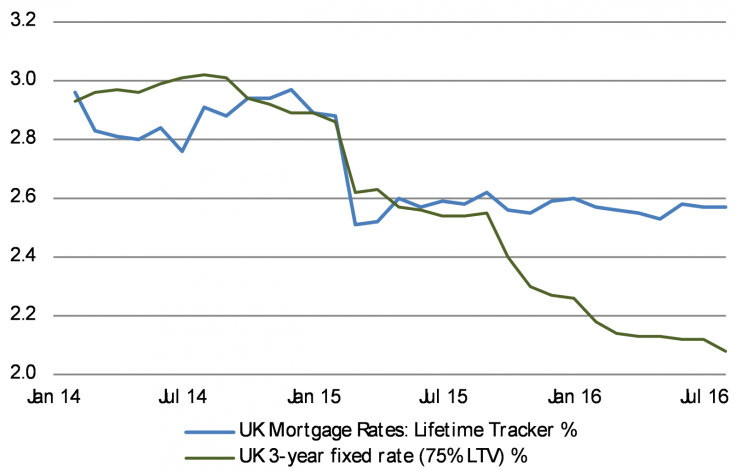

Remember too that Mark Carney, the Bank of England's governor, did his bit this month to support the local economy in cutting the Bank of England's base rate by 0.25%. This should cut the average lifetime tracker mortgage rate in the UK to around 2.3% going forwards. Note too how fixed rates have also continued to fall, with the average 3-year fixed mortgage rate for a 75% loan-to-value mortgage falling to just 2.1% as of July (Chart 3).

Four domestic UK stocks for value-hungry investors

With all the post-vote pessimism hurting a whole range of companies in the domestically-sensitive Retail, Housebuilding and Leisure sectors, there is still value to be had even after the recent stock market rally back.

Here are four companies that I think can rebound further should the UK economy hold up in the months ahead.

Retail: Debenhams and DFS Furniture

The unseasonably hot month of July has boosted clothing demand, and as we approach autumn we will likely be back in stores buying warmer clothing and boots in the months ahead.

The department store group Debenhams (code: DEB) has good potential to benefit from these clothing trends, and represents good value at the moment. One should not forget its strong online presence (debenhams.com), so it should also be helped by the stronger growth of online retail in clothing and footwear (think of the strong growth from Asos and BooHoo).

What particularly appeals to me about Debenhams is the attractive income potential: it pays out a 5.9% dividend yield annually, which is a very nice earner in today's near zero-rate environment.

DFS Furniture (code DFS): DFS was particularly optimistic in its August 11 trading update: sales in the second half of its financial year grew 7% over the previous year, and they expect "a record performance for the full year". Little impact from the Brexit vote expected, then...

If we are all going to stay more at home given the unfavourable tourist exchange rates post-vote, then we may engage in more "nesting" behaviour, helping sales of sofas and other furniture.

Leisure: Restaurant Group

Restaurant Group (code: RTN) has suffered since the beginning of this year as trading at their restaurant chains Frankie & Benny's, Chiquito and Coast to Coast weakened, driving shares from nearly 700p to just 422p today.

This month, the company ousted the former CEO on the back of this poor trading performance and has installed a new chief executive, who is leading a review of the company's whole growth strategy. Should UK consumers decide to spend more at home rather than go abroad, then Restaurant Group could see a further rebound in its fortunes.

Housebuilders: Taylor Wimpey

Housebuilders have been firmly out of favour since June 23's plebiscite, with today's share prices around 20% lower than back then.

Taylor Wimpey (code: TW) is well-positioned to take advantage of any resilience in new home sales thanks to lower mortgage rates on the back of the Bank of England's rate cut.

Results this year should be strong given the house price rises seen so far this year and the strong volumes of new homes sold, while investors are handsomely rewarded with an 8% annual income yield from Taylor Wimpey's dividend payouts.

© Copyright IBTimes 2025. All rights reserved.